Year End Payroll Adjustments

Jump to: Adjusting an Employee's Gross Pay or Work Weeks | Adjusting an Employee's Work Weeks | Adjusting an Employee's Tax Amount or Taxable Gross Pay | Adjusting Company Tax Amounts | Adjusting Work Code Totals

At times it is necessary to adjust tax amounts or gross pay for an employee or group of employees. This may be necessary if a wrong tax code has been used or if adjustments need to be made to an employee’s information after the payroll year has been closed and all timecards have been processed. Some basic notes or additions to an employee’s W-2 form can be accomplished without creating transactions with the journal entry screen and are explained in the proceeding Printing W-2 Forms section. These adjustments must be made with caution and should not be attempted unless the user has a thorough knowledge of the General Ledger and the effect that it has on the payroll records.

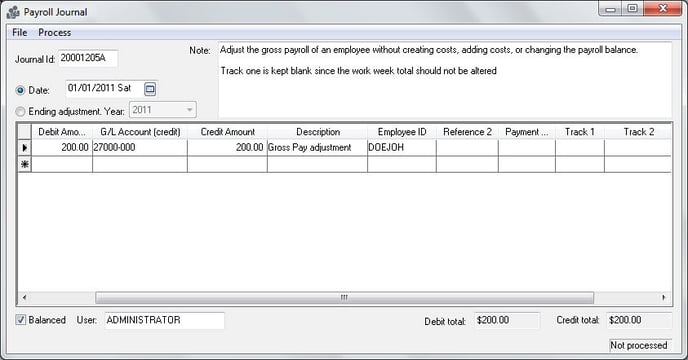

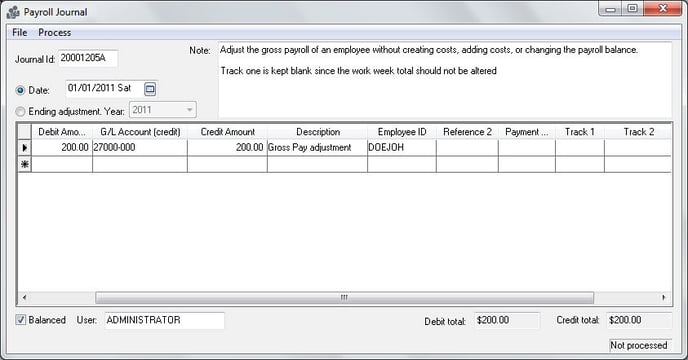

Adjusting an Employee’s Gross Pay or Work Weeks

Complete the following steps to adjust a worker's gross pay or work weeks for reporting purposes:

-

Go to Labor > Journal Entry from the main EBMS menu and click the New button to create a new journal entry.

-

Enter a descriptive Journal Id for the year end payroll adjustments.

-

The transaction Date must be within the month and year of the period that is being adjusted. Multiple journals must be entered if the user wishes to change the employee’s gross pay within different month periods. A single journal can be used to adjust the gross pay of multiple employees but not different monthly periods.

-

Employee’s gross pay may need to be raised for a number of reasons. The G/L Account (debit) and Debit Amount values depend on the type of gross pay adjustment.

-

If the gross pay is to be increased and the pay is payable to the employee, the debit G/L Account would identify the expense account. The user must then adjust Payroll Payable. To issue a check to the employee, enter an expense invoice using the Payroll Payable General Ledger account within the expense invoice.

-

If the gross pay is to be adjusted for the employee, but Payroll Payable should not be effaced, then the same General Ledger account that is entered into the credit G/L Account column should be entered in the credit G/L Account column. This will increase the employee’s gross pay without affecting the company’s profit and loss statement and without increasing payroll payable to the employee.

-

The G/L Account (credit) must be a liability General Ledger account classified as Payroll Payable in order to affect the employee’s gross pay.

-

Enter the gross pay adjustment into the Credit Amount column. The adjustment amount must be entered into the credit column. If you wish to decrease the gross pay amount, you must enter a negative value in the credit column rather than entering a debit.

-

The worker's ID code must be entered into the Employee ID column. Please verify that the Employee ID code is spelled correctly and in all caps. It is important to double-check each ID since the system will not verify the code or give a warning until the journal is posted.

-

The check number is normally entered into the Reference 2 column if gross pay is increased within the payroll system. Since the transactions will be created with this journal, enter a brief description such as "Adjustment" into the Reference 2 field.

-

Set the Payment Flag to ’E’ since it is an employee adjustment.

-

The Track 1 and Track 2 columns can be kept zero.

-

The journal entry must be balanced to ensure the integrity of the general ledger.

