Creating New Profit Centers

Profit centers must be created so that profit center reports can be generated. Complete the following steps to create profit centers:

-

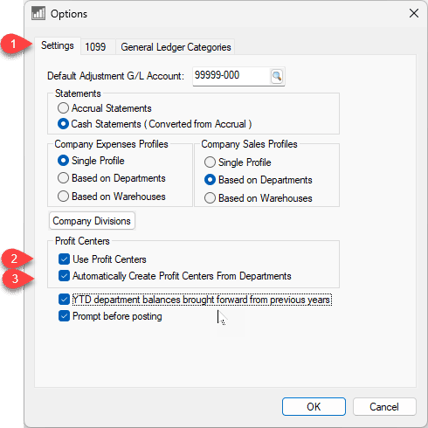

Go to Financials > Options > Settings tab as shown below:

-

Enable Use Profit Centers option. If departments have been created and the Profit Centers are to be the same as departments, enable the Automatically Create Profit Centers from Departments option and click OK.

-

Go to Financials > Profit Center menu option if the Automatically Create Profit Centers from Departments option is disabled. Go to Financials > Departments, open a department and click on the Profit Center tab if the option is enabled.

-

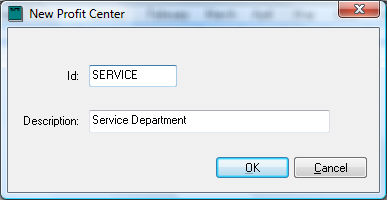

Skip to step 7 if the "Automatically Create Profit Centers from Departments" option is enabled. Otherwise click the New button at the bottom of the window. The following window will appear:

-

Enter the ID of the new Profit Center.

-

Enter the Description of the new Profit Center and click OK.

-

The main Profit Centers window will reappear with the new profit center selected but the list may be blank.

-

Verify the Fiscal Year.

-

Inactive must be disabled to edit Profit Center ratios or percentages.

-

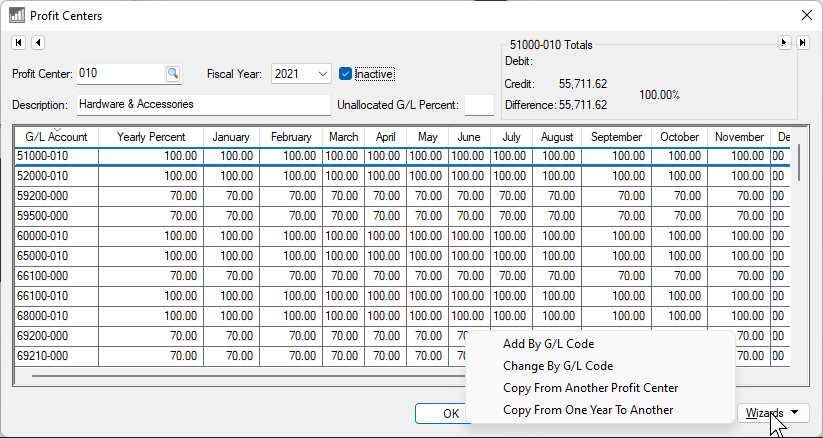

Use the following options under Wizards to add or change G/L account percentages:

-

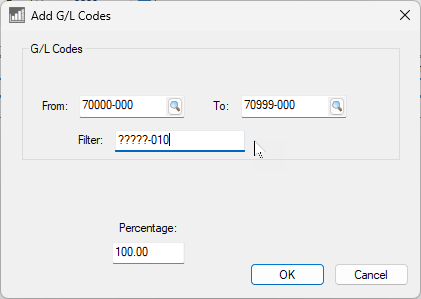

Add By G/L Code

- Review Assigning Direct Expenses to a Profit Center for additional steps to add accounts.

-

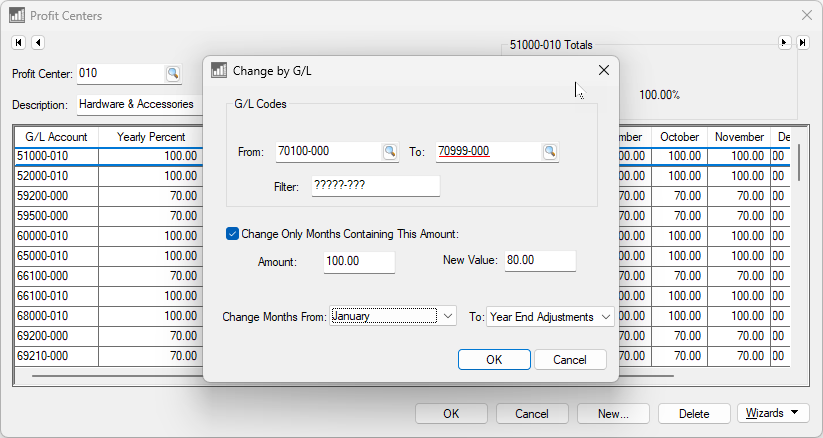

Change By G/L Code

- Review Allocating Indirect Expenses to a Profit Center for steps to adjust account percentages.

-

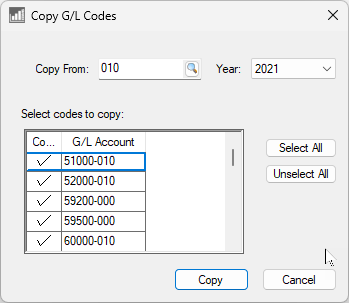

Copy From Another Profit Center

-

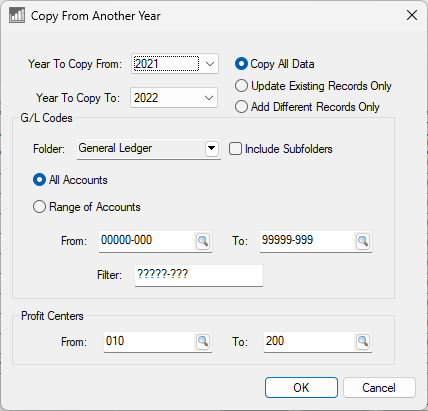

Copy From One Year to Another

-

Review Fine Tune Indirect Cost Ratios to complete the process.