Worker Configuration for Direct Deposit

EBMS allows the employer to pay all employees using direct deposit or only a portion of the employees. The worker must supply the employer with the routing and bank account numbers of the bank account(s) that will receive direct deposit payments. The employee must alert his employer if their bank account is moved or closed.

Complete the following steps to enter the employee’s bank account information:

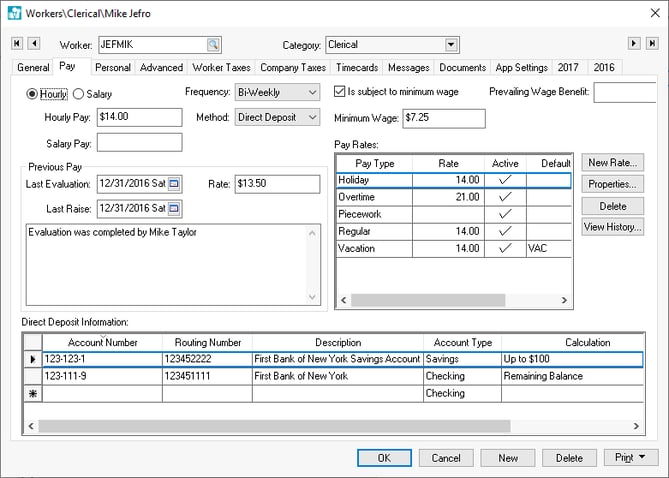

Open a worker record by selecting Labor > Workers from the main EBMS menu. Double-click on a worker ID to open that worker's record. Click on the Pay tab as shown below:

-

From the Method field on the Pay tab, select the Direct Deposit option, which allows the user to edit the account list. The Direct Deposit Information account list is located in the lower part of the Pay tab.

Note: The ON setting also produces ACH Transactions for the direct deposit of the employee’s pay during payment processing. Turning the switch OFF will inactivate the employee’s payment distribution and prevent the creation of ACH Transactions for direct deposit.

-

Enter the employee’s bank Account Number into the Direct Deposit Information table. This code identifies the bank account that will receive the worker's payroll deposit. This should be the employee’s unique account number within the destination bank. It is part of the MICR encoded numbers on the employee’s personal pre-printed checks and pre-printed deposit slips. It is the set of numbers that immediately precedes the On-US transit symbol ("

").

"). -

Enter the financial institution’s Routing Number. This code should be the designation bank’s unique identifying number within the Federal Reserve System. It is part of the MICR encoded numbers on pre-printed checks and pre-printed deposit slips. Use the nine-digit number between the two transit symbols ("

")

") -

Enter a Description of the designation bank account. This description will appear on the employee’s printed voucher that is generated from EBMS.

-

Select the Account Type. Direct Deposits can be made to a checking or savings account, so this type will be either be set to Checking or Savings.

-

The Calculation option specifies the method used to compute the amount to assign to the deposit transaction. Select an option from the list below:

-

Select the Remaining Balance option if the remainder of the pay amount is to be deposited into this account. This option will claim the balance of an employee’s net pay if the direct deposit is posted to multiple accounts. One account within the direct deposit account list must contain this option.

-

The ____% of net pay option and the Up to $____ option will deposit a portion of the pay to the bank account. The balance of the pay will be deposited into the account that contains the Remaining Balance option. This option can be used only if multiple accounts are entered in the direct deposit account list. Enter the percentage or amount of the partial deposit option into the Calculation option.

The order of account records sets the preference by which the employee’s net pay is divided up. Amounts calculated for each ACH Transaction are deducted from the employee’s net pay in succession until the last of the available balance of net pay is allocated to a payment distribution record. The exception to this rule is the Remaining Balance distribution record - regardless of its position in the table, the Remaining Balance record will have lowest priority, because this account will take whatever is left as a remainder. (Note that if only one direct deposit account is listed for a worker, the Calculation field must be set to Remaining Balance.)

There is no limit on the number of payment distribution records that may be entered for a single employee. The accounts can be located within multiple financial institutions and can be a combination of checking and savings accounts. EBMS will not permit the direct deposit settings to be saved unless at least one of the calculation methods has been set to Remaining Balance.

Repeat the steps for each employee that is paid using the ACH direct deposit method.