No Count Discount and Percentage Pricing Codes

Create a discount line within a quote or sales order for employee, volume, and promotional discounts.

In this article

Getting Started | Fixed Dollar Discounts | Percentage Discounts | Features

Getting Started

A discount item code is a convenient way to create a discount line within a quote or sales order. Discount items (which are recorded like inventory product records) are often used if the user wishes to add a separate line following the original items or group of items rather than discounting the item within the original sales order line.

This option is often used for discounts such as:

-

Employee discount

-

Volume discount

-

A promotional discount for a group of items based on the total purchase on multiple items. The Special Pricing module can also discount a price with date restrictions. Review the Special Pricing Overview section for more details on creating pricing for a single item.

-

A promotional discount connected with a promotional code: The system can restrict the number of times a single customer submits a promotional code for a discount. Review the Percentage Discount section below for more instructions on limiting a customer.

The price level formulas are the recommended method used to discount merchandise for a group of customers rather than a separate line item on the quote or invoice. Review the Default Pricing and Price Levels section for details on creating price levels for specific customers.

Discount inventory codes are grouped into two different types:

• Fixed dollar discounts calculated by a fixed dollar amount. (This is price reduction for a set amount. For example, a coupon for $10 dollars off would be a fixed dollar discount.)

• Percentage discounts calculated based on a percentage of the price from previous line items. The unit price of the new item classified as Discount is calculated from previous lines on the sales document, rather than entered into the Pricing tab of the inventory item record. (This is a price reduction based on a percentage of the whole purchase or part of a purchase. For example, the discount could be for 30% off of all gardening supplies, so the relevant line items would be added up and a discount applied to the total of those lines.)

Fixed dollar discounts

Fixed dollar discounts could be configured with an inventory item classified as No Count and priced with a negative number. Review the Entering New Inventory items section for more details on creating new inventory records classified as No Count.

In the Pricing tab, the pricing for the fixed dollar discount items is configured like any other inventory item except the value is negative to reflect the discount. (Adding a -10.00 fixed discount into a sales order as a line item will reduce the total price by 10 dollars.) Go to Inventory Pricing Overview for more pricing details.

In the Pricing tab, the Exclude from material list price distribution option should be enabled so that discount lines within materials lists are not adjusted.

Note that a fixed dollar discount uses the No Count classification rather than the Discount classification. (See the Classification field on the General tab in the image below.)

Percentage Discounts

Percentage discount items do not contain an actual price in the inventory item record. The discount amount is calculated by a percentage setting within an inventory item classified as Discount. The pricing within a Discount item is calculated from the pricing on the previous proposal or sales order line (or lines) depending on the settings within this item.

Complete the following steps to create a percentage discount item:

-

Launch the new inventory item wizard by clicking Inventory > New Product from the EBMS menu or by clicking the plus sign (+) next to Inventory > Product Catalog on the main page. (Review the Entering New Products section for more details on the inventory item wizard process.)

-

The discount item should be placed in a separate non-inventory folder if the user wishes to exclude this item when printing inventory history reports.

Click Next to continue.

-

Enter a Description of the discount or percentage adjustment. Select Show on: Purc to display this description line on purchase orders and Show on: Sale to display it on sales orders and invoices.

-

The Default Selling Unit and Manufacturer settings can all be ignored.

Click Next to continue.

-

Set the Classification setting to Percentage Discount.

Click Next to continue.

-

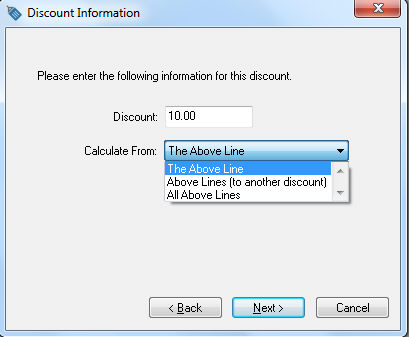

Set the Discount percentage value. For example, enter 10.00 if you wish to set the discount percentage to 10%.

-

Select one of the Calculate From options:

-

The Above Line: Select this option to calculate only the price of the discount item from the previous line on the sales document. Price of item = Extended price of previous line * Discount percentage.

-

Above Lines (to another discount): This option will total all previous lines until it locates another item classified as Discount.

-

All Above Lines: This option will calculate all the invoice or proposal lines listed before the line that contains the current discount item including any previous discount lines.

Click Next to continue.

-

-

Enter a Product ID for the discount item. The field above will contain the description entered earlier in the product creation process. (In the example above, Employee Discount is the description and EMPDISCOUNT is the product ID code.) Review Creating IDs for more details on creating ID codes or automating this step.

