- EBMS Knowledge Base

- Sales

- Sales and Use Tax

-

Client Resources

-

EBMS Main Documentation

- Introduction

- Getting Started

- Getting Started | Initial Installation

- Getting Started | Company Setup

- Quick User Guide | Financial Staff | Accountant

- Quick User Guide | Financial Staff | Accountant | Accountants Journal

- Quick User Guide | Sales Staff

- Quick User Guide | General Staff

- Features

- Reports

- Reports | Excel Add-In

- Reports | Excel Add-In | Troubleshooting

- Security

- Server Manager

- Technical

- Technical | Data Import and Export Utility

- Technical | SQL Mirror

- Automotive

- Automotive | Parts Catalog

- Automotive | Pricing

- Automotive | Point of Sale

- Automotive | Product Application

- Automotive | Keystone Interface

- Metal Supply

- Fuel Sales

- Horticulture

- Horticulture | Farm Setup

- Horticulture | Processing Payroll

- Horticulture | Managing the Farm

-

Sales

- Introduction

- Customers

- Customers | Miscellaneous Customers

- Proposals

- Proposals | Processing Proposals

- Proposals | Sets and Templates

- MyProposals

- MyOrders

- Sales Orders

- Invoices

- Materials Lists

- Sales and Use Tax

- Sales and Use Tax | TaxJar

- CRM

- CRM | Auto Send

- Recurring Billing

- Credits

- Customer Payments

- Payment Card Processing

- Payment Card Processing | Gift Cards

- Payment Card Processing | Loyalty Cards

- Payment Card Processing | Verifone Gateway

- Freight and Shipping Tools

- General Ledger Transactions

- Point of Sale

- Point of Sale | Point of Sale Hardware

- Point of Sale | Xpress POS System

- Point of Sale | Advanced Tools

- Signature Capture

- Salesperson Commissions

-

Inventory

- Product Catalog

- Product Catalog | Using Product Codes for No Count Items

- Product Pricing

- Product Pricing | Special Pricing

- Tracking Counts

- Unit of Measure

- Purchasing

- Special Orders and Drop Shipped Items

- Receiving Product

- Barcodes

- MyInventory and Scanner

- Components (BOM) and Accessories

- Components (BOM) and Accessories | Component Formula Tool

- Made-to-Order Kitting

- Configure-to-Order Kitting

- Multiple Inventory Locations

- Multiple Inventory Locations | Creating Locations

- Multiple Inventory Locations | Using Multiple Locations

- Multiple Inventory Locations | Product Catalog Sync

- Multi-Vendor Catalog

- Serialized Items

- Serialized Items | Purchasing or Manufacturing an Item

- Serialized Items | Selling and/or Associating an item with a customer

- Lots

- Product Attributes

- Product Attributes | Selling and Purchasing Items with Attributes

- Product Attributes | Custom Attributes

- Mobile Scanner (Legacy)

-

Labor

- Getting Started

- Workers

- Taxes and Deductions

- Work Codes

- Time and Attendance

- Time and Attendance | Time Track App

- Processing Payroll

- Closing the Payroll Year

- Processing Payroll - Advanced

- Salaried Pay

- Piecework Pay

- Direct Deposit

- 3rd Party Payroll Service

- Subcontract Workers

- Flag Pay

- Prevailing Wages

- MyDispatch

- MyTasks

- MyTime

- MyTime | Communications

- MyTime | Setup

- Tasks

- Tasks | Getting Started

- Tasks | Creating Tasks

- Tasks | Scheduling Tasks

- Tasks | Customizing Task Views

- Tasks | Managing Tasks

-

Financials

- Introduction

- Fiscal Year

- Chart of Accounts

- Budget

- Financial Reporting

- Transactions and Journals

- Transactions and Journals | Journals

- Account Reconciliation

- 1099

- Departments and Profit Centers

- Fund Accounts

- Bank Accounts

- Bank Feed

- Vendors

- Vendors | Miscellaneous Vendors

- Purchase Orders

- Expense Invoices

- Vendor Payments

- AP Transactions

- Landed Cost

- Fixed Assets and Depreciation

- Fixed Assets and Depreciation | Fixed Assets

- Fixed Assets and Depreciation | Fixed Assets | Adding Assets

- Fixed Assets and Depreciation | Processing Depreciation

- Fixed Assets and Depreciation | Disposing Assets

- MyJobs

-

E-commerce

-

Rental

-

Job Costing

-

Manufacturing

Configuring Use Tax for a Job

EBMS uses the job costing module to process use tax when it is consumed by a job. Use tax is required to be paid when product was purchased without sales tax for a job. Use tax must be paid if the job billings doe not included sales tax. This is common when a customer is billed for construction and other nontaxable services that include taxable parts or materials. Use tax must be paid based on the cost of the taxable products used within a non-taxable job.

