Closing Payroll Year

The payroll year must be closed at the end of each calendar year. This closing step must be completed before any additional pay can be processed within a new calendar year. The pay date rather than the pay period date indicates if the payroll falls within the new year or the past year.

For example, a payroll with a pay period ending date within the year 2018 and a pay date within the year 2019 is considered within the new year. The Close Year function must be completed before payroll can be processed within the new year. Pay periods and timecards may be created within the new year before the past year is closed, but the worker payments cannot be processed within the new year. Adjustments can be made to last year’s data via journal entries, and year-end reports such as W-2s and wage summaries can be printed after the year is closed.

The Close Payroll Year wizard closes the current payroll year and opens a new payroll year. Any timecards that have been created within the current year must be processed or deleted before the current year can be closed. Make sure that no one is entering, editing, or processing timecards while the Close Payroll Year wizard is in process.

Close the Payroll Year

-

Go to Labor > Close Payroll Year from the main EBMS menu to activate the close year wizard. The first page contains a warning message: "The current year of __ will be closed and a new year of __ will be opened. After closing, no timecards can be processed with a pay date within the year of __. Click next to continue, or cancel to abort."

-

Click on the Next button to continue. The wizard will prompt the user to close all pay periods if any payroll periods are open. Note that you cannot add or modify any timecards within a closed pay period.

-

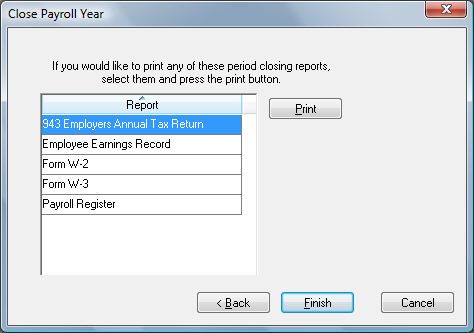

A message on the last page will prompt the user to run reports prior to closing the current year: "If you would like to print any of these period closing reports, select them and press the print button." Highlight each report and click the Print button. (Note that these reports can be printed after the year is closed.)

To print the reports listed within this wizard after the reports are closed, go to File > Reports > System Folders > Labor > Close Year and select the reports from the report list. See the next paragraph on Adding Reports to the Close Payroll Year Wizard for the necessary steps in adding reports to this list.

Adding Reports to the Close Payroll Year Wizard

Complete the following steps to insert additional reports into the Close Payroll Year wizard.

-

Go to File > Reports > System Folders > Labor > Close Year folder.

-

Drag a payroll report from any other payroll folder into the Close Year folder or click on the Add Report button and insert the desired report. Each report located within the Close Year folder will be listed within the Close Payroll Year wizard.

Click on the Finish button to close the year. The wizard will continue with the Automatic Payroll Tax Update wizard, which is explained in the next section.