Depreciation Reports

If the optional Depreciation module is installed, it will generate specific reports around fixed assets and depreciation progress. The following reports are excellent to print for an accountant or an agent that provides tax services:

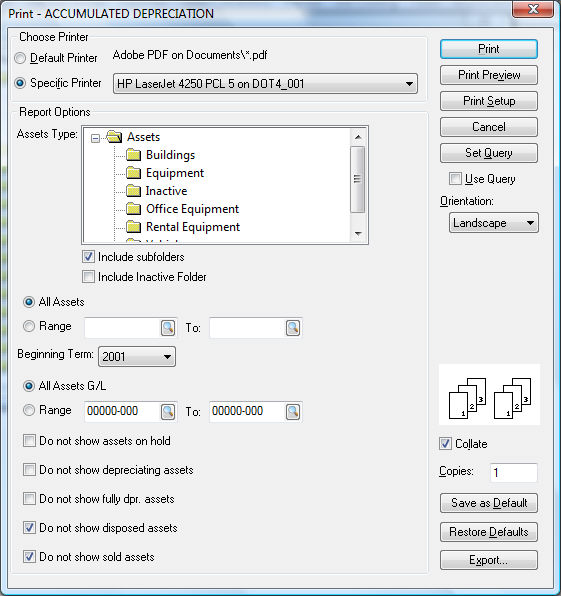

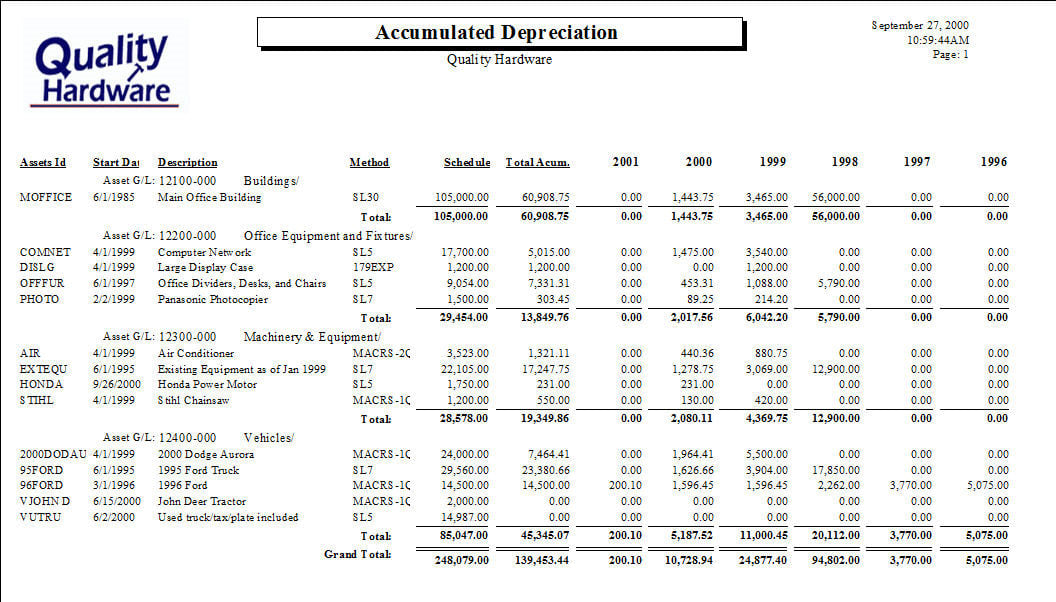

Accumulated Depreciation

Go to File > Reports > Financials > Depreciation > Assets > Accumulated Depreciation to print the accumulated depreciation for all assets.

Select All Assets to print all Assets and set the appropriate dates to print the last fiscal year information. This will list the accumulated depreciation for all assets.

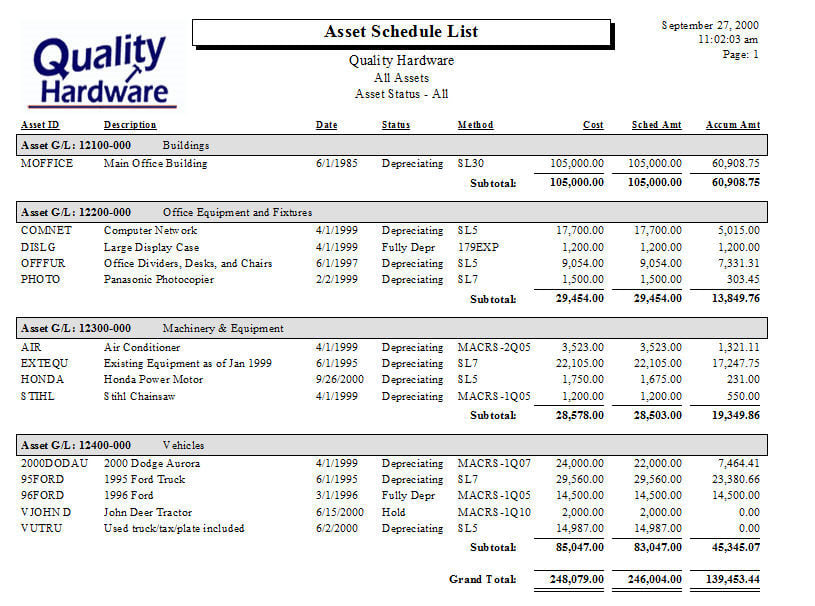

Asset Schedule List

Review the pertinent asset status information within the File > Reports > Financials > Depreciation > Assets > Asset Schedule List report.