TaxJar AutoFile

Automatically file sales tax returns with TaxJar AutoFile

Do you need a software solution to automatically file your sales tax returns on your behalf? AutoFile may be the solution you need.

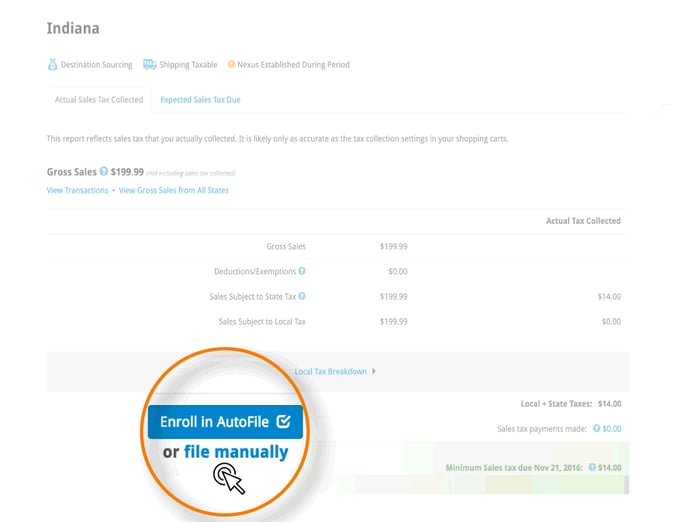

AutoFile is the name of TaxJar’s electronic filing service for state tax. TaxJar will use the information from EBMS to prepare and submit returns to the state, along with payments if the company enrolls in the optional service. TaxJar can AutoFile tax returns for every U.S. state. Use AutoFile as your fully automated solution to spend less valuable time filing and worrying about due dates and late penalties.

Manual file taxes rather than using AutoFile

Yes, you always have the option to choose to file on your own rather than use AutoFile. TaxJar will create a “return-ready” report for each state registered on the TaxJar website, so it often only takes minutes to complete state returns by filling in the blanks on the appropriate state's filing website.

Complete the following steps to file manually:

-

Load the TaxJar dashboard with current tax information. Review Upload Tax Data for Reporting and Filing for details.

-

Click Steps to File Manually to file individual tax returns on the state’s e-file website.

AutoFile Cost

AutoFile is a separate charge and varies depending on your plan type and volume. New to AutoFile? Your First AutoFile is always FREE! Review more pricing information at www.taxjar.com/autofile/#pricing.

AutoFile Requirements

-

State sales tax registration and Tax ID

-

State tax filing credentials

-

US-based bank account

-

Existing TaxJar subscription. (An upgrade is required if you are using the free trial of TaxJar.)

-

All product tax exemptions or items with a discounted tax rate MUST be categorized using the EBMS Inventory Tax Groups and match the TaxJar categories. Note that the generic user-defined tax exempt option may not be used with AutoFile. Click on the TaxJar tab within the Inventory Tax Group record. Go to Sales > Sales Tax > Rates > Inventory Tax Groups tab and select an existing tax group or create a new tax group record to open this window.

Complete the following steps to use the AutoFile service:

-

Launch the TaxJar website service and log into the company's TaxJar tax account.

-

Click on the Dashboard page and enroll in the AutoFile service for individual states.

-

After you file your return, make sure you record the payment in your TaxJar account. This will “lock” the data in your Report and also update your Dashboard to display the next filing due date.