Processing Subcontractor Labor

The subcontractor labor process creates expense transactions from the timecard and uses an expense invoice to pay the subcontractor. EBMS uses an accrual payroll payable process that posts labor costs on the day the labor was performed. The gross labor costs are posted to the EBMS financial system using the individual timecard details lines. Note that this pay is credited to the Payroll Payable account set within View > Advanced Options in the timecard menu.

Unlike the typical payroll service process, the expense invoice then debits the payroll payable account. The subcontractor labor process does not involve a 3rd party to complete the process. Review 3rd Party Payroll Service > Overview for steps to use a 3rd party processor.

Process 1099 Subcontract Work

Complete the following steps to process 1099 subcontractor workers using the EBMS labor module:

-

Create a payroll period as described in Opening a New Pay Period. The Pay Period should reflect the last day of the payroll pay period and the Pay Date will be used as the expense invoice date.

-

Record the optional payroll clock in/clock out times using the various options within EBMS. Review Time and Attendance Overview for more details.

-

Enter timecard details using the various EBMS options listed below:

-

Tasks and Work Orders: Review Tasks & Work Orders Overview

-

MyTime App: Review MyTime App Overview

-

MyJobs App: Review MyJobs App Overview

-

Job Costing module: Job Costing Overview

-

Time Track App: Time Track App Overview

-

MyTasks App: MyTasks App Overview

-

Timecard Entry: Review Entering Timecards

-

-

Process timecards and create unprocessed expense invoices. Complete the following steps within this dialog:

-

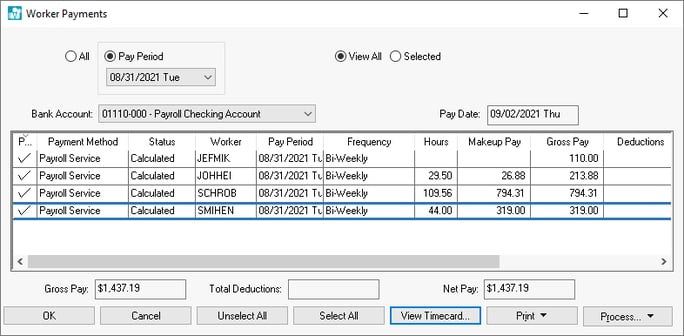

Select Labor > Worker Payments from the main EBMS menu to open the Worker Payments dialog.

-

Verify that the Payment Method for all employees listed is set to Payroll Service.

-

Click the Select All button to process labor for all employees listed.

-

Click on the Process button and select Calculate Taxes (Typical) option from the button menu. Note that this step may not calculate any taxes or deductions since the subcontractor labor process does not normally involve any taxes.

-

Click on the Process button again and select Process Payments to process the daily debit transactions to individual work codes, jobs, etc. and credit to the payroll payable account listed in the Advanced tab of each employee.

-

The recommended step is to click Create a new PO to create a separate invoice for each worker and pay period. A single payment can be made for a list of separate expense invoices listing each worker or pay period. The pay stub will list the description of each Accounts Payable (A/P) invoice. Choose the Select existing PO option only to append to an existing unprocessed expense invoice (also called Purchase Order or PO throughout EBMS).

-

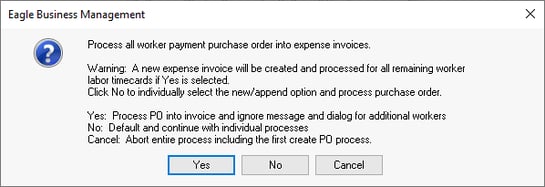

The following message will appear if the Create a new PO is selected: "Process all worker payment purchase order into expense invoices. Warning: A new expense invoice will be created and processed for all remaining worker labor timecards if Yes is selected. Click No to individually select the new/append option and process purchase order. Yes: Process PO into invoice and ignore message and dialog for additional workers. No: Default and continue with individual processes. Cancel: Abort entire process including the first create PO process."

Click Yes to process all worker payment purchase orders and mark them ready to pay.

Click No to create the purchase order but not process the new purchase order into an invoice. Repeat the step for each 1099 subcontractor worker if No is selected.

-

-

A list of expense purchase orders (unprocessed expense documents) and expense invoices (processed purchase orders) will be listed as shown below:

-

Print an optional form to generate a receipt report to list workers, hours, and pay for the pay period by completing the following steps:

-

Launch the report menu by selecting File > Reports from the main EBMS menu.

-

Launch the File > Reports > Labor > Forms > Individual Direct Deposit Notice report. Double-click on the report name to open the Print and Report Options page.

-

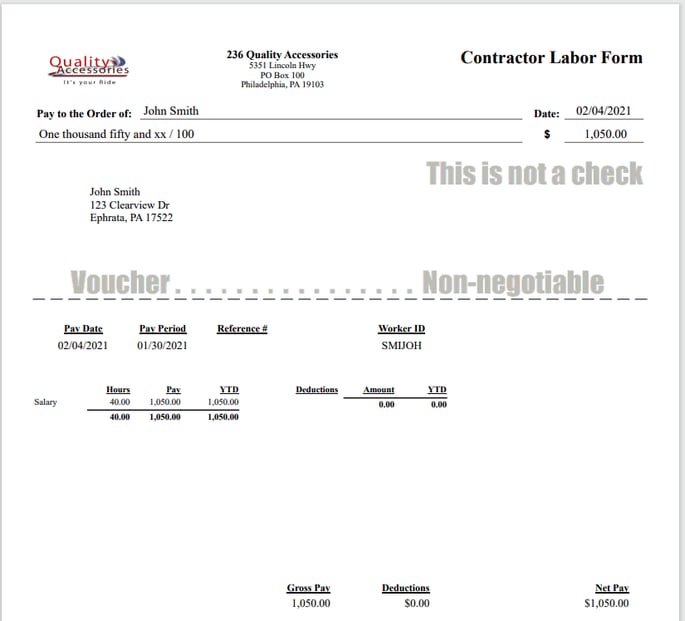

Select the Contractor Labor option as the Payment Method as shown above and click Print Preview to check settings. Click Print to generate the following form for each subcontract worker.

-

-

Open Expenses > Vendor Payments to view invoices.

Enable the Show P.O.s to show the purchase orders (unprocessed expense documents). -

Process the purchase orders into Accounts Payable (A/P) invoices.

-

Generate payments using one of the following Process button options:

-

Process Checks: Review Printing Vendor Checks for steps to generate paper checks.

-

Process Direct Payment: Review Processing Direct Payments ACH for steps to pay contractors using an ACH payment. This process is similar to the direct deposit option in payroll.

-

Manual Payment: Select Manual Payment from the Process button to process payments using other payment methods and record the payment information within a payment list.

-

-

Close the payroll period within EBMS by selecting Labor > Close Pay Period from the main EBMS menu. Review the Closing Payroll Periods section for more details on this step.

-

Review Printing 1099 Forms for end of year steps to generate 1099 forms.