-

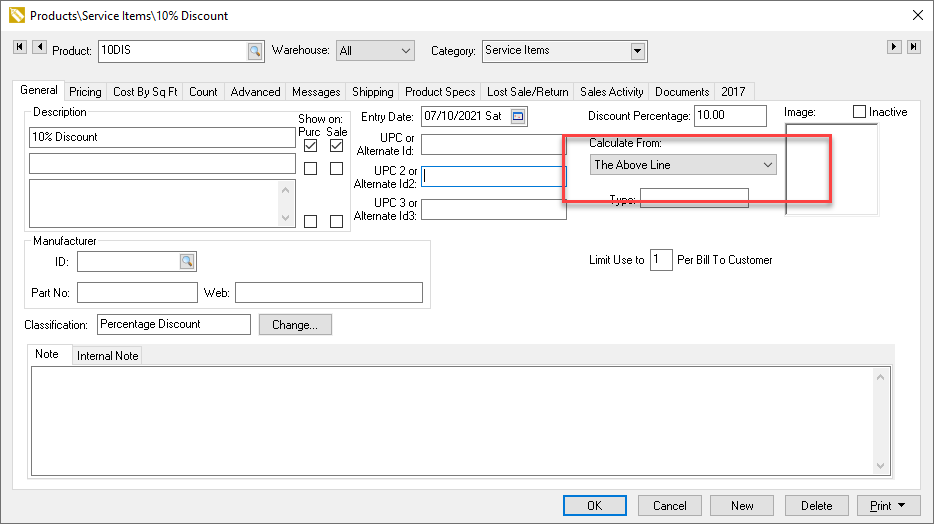

On the final page, enable the I want to view the new inventory item now option to open the following dialog on the General tab:

-

Set the Limit Use to __ Per Bill To Customer setting to restrict the number of times a customer can have this code applied to their account. This setting can be found in the middle of the page on the right-hand side. To set up this option:

- Keep the value blank or zero to remove any restrictions.

- Enter a positive number to restrict the code's usage within a specific customer's account to the number of times stated. In the example above, inventory code 10DIS can only be entered into a customer's account once, because the user selected Limit Use to 1 Per Bill To Customer.

- Enter a negative value to require a manager to override the restriction.

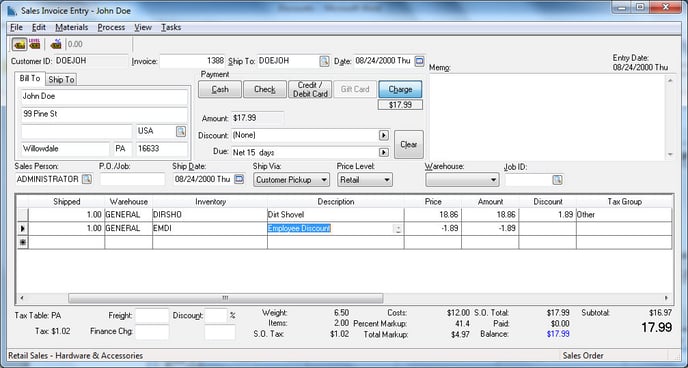

The Discount amount within a sales invoice is calculated from the total of detail lines selected by the Calculate From setting of the item. The discount amount is calculated from the Ordered or Shipped quantity (whichever is greatest) multiplied by the unit price of each previous item(s) line and then multiplied by the percentage entered within the Discount item.

Unit price of discount item = (Ordered or Shipped, whichever is greatest * Price) + Repeat for each line indicated from Calculate From setting

The extended amount of a percentage adjustment item is calculated by multiplying Shipped and Price, similar to any other inventory item.

The Ordered and Shipped quantities will normally equal 1 when a discount item is used within an invoice, but greater quantities can be utilized. Discount items should not be used within back orders under normal circumstances since back orders could create duplicate discounts. Review Processing a Sales Invoice for more details on back orders.

Common use cases

Discounts

Discount items are often used if the user wishes to add a separate line, following the original items or group of items, rather than discounting the item within the original sales order line. These options are often used for employee, volume, and promotional discounts based on total purchase amount.

Percentage pricing is used when the pricing is calculated by a percentage of previous lines within a proposal or sales order.

Features

- Employee Discounts

- Volume Discounts

- A promotional discount for a group of items based on the total purchases on multiple items

- Fixed dollar discounts that are calculated by a set dollar amount

- Percentage discounts that are calculated based on a percentage of the price from previous lines in a sales document

- Calculate a tax based on a percentage of previous lines

- Calculate a surcharge or any other item based on a percentage of a previous item rather than a fixed price