Fund Transfers

Funds are normally received into a fund through the revenue accounts using the sales invoice and dispersed through the expense accounts using the expense invoice. The fund transfer should only be used when funds are being transferred from one fund to another. For example, the board of directors may approve a transfer from the general fund into the special fund.

Complete the following steps to transfer monies between funds:

-

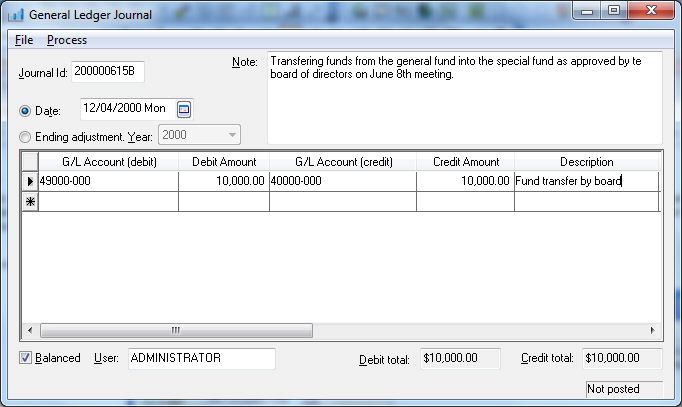

Open a new general ledger journal by going to Financials > New Journal Entry as shown below:

-

Create a new Journal ID and set the Date for the balance transfer.

-

Record any information about the transfer within the Note field of the journal.

-

Enter the fund account that is to be debited into the G/L Account (debit) column. The monies are transferred out of the G/L Account (Debit).

-

Enter the amount that is to be transferred into the Debit Amount and Credit Amount columns.

-

Enter the fund account that is to be credited or increased into the G/L Account (credit) column.

-

Select Process > Post from the journal menu to process the journal and post transfers to the general ledger accounts.

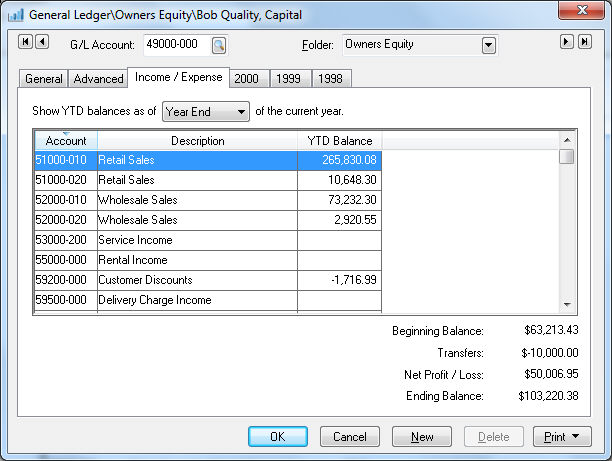

Open the fund account record from Financials > Chart of Accounts and click on the Income / Expense tab to view the transfer amounts

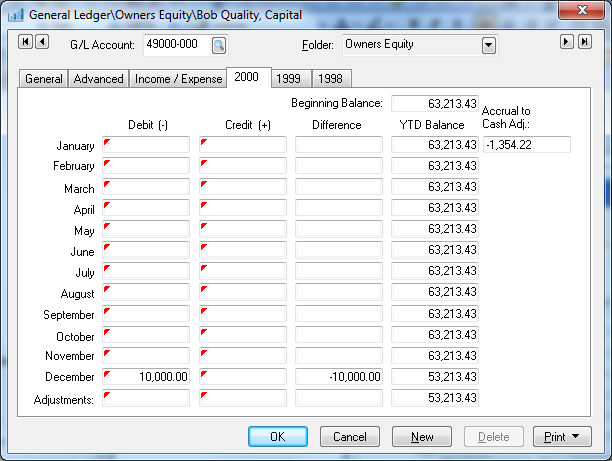

Click on a Year tab on the account record and you will see the debit based on the journal entry date. See example below:

Journal entry and transfers should be limited to funds transferred between fund accounts rather than posting income and expenses. Use the standard accounting features such as invoicing, timecards, etc. to record revenue and expenses.