- EBMS Knowledge Base

- Labor

- Processing Payroll

-

Client Resources

-

EBMS Main Documentation

- Introduction

- Getting Started

- Getting Started | Initial Installation

- Getting Started | Company Setup

- Quick User Guide | Financial Staff | Accountant

- Quick User Guide | Financial Staff | Accountant | Accountants Journal

- Quick User Guide | Sales Staff

- Quick User Guide | General Staff

- Features

- Reports

- Security

- Server Manager

- Technical

- Technical | Data Import and Export Utility

- Technical | SQL Mirror

- Automotive

- Automotive | Parts Catalog

- Automotive | Pricing

- Automotive | Point of Sale

- Automotive | Product Application

- Automotive | Keystone Interface

- Metal Supply

- Fuel Sales

- Horticulture

- Horticulture | Farm Setup

- Horticulture | Processing Payroll

- Horticulture | Managing the Farm

-

Sales

- Introduction

- Customers

- Customers | Miscellaneous Customers

- Proposals

- Proposals | Processing Proposals

- Proposals | Sets and Templates

- MyProposals

- MyOrders

- Sales Orders

- Invoices

- Materials Lists

- Sales and Use Tax

- Sales and Use Tax | TaxJar

- CRM

- CRM | Auto Send

- Recurring Billing

- Credits

- Customer Payments

- Payment Card Processing

- Payment Card Processing | Gift Cards

- Payment Card Processing | Loyalty Cards

- Payment Card Processing | Verifone Gateway

- Freight and Shipping Tools

- General Ledger Transactions

- Point of Sale

- Point of Sale | Point of Sale Hardware

- Point of Sale | Xpress POS System

- Point of Sale | Advanced Tools

- Signature Capture

- Salesperson Commissions

-

Inventory

- Product Catalog

- Product Catalog | Using Product Codes for No Count Items

- Product Pricing

- Product Pricing | Special Pricing

- Tracking Counts

- Unit of Measure

- Purchasing

- Special Orders and Drop Shipped Items

- Receiving Product

- Barcodes

- MyInventory and Scanner

- Components (BOM) and Accessories

- Components (BOM) and Accessories | Component Formula Tool

- Made-to-Order Kitting

- Configure-to-Order Kitting

- Multiple Inventory Locations

- Multiple Inventory Locations | Creating Locations

- Multiple Inventory Locations | Using Multiple Locations

- Multiple Inventory Locations | Product Catalog Sync

- Multi-Vendor Catalog

- Serialized Items

- Serialized Items | Purchasing or Manufacturing an Item

- Serialized Items | Selling and/or Associating an item with a customer

- Lots

- Product Attributes

- Product Attributes | Selling and Purchasing Items with Attributes

- Product Attributes | Custom Attributes

- Mobile Scanner (Legacy)

-

Labor

- Getting Started

- Workers

- Taxes and Deductions

- Work Codes

- Time and Attendance

- Time and Attendance | Time Track App

- Processing Payroll

- Closing the Payroll Year

- Processing Payroll - Advanced

- Salaried Pay

- Piecework Pay

- Direct Deposit

- 3rd Party Payroll Service

- Subcontract Workers

- Flag Pay

- Prevailing Wages

- MyDispatch

- MyTasks

- MyTime

- MyTime | Communications

- MyTime | Setup

- Tasks

- Tasks | Getting Started

- Tasks | Creating Tasks

- Tasks | Scheduling Tasks

- Tasks | Customizing Task Views

- Tasks | Managing Tasks

-

Financials

- Introduction

- Fiscal Year

- Chart of Accounts

- Budget

- Financial Reporting

- Transactions and Journals

- Transactions and Journals | Journals

- Account Reconciliation

- 1099

- Departments and Profit Centers

- Fund Accounts

- Bank Accounts

- Bank Feed

- Vendors

- Vendors | Miscellaneous Vendors

- Purchase Orders

- Expense Invoices

- Vendor Payments

- AP Transactions

- Landed Cost

- Fixed Assets and Depreciation

- Fixed Assets and Depreciation | Fixed Assets

- Fixed Assets and Depreciation | Fixed Assets | Adding Assets

- Fixed Assets and Depreciation | Processing Depreciation

- Fixed Assets and Depreciation | Disposing Assets

- MyJobs

-

E-commerce

-

Rental

-

Job Costing

-

Manufacturing

Calculating Taxes

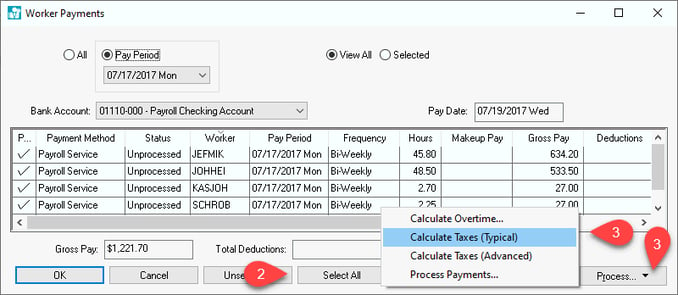

The labor module can be used to calculate payroll taxes and deductions as well as company taxes. The EBMS includes tools to handle very complex tax and deduction options. Taxes and deductions can be calculated from the timecard or the most common method of calculating taxes from the Worker Payments dialog as shown below:

Review Entering Timecards for instructions to calculate taxes from the timecard.

Complete the following steps to calculate taxes. Note that this step must be accomplished even if no taxes are included in the worker record because of 3rd party payroll.

-

Open the Labor > Worker Payments dialog launched from the main EBMS menu.

-

Click on the Select All button to calculate taxes for all workers or select individual workers.

-

Click on the Process button and select Calculate Taxes (Typical) to calculate the configured taxes and deductions for all selected timecards. The Calculate Taxes (Advanced) option should be used for pay periods that involve bonus or other uncommon payroll processes. Review Bonus Pay Periods for an example of the need to use the Calculate Taxes (Advanced) option.

-

The Calculate Taxes process changes the Status of each selected timecards from Unprocessed to Calculated. Continue to Process Payments if all selected timecards have a status of Calculated. This step must be launched again if any changes were made to the selected timecards. This Calculate Taxes utilities can be processed multiple times. There are no negative consequences to running this utility multiple times.

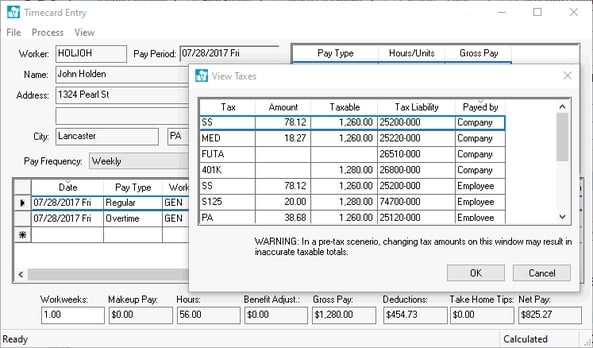

View Taxes

Complete the following steps to view the taxes and deductions that will be withheld from the paycheck:

-

Open the timecard you wish to view by opening individual Timecards.

-

Select the View > Taxes selection from the timecard menu.

-

Use the up and down cursor keys on the keyboard to scroll list. Be careful not to change the taxes inadvertently.

-

Click Ok on tax list to close window. Select File > Close from the timecard menu to close timecard window.