Configuring EBMS for Subcontractor Labor

The EBMS software must be configured to process subcontractor labor or vendors using the labor module. This configuration allows the user to collect job labor, other time, and manage work orders using the various EBMS labor collection and management tools.

Complete the following steps to configure EBMS for contractor workers:

- Open the payroll options by selecting Labor > Labor Options > General tab from the main EBMS menu.

- The Enable 3rd Party Pay Service & Subcontractors option must be enabled to process contractor pay.

- Click OK to save the payroll options.

From Financials > Chart of Accounts, click New to create a Payroll Payable G/L account in the Liabilities\Current Liabilities category folder to track payable for contractor workers as shown below.

In the Advanced tab, set the 1099 Form to the 1099-NEC Nonemployee Compensation option.

Review Adding General Ledger Accounts for more info on creating the subcontractor payable account and setting the 1099 Form.

Review Viewing 1099 Controls and Changing Thresholds Amounts to configure the 1099 settings for steps to configure 1099 settings within the contractor payable financial account.

Set up a subcontractor category

From Labor > Labor Options > Worker Categories, click New Category to create a subcontractor folder that contains all the 1099 contractor workers. If the subcontractor category already exists, proceed with the following steps.

Right-click on the subcontractor folder and select Edit Defaults from the context menu as shown above.

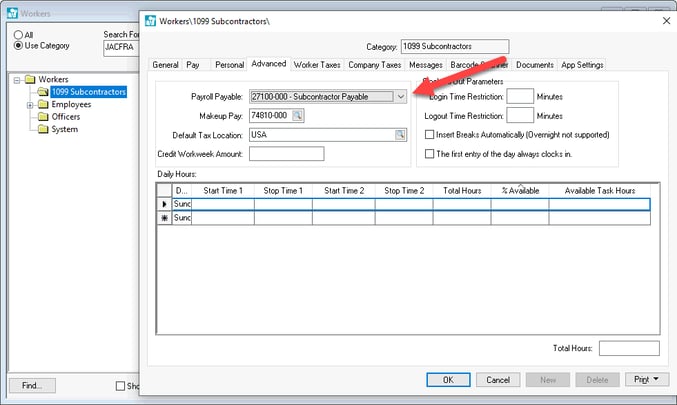

In the defaults for the subcontractors category, go to the Advanced tab. Set the Payroll Payable account to the subcontractor payable account that was created in the previous section.

Right-click on the Payroll Payable field and select Filter Down from the context menu to filter down this account for all existing workers within the subcontractor folder.

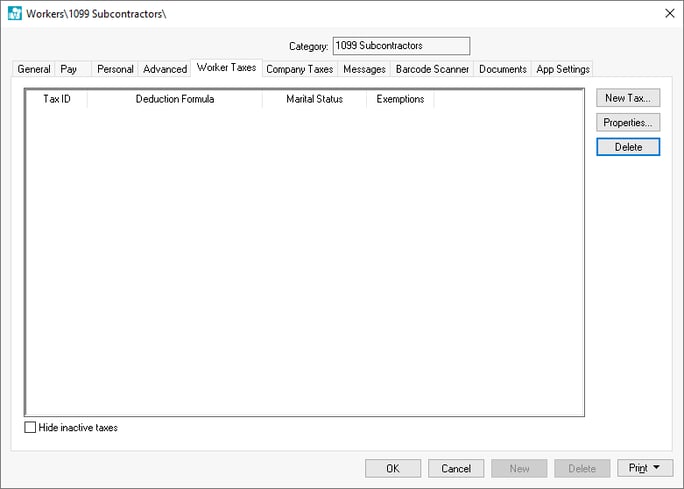

While in the defaults for the subcontractors category folder, click on the Worker Taxes tab.

Verify that all tax settings are cleared. The Worker Taxes tab should be blank.

Repeat the same for the Company Taxes tab in the subcontractors defaults. No tax records should be listed in the Company Taxes tab.

Click on the Pay tab and change the employee pay Method setting to Payroll Service option.

Use the filter down feature to change existing worker record settings. Review Edit Defaults, Filter Down Data, and Globally Change Data for filter down instructions.

