- EBMS Knowledge Base

- Labor

- Prevailing Wages

-

Client Resources

-

EBMS Main Documentation

- Introduction

- Getting Started

- Getting Started | Initial Installation

- Getting Started | Company Setup

- Quick User Guide | Financial Staff | Accountant

- Quick User Guide | Financial Staff | Accountant | Accountants Journal

- Quick User Guide | Sales Staff

- Quick User Guide | General Staff

- Features

- Reports

- Security

- Server Manager

- Technical

- Technical | Data Import and Export Utility

- Technical | SQL Mirror

- Automotive

- Automotive | Parts Catalog

- Automotive | Pricing

- Automotive | Point of Sale

- Automotive | Product Application

- Automotive | Keystone Interface

- Metal Supply

- Fuel Sales

- Horticulture

- Horticulture | Farm Setup

- Horticulture | Processing Payroll

- Horticulture | Managing the Farm

-

Sales

- Introduction

- Customers

- Customers | Miscellaneous Customers

- Proposals

- Proposals | Processing Proposals

- Proposals | Sets and Templates

- MyProposals

- MyOrders

- Sales Orders

- Invoices

- Materials Lists

- Sales and Use Tax

- Sales and Use Tax | TaxJar

- CRM

- CRM | Auto Send

- Recurring Billing

- Credits

- Customer Payments

- Payment Card Processing

- Payment Card Processing | Gift Cards

- Payment Card Processing | Loyalty Cards

- Payment Card Processing | Verifone Gateway

- Freight and Shipping Tools

- General Ledger Transactions

- Point of Sale

- Point of Sale | Point of Sale Hardware

- Point of Sale | Xpress POS System

- Point of Sale | Advanced Tools

- Signature Capture

- Salesperson Commissions

-

Inventory

- Product Catalog

- Product Catalog | Using Product Codes for No Count Items

- Product Pricing

- Product Pricing | Special Pricing

- Tracking Counts

- Unit of Measure

- Purchasing

- Special Orders and Drop Shipped Items

- Receiving Product

- Barcodes

- MyInventory and Scanner

- Components (BOM) and Accessories

- Components (BOM) and Accessories | Component Formula Tool

- Made-to-Order Kitting

- Configure-to-Order Kitting

- Multiple Inventory Locations

- Multiple Inventory Locations | Creating Locations

- Multiple Inventory Locations | Using Multiple Locations

- Multiple Inventory Locations | Product Catalog Sync

- Multi-Vendor Catalog

- Serialized Items

- Serialized Items | Purchasing or Manufacturing an Item

- Serialized Items | Selling and/or Associating an item with a customer

- Lots

- Product Attributes

- Product Attributes | Selling and Purchasing Items with Attributes

- Product Attributes | Custom Attributes

- Mobile Scanner (Legacy)

-

Labor

- Getting Started

- Workers

- Taxes and Deductions

- Work Codes

- Time and Attendance

- Time and Attendance | Time Track App

- Processing Payroll

- Closing the Payroll Year

- Processing Payroll - Advanced

- Salaried Pay

- Piecework Pay

- Direct Deposit

- 3rd Party Payroll Service

- Subcontract Workers

- Flag Pay

- Prevailing Wages

- MyDispatch

- MyTasks

- MyTime

- MyTime | Communications

- MyTime | Setup

- Tasks

- Tasks | Getting Started

- Tasks | Creating Tasks

- Tasks | Scheduling Tasks

- Tasks | Customizing Task Views

- Tasks | Managing Tasks

-

Financials

- Introduction

- Fiscal Year

- Chart of Accounts

- Budget

- Financial Reporting

- Transactions and Journals

- Transactions and Journals | Journals

- Account Reconciliation

- 1099

- Departments and Profit Centers

- Fund Accounts

- Bank Accounts

- Bank Feed

- Vendors

- Vendors | Miscellaneous Vendors

- Purchase Orders

- Expense Invoices

- Vendor Payments

- AP Transactions

- Landed Cost

- Fixed Assets and Depreciation

- Fixed Assets and Depreciation | Fixed Assets

- Fixed Assets and Depreciation | Fixed Assets | Adding Assets

- Fixed Assets and Depreciation | Processing Depreciation

- Fixed Assets and Depreciation | Disposing Assets

- MyJobs

-

E-commerce

-

Rental

-

Job Costing

-

Manufacturing

Prevailing Wage Rates

Prevailing wages are normally set based on the type of work that is performed on the job. The variable rates are set in EBMS using the work code and job.

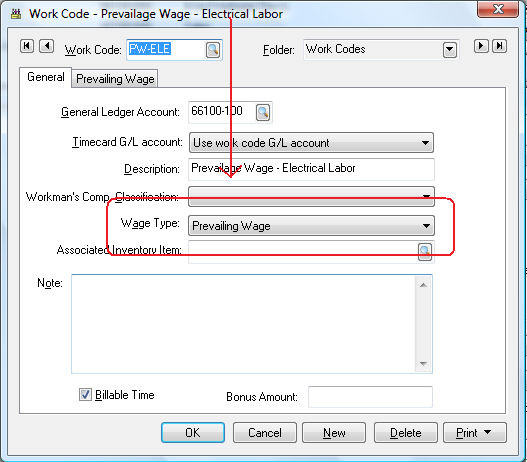

Work Codes

Click on Labor > Work Codes to set the rate for each work code. Create a separate work code for each type of task that contains a different prevailing wage rate. Review the Prevailing Wages > Creating Work Codes for Prevailing Wage Rates section for more detail on creating work codes for prevailing wages.

