Configuring EBMS to use TaxJar Tax Rates

The TaxJar subscription can be added to the EBMS software to calculate and process sales and use taxes for any state in the United States. Review TaxJar > Overview for details on this convenient cloud-based service.

The following optional EBMS modules must be installed before using the TaxJar subscription service:

-

TaxJar: TaxJar Module adds the communication link between EBMS and TaxJar's service website.

-

Advanced Sales Tax: Advanced Sales Tax Module to add Inventory Tax Groups.

Review the EBMS Optional Modules for instructions to add these EBMS modules.

Complete the following steps to add the TaxJar feature to the EBMS software:

-

Open the TaxJar configuration dialog by selecting Sales > Options > TaxJar tab from the main EBMS menu. The EBMS TaxJar API is required to use TaxJar's subscription services. Add the Optional TaxJar module if the TaxJar tab does not exist.

-

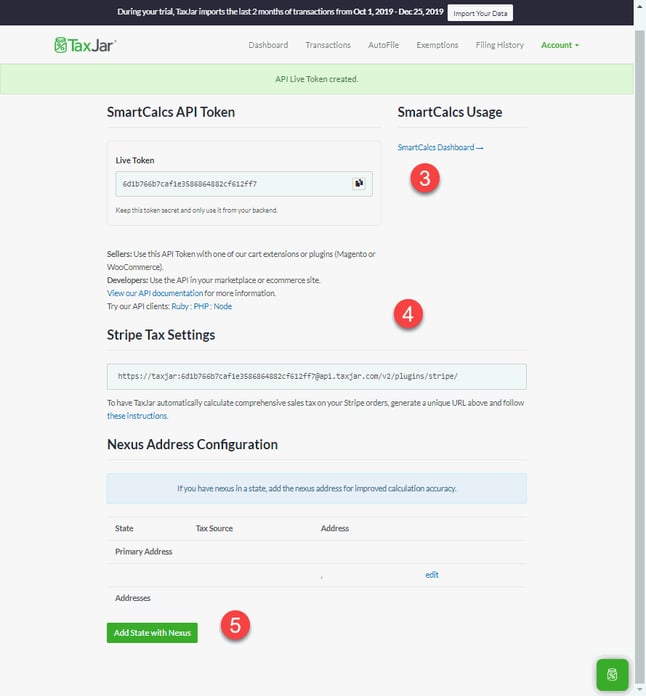

Sign up for the TaxJar Basic service by going to the TaxJar API Signup Page for the basic service. Continue to the web page to create the SmartCalcs API Token as shown below:

-

Enter the TaxJar API Key that is communicated during the subscription steps

-

Enter https://api.taxjar.com/v2/ into the TaxJar API URL field within the EBMS options dialog to access the TaxJar API from EBMS.

-

Each state must be identified on the TaxJar website to calculate sales tax. Do not list any states that are outside the company sales tax nexus. EBMS will create tax records for each state configured within TaxJar.

-

Complete the TaxJar subscription for the sales tax services needed. TaxJar support will contact you using the email that was entered during the original sign up step (#2).

-

The setup of state nexus settings within TaxJar will create sales tax rate records within EBMS. Verify that the liability account is properly set up by TaxJar. Review Establishing Tax Rates for details on the necessary state sales tax rate records.

-

Each EBMS tax group must be associated to a TaxJar Category. Review Inventory Tax Groups steps to configure TaxJar categories. The recommended method is to identify all inventory tax groups that are exempt or have a reduced rate that are sold at the company.

The alternative to using Inventory Tax Groups is to set the TaxJar settings for the manual taxable/non-taxable method as follows:Taxable: Blank the TaxJar Category code within the TaxJar tab.

Non-Taxable: Set the TaxJar Category to 99999. Note that the 99999 code cannot be used when using the TaxJar AutoFile option.

-

Review the TaxJar settings as well as the EBMS tax setup settings in this section to verify that the TaxJar setup is complete. Each step must be completed before continuing.

-

Disable the TaxJar service option till the end of the month and click OK to activate TaxJar. Disable this option to temporarily use the EBMS tax tables instead of TaxJar.

Review Upload Data for Reporting and Filing to generate report to file sales tax with the state or other jurisdiction.