Customer ACH Payments

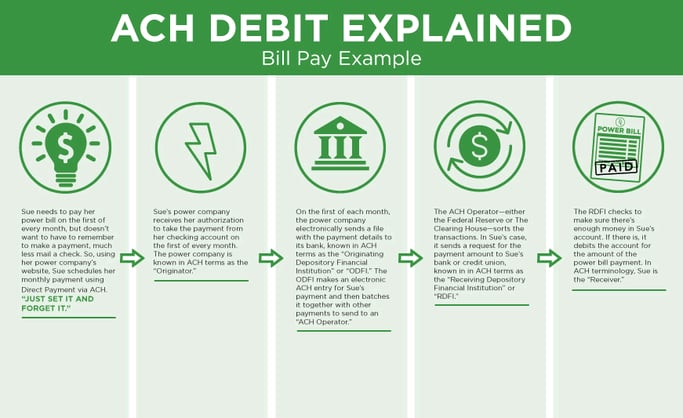

EBMS direct payments are electronic payments made through the Automated Clearing House (ACH) network, a secure system for clearing electronic payments between banks. Managed by NACHA (formerly the National Automated Clearing House Association).

Direct debit via ACH transactions is a simple, safe, convenient and cost-effective method to receive electronic payments from customers. Visit www.electronicpayments.org to learn more.

Electronic Fund Transfer (EFT) is the backbone of the Canadian payment industry including debit and fund transfers: Contact Eagle Software Canada for assistance to configure EFT transactions.

Accepting ACH payments for Accounts Receivable (A/R) invoices may reduce outstanding accounts receivable by making payments more convenient. ACH payments can also save fees compared to other electronic payments such as credit card payments.

EBMS uses a NACHA file to upload customer payment details to the EBMS user's bank. Review www.nacha.org for more information on NACHA.

Complete the following steps to configure EBMS to collect ACH payments:

-

Open a customer record by selecting Sales > Customers from the EBMS menu and selecting a customer. Once the customer record is open, click on the Terms tab as shown below:

-

Under Direct Payment Information, enter the customer's bank Account Number. As the source of funds for the direct payment, this should be the customer’s checking account number. It is part of the MICR encoded numbers along the bottom of the customer's checks and consists of the numbers that immediately precede the On-US transit symbol (

).

). -

The bank Account Type should be set to Checking or the bank account type used by the customer.

-

Enter the Routing Number/ODFI of the customer's bank. As the origin of funds for the direct deposit transactions, this should be the bank’s unique identifying number within the Federal Reserve System. It is part of the MICR encoded numbers along the bottom of pre-printed checks and pre-printed deposit slips. Use the nine-digit number between the two transit symbols (

).

). -

Enter a direct payment Description (such as the bank name).

-

Enable the Customer Payments: Group multiple invoices into one debit transaction in ACH file option. Disabling this option will individualize each sales invoice within the customer's checking account.

-

Verify that the receiving bank account is configured to receive the customer direct payments. Review Configuring ACH and EFT Direct Payments for instructions to set up the bank account used to receive customer payments.

-

Test the customer’s bank information by uploading a Prenote file for each customer to your bank. A Prenote file is a zero-dollar transaction that is created and sent through the ACH network to test the validity of the customer’s bank information within the payment vendor record. This pre-authorization process is required by some banks whenever a customer’s bank information is entered or changed. This process does not transfer funds from the customer. Review Create Prenote and Submit NACHA to Bank Web Portal for instructions to test the direct payment.

-

Repeat each of the steps listed above for each customer that agrees to pay sales invoices with the EBMS direct pay ACH feature.

Review Processing Direct Payments ACH for instructions on processing customer ACH direct payments.

Review Reconciling a Bank Account for steps to review and reconcile ACH payment transactions.