Reversing Journal Entries

If a journal entry that should not have been has been posted by accident or an entry needs to be edited, take the following steps:

-

Go to Financials > Journal Entry.

-

Go to File > Open.

-

Check the switch in front of All to select all existing journal entries.

-

Select the journal entry that you wish to undo. The journal date must be within a valid fiscal year.

-

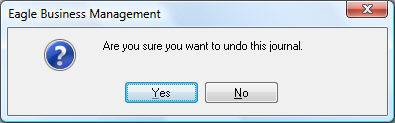

On the journal page, select Process > Undo from the header. The following message will appear:

-

Select Yes to un-process the journal entry.

This is how month and year-end journal entries are reversed as well. Another way to reverse entries is to enter new entries that would post the same amounts to the same account numbers, using opposite debit/credit fields.

Example: You have a journal entry posted for a $15.00 debit (-) to account 12000 and a $15.00 credit (+) to account 73100. You do not want this entry. You can either undo the journal entry as outlined in the above steps or make a new entry and post a $15.00 debit (-) to account 73100 and a $15.00 credit (+) to account 12000. Either option will have the same effect on the General Ledger.

To see the effect on the detail information, go to Financials > Chart of Accounts > Year tab for that year and drill down. Notice that the posting occurs when entries are posted and undone. Posting will enter the number as a positive and undoing will enter the number as a negative.