Fine Tune Indirect Cost Ratios

Individual account ratios can be adjusted throughout the year. Adjusting percentages for past months will change expense totals for the given month without requiring any journal entries. This flexibility gives the manager the ability to change the ratio assigned to a specific profit center after the expense has occurred.

Complete the following steps to adjust profit center ratios for a single account:

- Open an expense account within Financials > Chart of Accounts.

-

Click Profit Centers on the General Ledger account record.

-

Adjust ratios per account: the remainder will display unallocated percentage. The remainder should equal zero, which will hide the line.

-

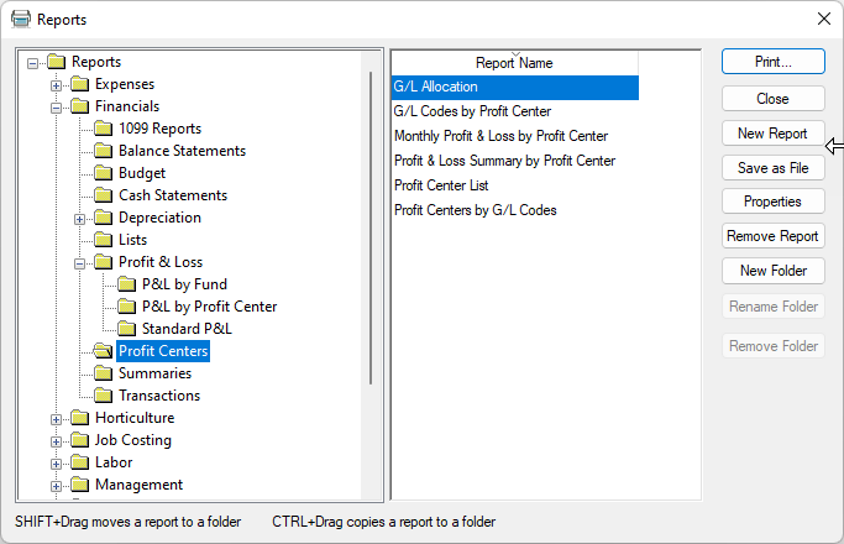

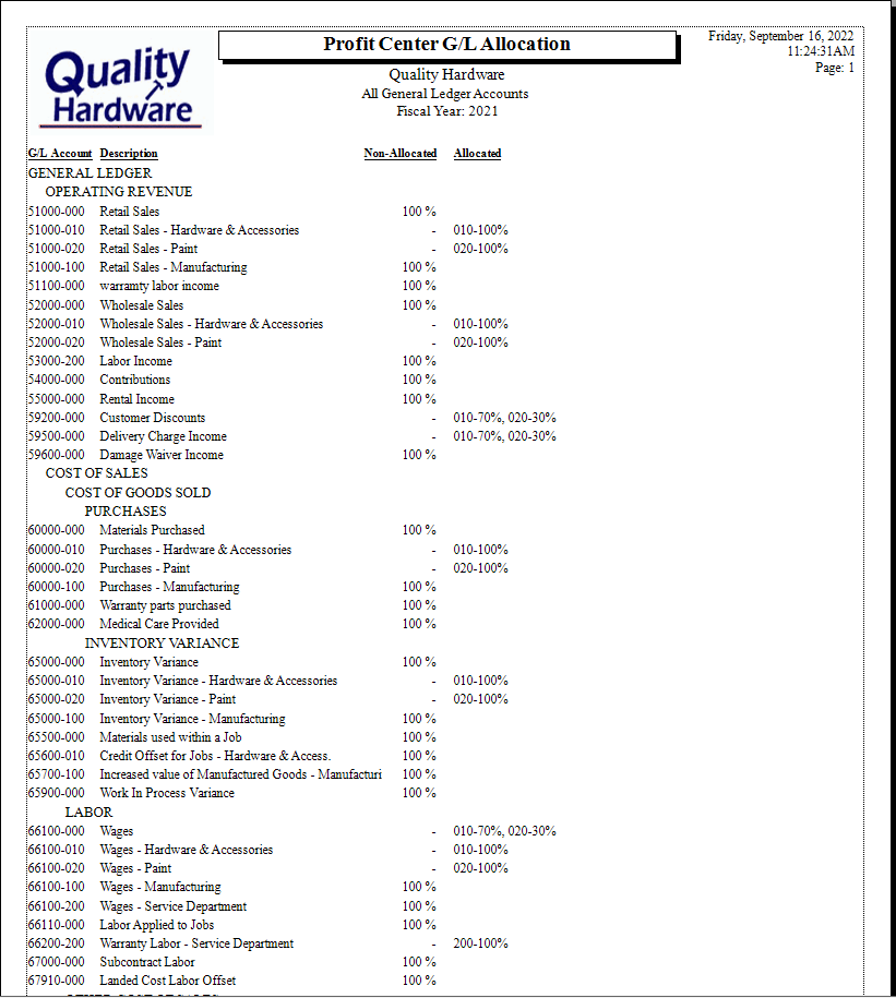

Verify that ratios are complete using the G/L Allocation report.

- Direct cost ratios will show as 100% and indirect cost ratios will show individual profit center percentages.