-

Select Process > Process from the payroll journal menu to create the transactions. TRANSACTIONS MUST BE POSTED TO GENERAL LEDGER BEFORE THE EMPLOYEE’S HISTORY IS ADJUSTED. Select Labor > Post Transactions to post the adjustment transactions to the General Ledger and to employee history pages.

| Debit/Credit | G/L Class | Employee ID | Reference2 | Payment Flag | Track1 | Track2 |

| Debit | Payroll Payable | Employee ID | Check No. | E |

Note that adjusting the gross pay within a journal will not add gross pay by pay type in the worker record Pay tab > Pay Rates table > View History button. The gross pay totals by pay type cannot be adjusted since these totals are determined based on the pay date rather than the timecard detail date.

Adjusting an Employee's Work Weeks

| Debit/Credit | G/L Class | Employee ID | Reference2 | Payment Flag | Track1 | Track2 |

| Debit | Payroll Payable | Employee ID | Work Weeks |

Complete the following steps to adjust an employee’s Work Week values for past payroll periods.

-

Go to Labor > Journal Entry and click the New button to start a new journal.

-

The G/L Account (debit) must be a liability General Ledger account classified as Payroll Payable in order to affect the employee’s work week totals.

-

Enter a zero value into the Debit Amount and the Credit Amount columns if the gross pay should not be adjusted.

-

The worker's ID code must be entered into the Employee ID column. Please verify that the Employee ID code is spelled correctly and in all caps. It is important to double-check each ID, since the system will not verify the code or give a warning until the journal is posted.

-

The check number is normally entered into the Reference 2 column if gross pay is increased within the payroll system. Since the transactions will be created with this journal, enter a brief description such as "Adjustment" into the Reference 2 field.

-

The Payment Flag and the Track 1 setting should not have values.

-

Enter the work week adjustment into the Track 1 entry. The user can enter a negative or positive work week amount. The journal example above will reduce the work week value for the listed employee (DOEJOH) by 2 work weeks.

Note that the General Ledger code classified as PAYROLL PAYABLE must be entered into the G/L account (debit) column to adjust the work week values. Process the journal as usual.

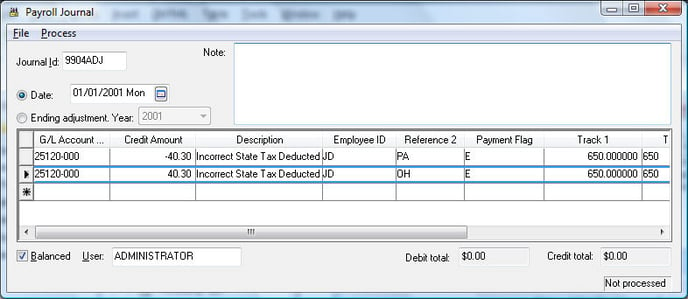

Adjusting an Employee’s Tax Amount or Taxable Gross Pay

| Debit/Credit | G/L Class | Employee ID | Reference2 | Payment Flag | Track1 | Track2 |

| Credit | Payroll Tax Deduction | Employee ID | Tax ID | E | Taxable Gross | Gross Pay |

Complete the following steps to adjust an employee’s tax-withheld amounts or taxable gross pay totals. This may be necessary if the wrong tax or deduction has been withheld from the employee’s pay. This method may also be used to enter an employee’s beginning balances if the payroll system has been implemented after payroll has already been processed.

-

Go to Labor > Journal Entry and click the New button to start a new journal.

-

In the example above, an adjustment was needed since the wrong state tax was withheld from the employee JD's pay. A total of $40.30 was withheld from an employee’s taxable gross pay of $650.00 in the month of January. The first line removes it from the wrong state tax of PA and the second line enters the tax into the Tax ID of OH. The taxable gross pay and the gross pay are also adjusted within the Track 1 and Track 2 columns. This adjustment will NOT adjust the employee’s taxable gross pay. See previous section for details in adjusting an Adjusting an Employee’s Gross Pay.

-

Enter a descriptive Journal Id for the year-end adjustments. A possible format may be the last two digits of the payroll year suffixed with "YRAD" as an abbreviation of year-end adjustments.

-

Enter the transaction Date or click on the Ending Adjustment Year option. It is important that the date or ending adjustment year is set to adjust the appropriate payroll year.

-

The G/L Account (debit) and Debit Amount should be blank.

-

Enter a liability General Ledger account classified as a payroll tax/deduction account into the G/L Account (credit) column.

