3rd Party Payroll Service Overview

The EBMS software includes options to record and manage labor for a 3rd party payroll service. This option uses the strengths of work codes, time tracking, job costing, and task management within the EBMS software with the option of using a 3rd party to process taxes and other legal payroll requirements.

The Payroll Service option processes individual General Ledger transactions for labor transaction and posts to a payroll payable G/L account. This makes the G/L journal entries simpler for the outside payroll service.

Data Collection

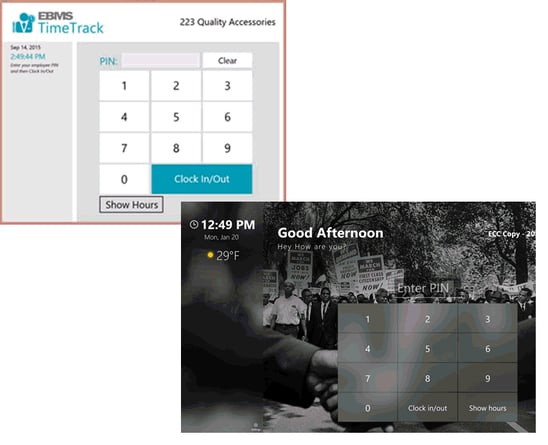

Review Time Track Overview for time clock information. This app can be used to record worker clock in / clock out times.

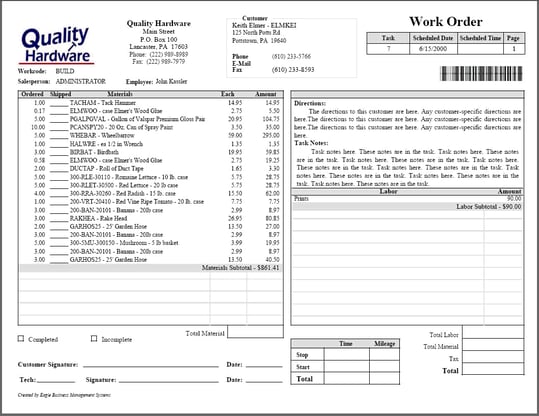

Review Using Tasks as Work Orders for information on tracking labor through work orders.

Review Job Costing > Labor Expenses for instructions to record labor for jobs.

Review Piecework Payroll Processing Overview for details on processing piecework pay.

Review Flag Pay Overview for details on managing task flag pay.

Labor Processing

![]()

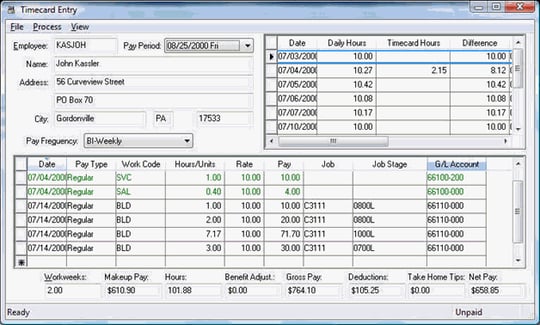

Review the Configuring EBMS for 3rd Party Pay Service section to configure EBMS for an optional payroll service.

Review the Processing 3rd Party Pay section for instructions on processing regular pay within the EBMS software.

Importing Transactions from 3rd party into EBMS

Review the Posting G/L Transactions from a 3rd Party section for more details on posting accounting transactions within EBMS.

Business Scenarios

Scenario 1: Labor is an important asset within a building supply center that sells and manufactures building materials. A payroll service is used to process payroll taxes and deductions. The supply center tracks labor using EBMS time clocks to record the time spent within the sales, delivery, office, and manufacturing departments. Some employees allocate their time to multiple departments when they clock in and out of the Time Track App. The payroll service generates the employee pay via direct deposit with the exception of one employee. This employee requires a printed check which is calculated and printed within EBMS. Combining the power and details of an internal labor system with the convenience of a 3rd party payroll service allows this building supply center to maximize the effectiveness of their labor management.

Scenario 2: An agriculture equipment sales and service company tracks service and sales labor using work orders and time clocks. It is important to manage the actual time for both time and materials (T&M) work orders and labor cost for parts, assembly, sales commissions, and clerical work. The EBMS Task & Work Orders system gives the service department tools to measure time spent and record service details. Management has the employees record various non-billable time such as worker service, clean up, and meetings, along with billable time. The resulting bar graph summary is used as a motivation for employees. The time summary is uploaded to a payroll service who calculates taxes and generates pay checks. The resulting EBMS financial journal is merely recording the employee’s paycheck and debiting payroll payable. The detailed labor expense transactions are created within EBMS.

Scenario 3: A construction business uses both hourly and salary pay as well as a comprehensive piecework payroll system to pay the 600 to 800 builders and staff within the company. In the field, employee start times and stop times are collected using the Time Track app on the foreman's mobile phone. The EBMS labor module calculates the piecework pay along with non-productive time, break times, and benefit pay and calculates payroll along with payroll taxes and various deductions. EBMS is used to print payroll checks for most employees, as well as direct deposit for some. The payroll details, including withholdings, are communicated to the 3rd party payroll service using a CSV file for them to manage and file taxes as well as handle HR needs. The time collection, the flexible pay type options, and payroll process within EBMS fit the payroll needs of the company well.

Related Videos and Content

Videos