Reconciling Depreciable Asset General Ledger Accounts

How to reconcile depreciable asset accounts

It is important to reconcile the General Ledger asset accounts with the list of depreciable accounts within the optional Depreciation module. Complete the following steps to reconcile the depreciation accounts:

-

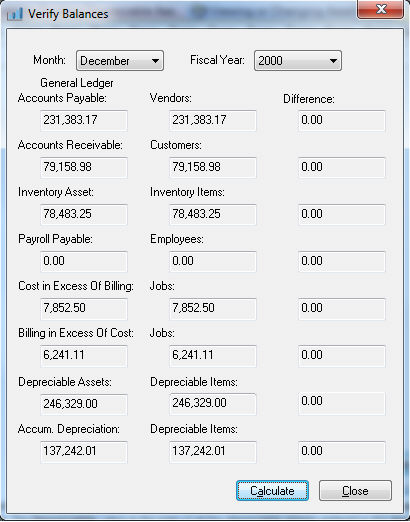

Go to Financials > Utilities > Verify Balances:

-

Click on the Calculate button to update all totals.

-

Compare the Depreciable Assets total in the left column with the Depreciable Items total on the right. The Depreciable Assets amount is the total of all general ledger accounts classified as Depreciable Asset. The Depreciable Items value is the total of all the depreciable assets entered in the depreciation module with the exception of those that are sold or disposed.

-

General Ledger adjustments or depreciable asset changes will need to be made if the Difference amount does not equal zero. Print the report found in File > Reports > Financials > Depreciation > Assets > Asset Schedule List to verify the asset list.

The Accumulated Depreciation (Accum. Depreciation) General Ledger amount found in the left column should equal the Depreciable Items value totaled within the asset list. Adjustments should be made before any depreciation is processed or additional assets are added or disposed.