Landed Cost Overview

Calculate costs incurred in getting the product to your shelf.

In this article

What is Landed Cost? | Scenarios | Related Content

What is Landed Cost?

The Landed Cost module is an optional enhancement to the inventory purchasing process within the EBMS software. This module adjusts the purchase cost of an inventory item to reflect the true landed cost of inventory. Landed cost refers to the total cost of getting a product from the manufacturing facility to the buyer. These costs include line items like shipping and handling, customs, tariffs, insurance, brokerage, etc. The goal of this module is to record an accurate cost used to calculate profit reports and salesperson commissions.

Landed cost = Purchase Price + Additional Costs

The total cost of a landed shipment may not equal the price listed on the purchase order because of freight, customs, insurance, rebates, or other additional costs and adjustments. Landed Costs, or the "all in" costs of materials and inventory on the shelf, are very important for understanding true cost of products and profit margins. Essentially, a landed cost is a realistic product cost that includes not just materials cost paid to the vendor, but all of the costs incurred in getting it to your shelf. Typical landed costs can include inbound ocean freight, duties and fees paid, tariffs, internal processing, hauling charges, or even guaranteed rebates from a vendor.

Some buyers even include their own internal material handling or receiving inspection charges to get inventory onto the shelf or into a state where the inventory is ready for sale or use in a manufacturing process. Such costs can be considerable, especially if there are significant freight costs due to weight or oversees freight.

Some commonly used features in the Landed Cost module:

-

Add Freight Costs: This option is required if the freight costs are invoiced on another expense invoice.

-

Add Other Costs: Add costs such as insurance, handling, or any other miscellaneous costs to the original purchase cost.

-

Add Handling or Processing Adjustments: Add any internal costs such as handling, packaging, or processing that does not include other inventory items.

-

Reduce Cost Based on Guaranteed Rebates: Reduce the purchase cost to reflect guaranteed rebates.

Additional costs that adjust the inventory value can be accomplished using one of the following methods:

-

Additional costs included in the same invoice as the product purchase can be adjusted within the expense invoice. Review Distribute Freight and Other Costs for steps to distribute costs, such as freight, to the purchase cost.

-

Additional costs that are NOT included in the original invoice requires the landed cost option. Review the following sections for details on the landed cost module:

Practical Scenarios

Scenario 1: A fastener company imports screws from Asia. The shipping costs are paid to a broker using a separate expense invoice. The cost of the screws needs to include shipping and duty costs to calculate a true landed cost. The landed cost module within EBMS is used to increase the inventory value of each screw to include these important costs. The cost is used for pricing as well as calculating the cost of goods (COGS) and is determined by combining the original screw cost from the manufacturer with shipping and other additional costs. Margins calculated for profit and loss reports and salesperson commissions are calculated from the landed cost rather than the purchase cost recorded on the vendor’s invoice.

Scenario 2: A fertilizer company wishes to add some internal handling labor to the raw material costs from the manufacturer. The labor is processed within the EBMS labor module using a labor work code. The landed cost feature adds this accrued labor costs to the inventory value of the raw materials. This process gives this company the ability to compare the true landed costs including labor with the cost of the purchased product from the manufacturer. The landed cost feature calculates the accounting, inventory value, and the cost of goods values seamlessly and accurately.

Scenario 3: An auto parts store sells truck alternators to a company with a large fleet of vehicles. The alternator manufacturer offers the auto parts store a rebate, so the owner wishes to include that savings in the landed cost of each part. This EBMS client can reduce the product cost by applying the rebate to the purchase price using the landed cost feature. This adjustment simplifies the profit evaluation of individual sales invoices, as well as the commission calculations for the sales staff. The total rebate promised by the manufacturer is recorded within the rebates receivable general ledger account that is credited when the rebate is received.

Related Videos and Content

Video: Landed Cost ERP Support

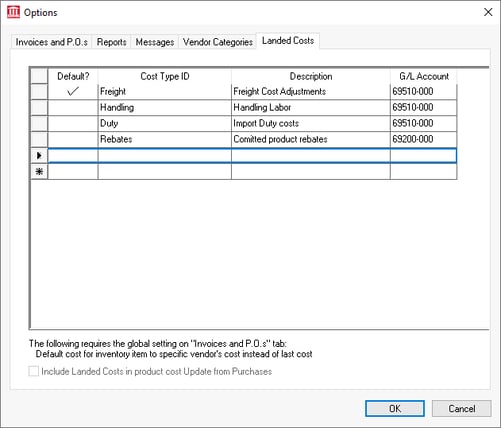

- Review the Cost Adjustment Types section for details on how to setup landed cost adjustment types.

- Review the Assigning Default Landed Costs to an Item section for instructions on how to add default landed costs to an inventory item.

- Review the Adjusting Landed Costs within a Purchase Order section for instructions on how to use the landed cost features.

- Refer to the Inventory documentation for more details on the purchasing tools, purchase orders, and inventory counts and values.