No Count Percentage Pricing Code

How to create an inventory code for percentage price

An item can be classified as Percentage Pricing within the inventory module of EBMS when the pricing is calculated by a percentage of pervious lines within a proposal or sales order. A Percentage Pricing item is useful in the following situations:

-

Calculating a tax based on a percentage of the previous lines. (This option should not be used for general sales tax calculation.)

-

Calculating a surcharge or any other item based on a percentage of previous item values rather than a fixed price.

-

The Percentage Price can be restricted so it is only included in a sales invoice a set number of times. Administrators can control how many times percentage pricing may be entered into a sales invoice. For example, a customer may be limited to only enter a specific percentage price item 1 time.

The calculation can be based on the previous line of the document, all the previous lines, or the previous lines located between the inserted item and a previous item classified as Percentage Pricing.

Creating the Inventory Item

Complete the following steps to create a percentage pricing item:

-

Launch the new inventory item wizard as shown below: Review the Entering New Products section for more details on the inventory item wizard.

-

Select an appropriate category folder (the category folder should be named Service Items or No Count or some other category that is separate from typical track count inventory).

Click Next to continue.

-

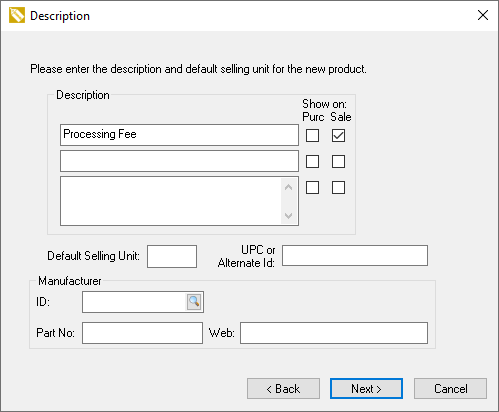

Enter a Description of the discount or percentage adjustment. Select Show on: Purc to display the description line on a purchase order and Show on: Sale to display the description line on a sales order or invoice.

-

All Default Selling Unit and Manufacturer settings can be ignored.

Click Next to continue.

-

Set the Classification setting to Percentage Price.

-

Select the proper Tax Group and click Next. Review the Sales Tax section of the sales documentation for more details on the Tax Group setting.

-

Set the Percentage Pricing value. For example, enter 2.00 to set the pricing at 2% of the line above the tax line.

-

Select one of the Calculate From options:

-

-

The Above Line: This is the most common option used for taxes and other fees that are displayed following specific items on a sales invoice. Add the Percentage Price item as an accessory if this item should always follow a parent item. Review the Components and Accessories > Components and Accessories Overview section for more details on adding items as accessories.

-

Above Lines: This option will total all previous lines until it locates another item classified as percentage pricing. This option makes the order of the sales line items very important.

-

All Above Lines: This calculate is derived from all the invoice or proposal lines listed above the percentage pricing item.

-

-

-

Percentage pricing item must be placed after any items that are used to calculate the percentage pricing price.

Click Next to continue.

-

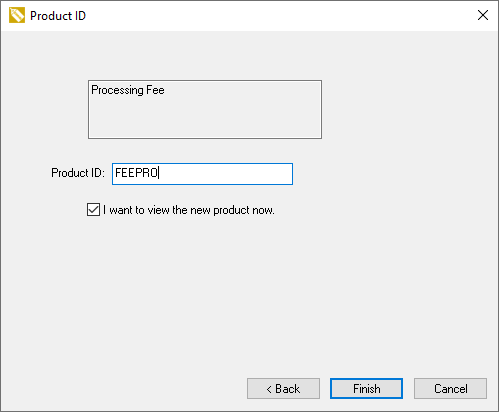

Enter a Product ID for the new percentage pricing inventory item. Review Creating IDs for more details on creating ID codes or automating this step.

- Enable the I want to view the new product now option and go to the General tab when the new product record opens.

-

On the new product record's General tab, find the Limit Use to __ Per Bill To Customer setting to restrict the number of times the customer can have this code applied to their account. It is in the middle right-hand side of the page. How to configure this setting:

-

Keep the value blank or zero to remove any restrictions.

-

Enter a positive number to restrict the code's usage within a specific customer's account to the number of times stated. For example, if it says Limit Use to 1 Per Bill To Customer, this percentage pricing can only be applied once per customer.

-

Enter a negative value to require a manager to override the restriction.

-

Using the Percentage Pricing Code in a Sales Order

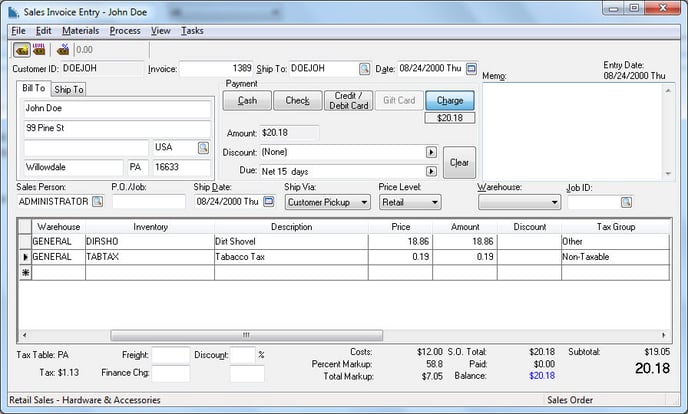

The Percentage Price amount within a sales invoice is calculated from the total of detail lines selected by the Calculate From setting of the item.

The percentage price is calculated from the Ordered or Shipped quantity (whichever is greatest) multiplied by the unit price of each previous item line and then multiplied by the percentage entered within the Percentage Price item.

Unit price of Percentage Price item = (Ordered or Shipped, whichever is greatest * Price) + Repeat for each line indicated from Calculate From setting

The Ordered and Shipped quantities will normally equal when a percentage pricing item is used within an invoice, but greater quantities can be utilized. Percentage pricing items should not be used within back orders under normal circumstances, since back orders could create duplicate discounts. Review the Processing a Sales Invoice section from the sales documentation for more details on back orders.