General Account Adjustments

Any financial system requires some account adjustments at times to verify balances. Some adjustments, such as operational adjustments, should be made to an adjustment account. Other adjustments should be adjusted to a proper offsetting account instead of the adjustment account.

Types of adjustments typically made to the adjustment account:

-

Cash over or cash under (unless a separate cash over/under adjustment account is desirable).

-

Minor adjustments to various accounts that cannot be reconciled, such as other inventory, other receivables, other payables, bank accounts, etc.

The following adjustments should NOT be made to the general adjustment account:

-

General ledger beginning balances: Review Entering General Ledger Beginning Balances for adjustment recommendations.

-

Inventory adjustments: Review Adjusting Inventory Counts and Value for adjustment details.

-

Accounts payable and other expense invoice adjustments: Review Changing or Voiding Vendor Invoices for instructions to change invoices rather than a journal entry adjustment.

-

Accounts receivable and other sales invoice adjustments: Review Changing or Voiding Sales Invoices for instructions to change invoices rather than a journal entry adjustment.

-

Accrual to cash accounting adjustments: Review Create Cash Accounting Adjustments for adjustment recommendations.

The Default Adjustment G/L Account is set by opening the Financials > Options > Settings tab as shown below:

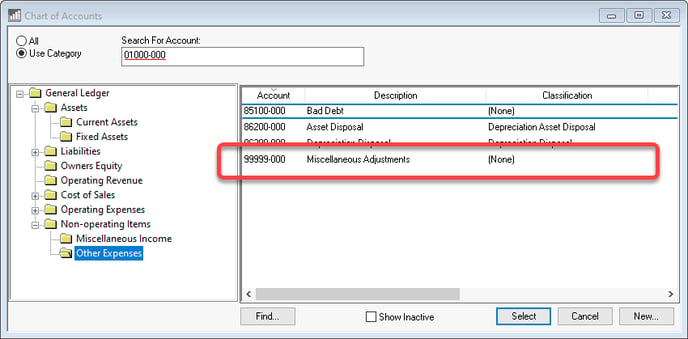

The Default Adjustment G/L Account (also known as Miscellaneous Adjustments) is often found within the Non-Operating Items folder at the end of the Chart of Accounts, as shown below:

Since this account is used primarily as a management tool to calculate the total adjustments for the period, the adjustment account balance should be zeroed at the end of each fiscal year.