The recommended method for processing a tax exempt job in EBMS is to use the job costing module. An alternative method is to group product in a materials list within a sales order and enable the Collect Use Tax option. Review the sales invoice settings within Paying Use Tax on Items Consumed to use a sales order instead of job cost module.

Configuring a Job

Complete the following steps to enable use tax calculation for a job:

-

Verify that the use tax option is enabled. Review Configure Use Tax for steps to enable Use tax within EBMS.

-

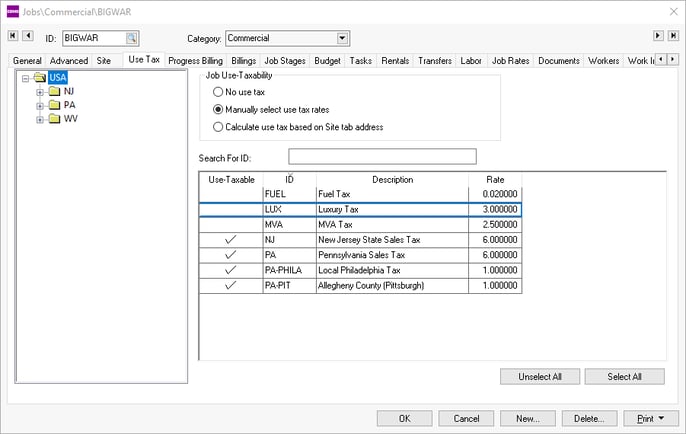

Open a job and click on the Use Tax tab as shown below:

-

Set one of the following Job Use-Taxability settings:

-

Select No use tax to disable use tax calculations for this job.

-

Select Manually select use tax rates to select the appropriate Use-Taxable taxes as shown at the bottom of the dialog. Select a jurisdiction from the category folder tree to query specific tax rate options.

-

Select Calculate use tax based on the Site tab option to select use tax rates based on the site tab address.

-

Click on the Site tab and enter the required address information if use tax is calculated based on the job's location. Review the Site Tab section of [Financials] Jobs > Changing Job Information for more details on this setting.

Processing Use Tax on Taxable Purchased Product

Use tax is calculated when product is consumed within a job. Use tax is calculated from the following job expenses:

-

Expense invoices applying costs to a job: Review [Financials] > Job Costs > Allocating Costs from a Purchase Order or Expense Invoice for steps to apply AP expenses to a job.

-

Materials transfers to a job: Review [Financials] > Job Costs > Transfers for steps to apply material expenses to a job.

-

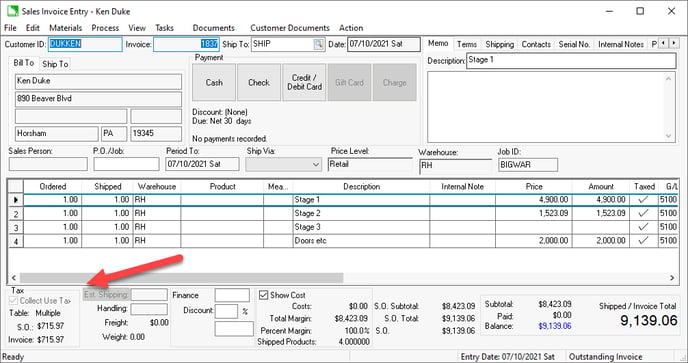

Sales invoice that contain inventoried product: Review [Financials] > Job Costs > Sales Invoice for details on applying cost of goods sold from a sales invoice to a job.

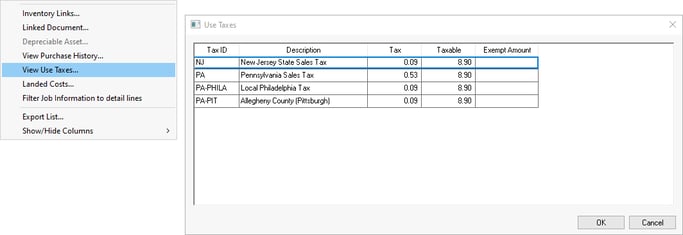

Save any of these documents, right click on a detail line, and select View Use Taxes to view the taxes for a specific line.

Billing Jobs with Use Tax Enabled

All billings for a job with use tax enabled will exclude sales tax on the sales invoice. Note that the Collect Use Tax option on the sales order is enabled which disables sales tax for the same invoice. This option can only be changed by disabling Use Tax on the job or by removing the job.