Excise Tax

The EBMS system contains a feature to charge Federal Excise Tax (FET) when certain parts such as tires are sold to the customer. This tax amount is collected and recorded in a liability account until it is paid to the federal tax agency. The system is delivered with a pre-configured excise tax inventory item called FET.

The inventory code FET is created to record history and the liability general ledger account. This inventory code will then be attached to any item that is taxable by a Federal Excise Tax.

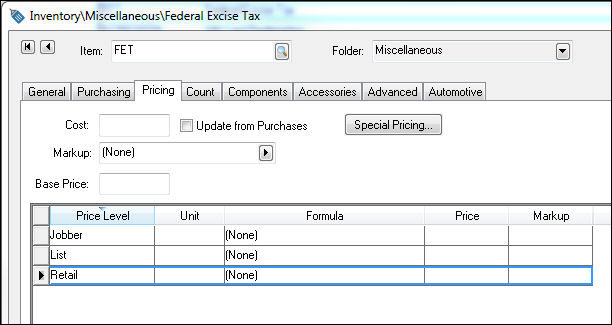

Pricing Setup for the FET Item

Go to Inventory > Product Catalog and open the FET item. Open the Pricing tab to see the pricing configuration for this item. All the Formulas must be set to (None) as shown below:

Attaching the FET Item to the Taxable Inventory Items

The FET inventory item must be attached to each item that is taxable. Complete the following steps to setup FET for a part or item:

-

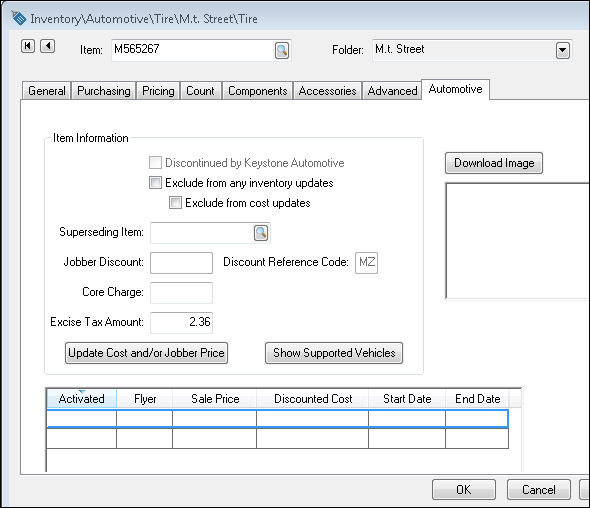

Open a product record (such as a tire) that requires federal excise tax (FET).

-

Click on the product record Automotive tab as shown below

-

Enter the Excise Tax Amount that is charged for this item.

-

Save the current inventory item settings by clicking OK.

Repeat these steps for each inventory item that requires federal excise tax FET.

Note: When an item that has FET charge is imported from the eCatalog, EBMS will automatically set the FET value. The EBMS inventory process will update this value when the eCatalog updates this value.