-

The Credit Amount should equal the amount of the tax or deduction adjustment. Both positive and negative adjustments must be listed in the credit column, so the employee’s accumulated tax totals are adjusted. To decrease the tax or gross values use a negative number within the credit column rather than creating a debit transaction.

-

The Employee Id must be entered in the Employee Id column to identify the employee who requires an adjustment. Please verify that the Employee ID code is spelled correctly and in all caps. It is important to double-check each ID, since the system will not verify the code or give a warning until the journal is posted.

-

Enter the tax or deduction’s Tax ID code into the Reference 2 column. It is important that the proper Tax ID is entered with the code properly spelled and formatted. The Journal Entry window does not verify the spelling or formatting of ID codes.

-

The Payment Flag option must be set to E to adjust the employee’s tax history.

-

Enter the employee’s Taxable Gross pay into the Track 1 and Track 2 columns. The Track 1 values should be zero if the employee has already reached the maximum amount of tax for the tax that is being adjusted. The Track 2 value should always equal the employee’s gross pay even if the tax in question is not being withheld.

-

The journal entry must be balanced to ensure the integrity of the general ledger.

-

Select Process > Process from the journal menu to create the transactions. TRANSACTIONS MUST BE POSTED TO THE GENERAL LEDGER BEFORE THE EMPLOYEE’S HISTORY IS ADJUSTED. Select Labor > Post Transactions to post the adjustment transactions to general ledger and to employee history pages.

The General Ledger transactions created from the journal explained above, will also adjust the tax totals found in the main tax window.

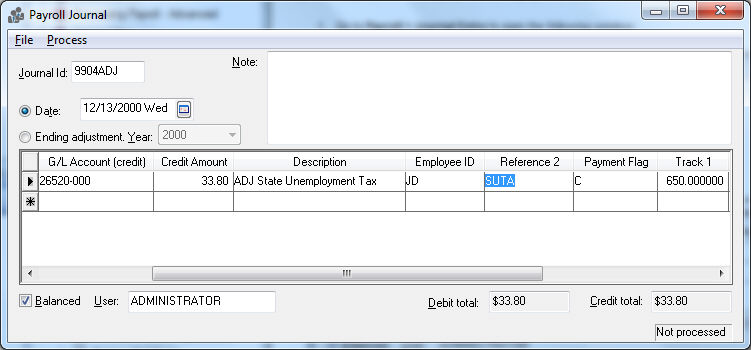

Adjusting Company Tax Amounts

| Debit/Credit | G/L Class | Employee ID | Reference2 | Payment Flag | Track1 | Track2 |

| Credit | Payroll Tax Deduction | Employee ID | Tax ID | C | Taxable Gross | Gross Pay |

Adjusting the company taxes is a process very similar to adjusting Employee taxes. All the information is identical with exception of the Payment Flag column. This option must be set to C instead of E.

A General Ledger journal can be processed without any employee identification, but the adjustments will NOT affect the employee’s company tax history. All payroll reports that display company tax information will not be accurate if a journal is processed without the Employee ID. To view company tax history for a specific worker, go to the worker record Company Taxes tab, highlight the tax you wish to view, and click the Properties button to view the worker's tax history.

-

Go to Labor > Journal Entry and click the New button to create a new journal.

-

Enter the company’s expense General Ledger account into the G/L Account (debit) and enter the amount of the adjustment within the Debit Amount field.

-

Enter a liability General Ledger account classified as a payroll tax/deduction account into the G/L Account (credit) column.

-

The Credit Amount should equal the Debit Amount, which is the amount of the tax adjustment.

-

The Employee Id must be entered in the Employee Id column if the employee’s history should be affected.

-

Enter the tax or deduction’s Tax ID code into the Reference 2 column. It is important that the proper Tax ID is entered with the code properly spelled and formatted. The Journal Entry window does not verify the spelling or formatting of IDs.

-

Set the Payment Flag option to C.

-

Enter the taxable gross pay into the Track 1 column and the gross pay into the Track 2 column.

-

The journal entry must be balanced to ensure the integrity of the General Ledger.

-

Select Process > Process from the journal menu to create the transactions. TRANSACTIONS MUST BE POSTED TO THE GENERAL LEDGER BEFORE THE EMPLOYEE’S HISTORY IS ADJUSTED. Select Labor > Post Transactions to post the adjustment transactions to general ledger and to employee history pages.

Adjusting Work Code Totals

Use the following guide to adjust work code totals. Follow the same entry and posting steps as explained in the preceding sections.

| Debit/Credit | G/L Class | Employee ID | Reference2 | Payment Flag | Track1 | Track2 |

| Credit | Payroll Payable | Employee ID | Work Code ID | Hours | Pay Level |