A Prevailing Wage tab will appear if the Wage Type is set to Prevailing Wage as shown above. Click on the Prevailing Wage tab.

Job Settings

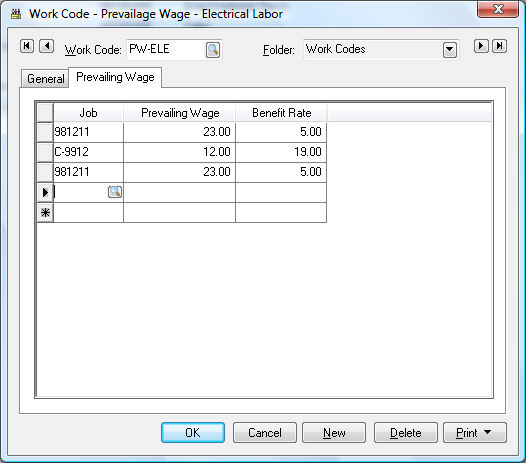

The following job list will appear on the tab if the optional Job Costing module is installed within EBMS. Otherwise the Prevailing Wage tab will only show a single set of rates. The Job Costing module must be installed to set prevailing wages based on the job. Contact an EBMS worker service rep for more details on the job costing module.

The Prevailing Wage tab will show a table of job entries if the Job costing module exists. The prevailing wage rate consists of two rates; Prevailing Wage and the Benefit Rate.

Worker Settings

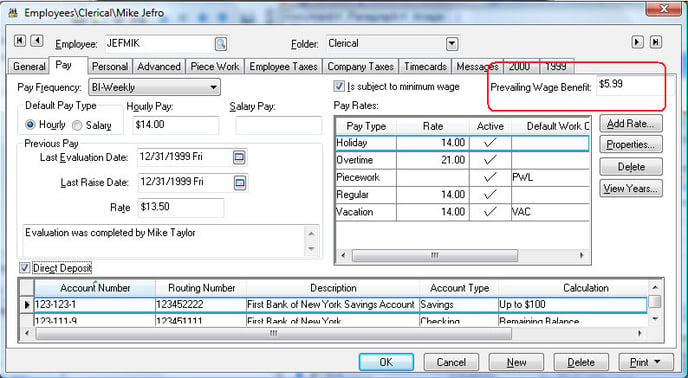

The employee is paid a minimum of the Prevailing Wage rate and a maximum based on the Prevailing Wage rate plus the Benefit Rate. For example based on the example shown below, the employee will be paid a minimum of $23 an hour for job - 981211 or a maximum of $28 an hour based on the Prevailing Wage Benefit set within the employee. Click on the Pay tab of an employee to set the Prevailing Wage Benefit rate as shown below:

The Prevailing Wage Benefit rate should reflect the total hourly value of the benefits given to an employee such as holiday pay, vacation pay, medical insurance, and any other company paid benefit. This hourly rate will be used to calculate the prevailing wage within the timecard. The employee’s pay = the Prevailing Wage rate within the work code tab + (the Benefit Rate within the work code – Prevailing Wage Benefit rate set within the employee). If the Prevailing Wage Benefit rate within the employee record is greater than the Benefit Rate within the work code the total pay will be equal the Prevailing Wage amount found in the work code.

Using the examples shown above, Mike Jeffro (JEFMIK) will be paid a prevailing wage of $5.99 an hour for electrical labor (PW-ELE work code) for the 981211 job.

Note: The formula set for hourly pay must be set to use the hourly pay setting within the pay tab for prevailing wages to be calculated properly. For example, the Regular pay type formula must be set to Equal to rather than set to a specific rate. Review the Workers > Setting Employee Defaults section for more details on setting pay rates.

Overtime pay rates are calculated based on the average pay on the timecard rather than calculated from the hourly pay rate entered in the Pay tab of the employee record. Review the Processing Payroll > Calculating Overtime section for more details.

Reports

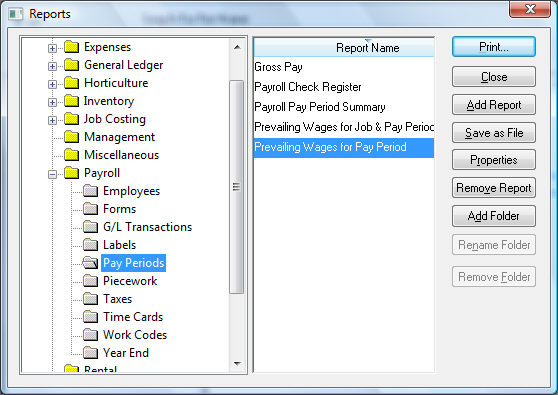

Go to the File > Reports option from the main EBMS menu to view the prevailing wage reports.

Prevailing wage reports can be found within the Labor > Pay Periods section of the reports menu as shown above. Prevailing wage reports are useful to communicate certified payroll job summary to the state.