Set Up Worker Records for Subcontractors

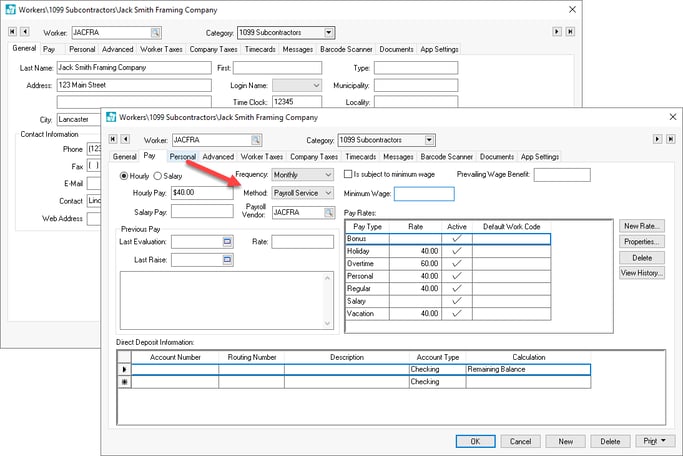

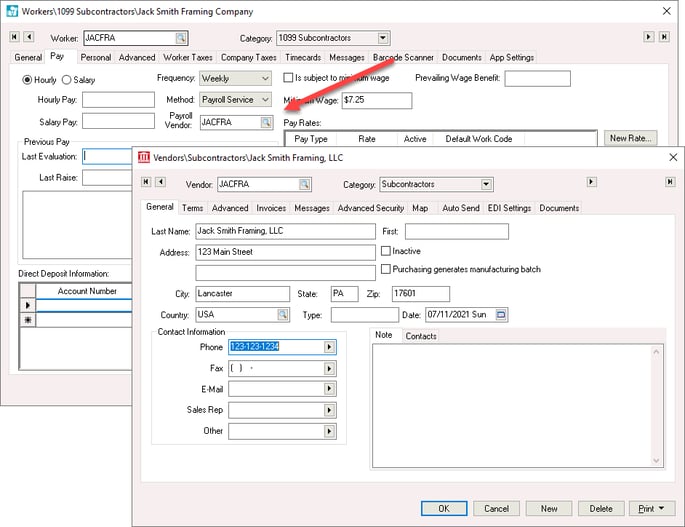

Create a worker record for each subcontractor and verify that the Method within the worker record Pay tab is set to Payroll Service.

Review Entering New Workers for setup instructions.

Create a matching vendor record for each subcontract worker unless a group of workers are leased as a group. Multiple workers' subcontractor pay can be directed to a common vendor such as a labor leasing company. Configure the Vendor name, Address, and Contact Information to match the worker record. Configure the required 1099 settings for each subcontractor. Review Setting 1099 Vendor Information for important vendor settings.  Enter this Vendor ID into the Payroll Vendor entry on the worker record Pay tab, as shown above. Note that the Method must be set to Payroll Service to display the Payroll Vendor setting.

Enter this Vendor ID into the Payroll Vendor entry on the worker record Pay tab, as shown above. Note that the Method must be set to Payroll Service to display the Payroll Vendor setting.

Verify each contractor worker settings such as pay rates and pay types are set properly. Review the Changing Worker Information section for more details on other worker settings.

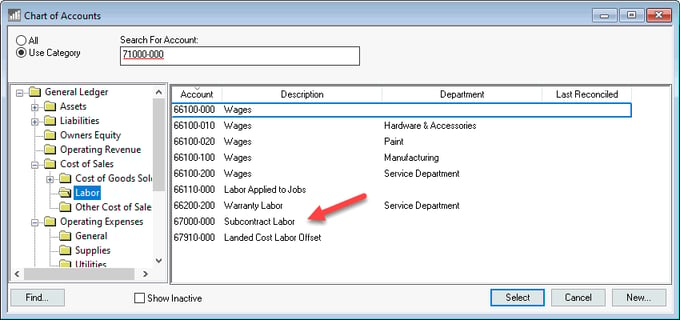

Verify that separate financial accounts are created from employee labor. This step is recommended to meet general accounting practices but is not required.

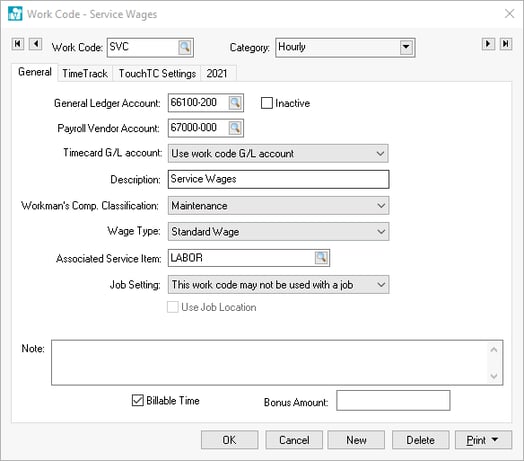

Configure Work Codes

Configure work codes with both financial labor accounts as shown below:

Enter the Payroll expense account that will be used when this work code is used in a non-contractor process. This financial account will be used for any employee or 3rd party pay.

Enter the optional Subcontract labor account in the 2nd financial account entry. This financial account is only needed if the subcontract labor expense differs from the employee labor expense.

Review Work Codes Overview for additional work code setup instructions.

Review Processing Subcontractor Labor to process labor within EBMS for a subcontractor.