Correcting Differences in Reconciliation

If there is a difference when reconciling a bank account and it can be traced to a specific deposit or check payment, go back and edit the deposit or check payment. By making the correction to the source document, all totals and posting will be updated properly. If the correction to the source document is not made, there is a possibility that corresponding vendor or customer totals will be wrong. Make sure transactions of the corrected document have been posted to update the reconciliation list.

If you cannot locate the cause of a difference between the account balance and the bank statement, an adjustment is necessary. IMPORTANT NOTE: The adjustment will not correct the incorrect transaction but will only adjust your account balance so that it agrees with the bank statement.

Making Adjustments

EBMS includes two convenient ways to adjust an account:

-

The recommended method, although it requires more financial understanding of the general ledger system in EBMS, is to create an adjusting journal entry. Review the Creating Journal Entries section for details on this option.

-

A similar method, although it does not contain a detailed supporting document, is described below:

Open the tab where the adjustment is to be inserted (Cash In or Cash Out). Click the Adjustments button to insert new transactions directly into the tab. This function is useful to enter bank account adjustments, fees, or miscellaneous debits when reconciling a bank account. Reconciling a cash account may require a miscellaneous adjustment to the general ledger balance so it matches your current cash balance. This feature should only be used for adjustments and should not be used to replace the invoice or deposit processes.

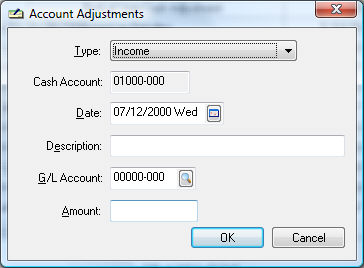

The Account Adjustments window allows three types of adjustments:

- Expense adjustments are credits to the account and will display in the third tab.

- Income adjustments are debits to the account and will be displayed in the second tab.

- Transfers are used to transfer monies from one account to the other. The system will credit the current account and debit the selected Transferred To: bank account. The Transferred From account is always the account being reconciled and cannot be changed. To transfer into this account, go into the account you are transferring from.

- Enter the transaction Date. This date will default to today's date.

- Enter a brief Description of the adjustment.

- Set the G/L Account that you wish to use to offset this transaction. This would normally be an expense general ledger account for an expense transaction, a revenue account for an income transaction, or a bank account for a transfer transaction.

- Enter the dollar Amount of the transaction and click OK.