Entering New Workers

A worker record must be created for every worker that is processed within the payroll system. Each worker record is created only once and is used to record worker contact information, tax identification, and pay detail. The worker record also includes a large amount of payroll history, such as timecards and hours.

There are several places to start a new worker record:

- Click the plus sign (+) next to Labor > Workers on the main EBMS page.

- In the EBMS menu, go to Labor > New Worker.

- From Labor > Workers, click the New button.

Any of these options will bring up a new worker wizard. From that wizard, follow these steps to enter a new worker record into EBMS.

-

A new worker wizard will take the user through the following steps:

-

From the first page (Select Type), select the correct category folder or subfolder for the new worker. Review the Adding and Deleting Worker Categories section for more details on creating new categories.

Click Next to continue.

-

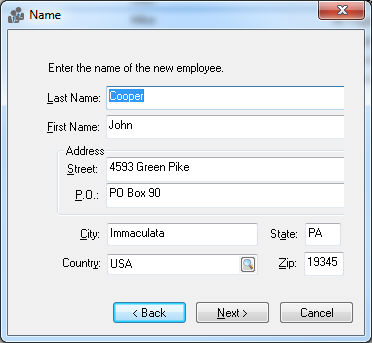

From the second page (Name), enter the worker’s Last Name, First Name, and all relevant Address information into the appropriate fields. Entering a Zip code will populate the City, State, and Country settings, because EBMS searches through a postal code database when the user enters a Zip code.

Click Next to continue.

-

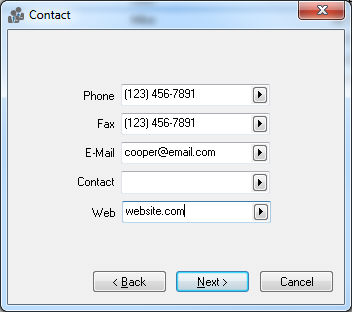

From the third page (Contact), enter the Contact Information for the worker as requested. The contact options are Phone number, Fax number, E-Mail address, general Contact, and Web domain address. Change any contact field labels by clicking on the arrow key to the right of each field and selecting the appropriate field label.

Click Next to continue.

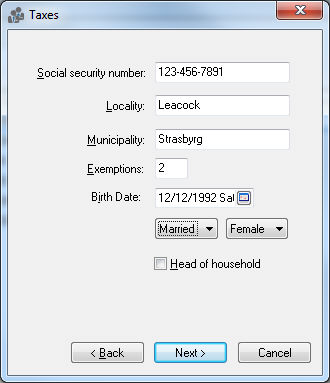

- From the fourth page (Taxes), enter the requested information:

-

Enter worker’s Social Security number. Social security numbers are required for all worker records by law.

-

Enter Locality. Enter the residence county of the worker for this field.

-

Enter the Municipality or township in which the worker resides.

-

Enter the number of Exemptions the worker is claiming for tax purposes as recorded on the W-4 form.

-

Enter the worker’s Birth Date or select the date from the calendar icon. (MM/DD/YYYY format)

-

Select the worker’s marital status as Single or Married by clicking on the down arrow.

-

Set the worker’s sex as Male or Female.

-

If the worker is claiming Head of Household status for tax purposes, check the checkbox for that option. Click the Next button and the following window will appear:

-

-

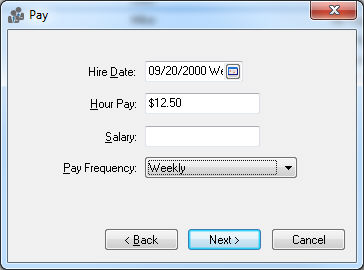

From the fifth page (Pay), enter all relevant Pay information.

-

Enter the worker's Hire Date. This date will be used to determine the worker’s anniversary.

-

Enter worker’s Hour Pay. If this worker is salaried, enter an hourly pay rate only if overtime pay is available for this worker.

-

Enter Salary only if a worker is salaried, otherwise keep this field blank.

-

Select the appropriate Pay Frequency for the new worker. Options include Daily, Weekly, Bi-Weekly, Semi-Monthly, Monthly, Bi-Monthly, Quarterly, Semi-Annually, and

Annually. Click the Next button and the following window will appear:

-

-

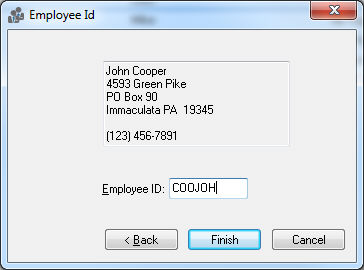

From the sixth page (Employee Id), enter the Worker ID or Employee ID code. This code must be unique to a specific worker. This ID is used throughout the entire accounting system for all transactions associated with this worker. (Changing the Worker ID is a lengthy process, so plan to use an ID that is a consistent format and will work for the long term. A common ID format is the first 3 letters of the worker's last name + the first 3 letters of the worker's first name.)

Check the I want to view the new worker now option to open and review the new worker record once the creation process finishes. -

Click Finish to create a new worker or Cancel to ignore the new information.

Go to File > System Options > Zip Codes tab to view or change the city, state, and zip code list.

Continue with Changing Worker Information to set up worker taxes, company taxes, and other record information for individual workers.