- EBMS Knowledge Base

- Sales

- Invoices

-

Client Resources

-

EBMS Main Documentation

- Introduction

- Getting Started

- Getting Started | Initial Installation

- Getting Started | Company Setup

- Quick User Guide | Financial Staff | Accountant

- Quick User Guide | Financial Staff | Accountant | Accountants Journal

- Quick User Guide | Sales Staff

- Quick User Guide | General Staff

- Features

- Reports

- Reports | Excel Add-In

- Reports | Excel Add-In | Troubleshooting

- Security

- Server Manager

- Technical

- Technical | Data Import and Export Utility

- Technical | SQL Mirror

- Automotive

- Automotive | Parts Catalog

- Automotive | Pricing

- Automotive | Point of Sale

- Automotive | Product Application

- Automotive | Keystone Interface

- Metal Supply

- Fuel Sales

- Horticulture

- Horticulture | Farm Setup

- Horticulture | Processing Payroll

- Horticulture | Managing the Farm

-

Sales

- Introduction

- Customers

- Customers | Miscellaneous Customers

- Proposals

- Proposals | Processing Proposals

- Proposals | Sets and Templates

- MyProposals

- MyOrders

- Sales Orders

- Invoices

- Materials Lists

- Sales and Use Tax

- Sales and Use Tax | TaxJar

- CRM

- CRM | Auto Send

- Recurring Billing

- Credits

- Customer Payments

- Payment Card Processing

- Payment Card Processing | Gift Cards

- Payment Card Processing | Loyalty Cards

- Payment Card Processing | Verifone Gateway

- Freight and Shipping Tools

- General Ledger Transactions

- Point of Sale

- Point of Sale | Point of Sale Hardware

- Point of Sale | Xpress POS System

- Point of Sale | Advanced Tools

- Signature Capture

- Salesperson Commissions

-

Inventory

- Product Catalog

- Product Catalog | Using Product Codes for No Count Items

- Product Pricing

- Product Pricing | Special Pricing

- Tracking Counts

- Unit of Measure

- Purchasing

- Special Orders and Drop Shipped Items

- Receiving Product

- Barcodes

- MyInventory and Scanner

- Components (BOM) and Accessories

- Components (BOM) and Accessories | Component Formula Tool

- Made-to-Order Kitting

- Configure-to-Order Kitting

- Multiple Inventory Locations

- Multiple Inventory Locations | Creating Locations

- Multiple Inventory Locations | Using Multiple Locations

- Multiple Inventory Locations | Product Catalog Sync

- Multi-Vendor Catalog

- Serialized Items

- Serialized Items | Purchasing or Manufacturing an Item

- Serialized Items | Selling and/or Associating an item with a customer

- Lots

- Product Attributes

- Product Attributes | Selling and Purchasing Items with Attributes

- Product Attributes | Custom Attributes

- Mobile Scanner (Legacy)

-

Labor

- Getting Started

- Workers

- Taxes and Deductions

- Work Codes

- Time and Attendance

- Time and Attendance | Time Track App

- Processing Payroll

- Closing the Payroll Year

- Processing Payroll - Advanced

- Salaried Pay

- Piecework Pay

- Direct Deposit

- 3rd Party Payroll Service

- Subcontract Workers

- Flag Pay

- Prevailing Wages

- MyDispatch

- MyTasks

- MyTime

- MyTime | Communications

- MyTime | Setup

- Tasks

- Tasks | Getting Started

- Tasks | Creating Tasks

- Tasks | Scheduling Tasks

- Tasks | Customizing Task Views

- Tasks | Managing Tasks

-

Financials

- Introduction

- Fiscal Year

- Chart of Accounts

- Budget

- Financial Reporting

- Transactions and Journals

- Transactions and Journals | Journals

- Account Reconciliation

- 1099

- Departments and Profit Centers

- Fund Accounts

- Bank Accounts

- Bank Feed

- Vendors

- Vendors | Miscellaneous Vendors

- Purchase Orders

- Expense Invoices

- Vendor Payments

- AP Transactions

- Landed Cost

- Fixed Assets and Depreciation

- Fixed Assets and Depreciation | Fixed Assets

- Fixed Assets and Depreciation | Fixed Assets | Adding Assets

- Fixed Assets and Depreciation | Processing Depreciation

- Fixed Assets and Depreciation | Disposing Assets

- MyJobs

-

E-commerce

-

Rental

-

Job Costing

-

Manufacturing

Voiding a Sales Invoice

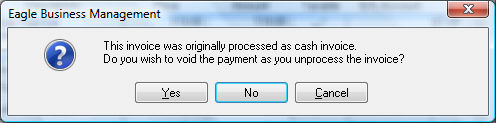

An invoice can be unprocessed to make corrections, changes, or voiding an invoice. Negative transactions are posted to the general ledger when an invoice is unprocessed. These negative transactions offset the original transactions posted when the invoice was processed. An invoice must be unprocessed before it can be deleted. The user has the option to void the payments if the invoice was processed as a cash invoice. Any payments posted to a charge invoice will NOT be voided but will be recorded as down payments to the sales order. Review the Payment Methods and Terms section for more details on down payments. Any payments must be voided before an invoice can be deleted. Review the Customer Payments > Viewing or Voiding Customer Payments section for more details.

An invoice may need to be voided for the following reasons:

Invoice information was entered incorrectly and data needs to be changed such as a wrong G/L code, wrong invoice date, invalid pricing, wrong inventory code, etc. Voiding the original invoice, changing the incorrect data, and reprocessing it can only accomplish this. After an invoice is processed, most of the information cannot be changed since the transactions were used to update a variety of history information.

The invoice was accidentally processed.

A processed invoice cannot be deleted directly but must be voided before the unprocessed invoice (sales order) can be deleted.

Undoing an Invoice

Open and view the invoice to be voided. Review the Viewing a Sales Invoice section for further details.

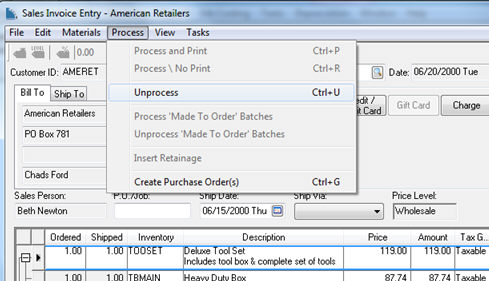

Select invoice menu option - Process > Unprocess or press Ctrl + U on the keyboard.

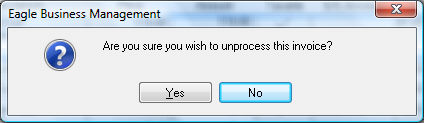

Click Yes to continue with the void or No to cancel. The following dialog will appear if the original invoice was processed as cash.

If Yes is selected the Invoices and S.O.s window will open with the unprocessed invoice (sales order) displayed. Make the desired changes and either save or reprocess the sales order.

NOTE: You will not be able to void an invoice that was processed within a fiscal year or month that has already been closed. If it is not possible to void the invoice, enter a credit to offset the transactions that were created by the original invoice.