- EBMS Knowledge Base

- Labor

- Workers

-

Client Resources

-

EBMS Main Documentation

- Introduction

- Getting Started

- Getting Started | Initial Installation

- Getting Started | Company Setup

- Quick User Guide | Financial Staff | Accountant

- Quick User Guide | Financial Staff | Accountant | Accountants Journal

- Quick User Guide | Sales Staff

- Quick User Guide | General Staff

- Features

- Reports

- Security

- Server Manager

- Technical

- Technical | Data Import and Export Utility

- Technical | SQL Mirror

- Automotive

- Automotive | Parts Catalog

- Automotive | Pricing

- Automotive | Point of Sale

- Automotive | Product Application

- Automotive | Keystone Interface

- Metal Supply

- Fuel Sales

- Horticulture

- Horticulture | Farm Setup

- Horticulture | Processing Payroll

- Horticulture | Managing the Farm

-

Sales

- Introduction

- Customers

- Customers | Miscellaneous Customers

- Proposals

- Proposals | Processing Proposals

- Proposals | Sets and Templates

- MyProposals

- MyOrders

- Sales Orders

- Invoices

- Materials Lists

- Sales and Use Tax

- Sales and Use Tax | TaxJar

- CRM

- CRM | Auto Send

- Recurring Billing

- Credits

- Customer Payments

- Payment Card Processing

- Payment Card Processing | Gift Cards

- Payment Card Processing | Loyalty Cards

- Payment Card Processing | Verifone Gateway

- Freight and Shipping Tools

- General Ledger Transactions

- Point of Sale

- Point of Sale | Point of Sale Hardware

- Point of Sale | Xpress POS System

- Point of Sale | Advanced Tools

- Signature Capture

- Salesperson Commissions

-

Inventory

- Product Catalog

- Product Catalog | Using Product Codes for No Count Items

- Product Pricing

- Product Pricing | Special Pricing

- Tracking Counts

- Unit of Measure

- Purchasing

- Special Orders and Drop Shipped Items

- Receiving Product

- Barcodes

- MyInventory and Scanner

- Components (BOM) and Accessories

- Components (BOM) and Accessories | Component Formula Tool

- Made-to-Order Kitting

- Configure-to-Order Kitting

- Multiple Inventory Locations

- Multiple Inventory Locations | Creating Locations

- Multiple Inventory Locations | Using Multiple Locations

- Multiple Inventory Locations | Product Catalog Sync

- Multi-Vendor Catalog

- Serialized Items

- Serialized Items | Purchasing or Manufacturing an Item

- Serialized Items | Selling and/or Associating an item with a customer

- Lots

- Product Attributes

- Product Attributes | Selling and Purchasing Items with Attributes

- Product Attributes | Custom Attributes

- Mobile Scanner (Legacy)

-

Labor

- Getting Started

- Workers

- Taxes and Deductions

- Work Codes

- Time and Attendance

- Time and Attendance | Time Track App

- Processing Payroll

- Closing the Payroll Year

- Processing Payroll - Advanced

- Salaried Pay

- Piecework Pay

- Direct Deposit

- 3rd Party Payroll Service

- Subcontract Workers

- Flag Pay

- Prevailing Wages

- MyDispatch

- MyTasks

- MyTime

- MyTime | Communications

- MyTime | Setup

- Tasks

- Tasks | Getting Started

- Tasks | Creating Tasks

- Tasks | Scheduling Tasks

- Tasks | Customizing Task Views

- Tasks | Managing Tasks

-

Financials

- Introduction

- Fiscal Year

- Chart of Accounts

- Budget

- Financial Reporting

- Transactions and Journals

- Transactions and Journals | Journals

- Account Reconciliation

- 1099

- Departments and Profit Centers

- Fund Accounts

- Bank Accounts

- Bank Feed

- Vendors

- Vendors | Miscellaneous Vendors

- Purchase Orders

- Expense Invoices

- Vendor Payments

- AP Transactions

- Landed Cost

- Fixed Assets and Depreciation

- Fixed Assets and Depreciation | Fixed Assets

- Fixed Assets and Depreciation | Fixed Assets | Adding Assets

- Fixed Assets and Depreciation | Processing Depreciation

- Fixed Assets and Depreciation | Disposing Assets

- MyJobs

-

E-commerce

-

Rental

-

Job Costing

-

Manufacturing

Processing Tips

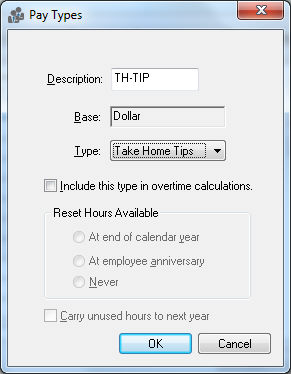

Paying out employee tips must be processed in a unique manner because of tax reporting requirements. All tips must be identified within a timecard with a Pay Type of either Take Home Tips or Employer Paid Tips.

Complete the following steps to create a pay type for tip payments:

Go to Labor > Labor Options > Pay Types tab and click on the New button to create a new pay type.

-

Enter a pay type Description that describes the tip pay. For example, use the EP-TIP description for Employer paid tip or TH-TIP for take home tips. (See image above.)

-

The Base should be set to the Dollar option.

-

The Type option should be set to Employer Paid Tips if the tip is included within the worker's paycheck. The Take Home Tips option should be used if the cash tips were given to the worker but must be added to the gross pay for tax calculations. Create both pay types separately if employees are paid using both methods.

-

Click on the OK button to save changes to the pay type.

Review the Entering Salaried Employee Timecards section for details on entering pay into the timecard.