Processing Tips

Paying out employee tips must be processed in a unique manner because of tax reporting requirements. All tips must be identified within a timecard with a Pay Type of either Take Home Tips or Employer Paid Tips.

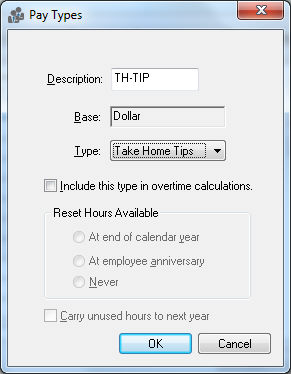

Complete the following steps to create a pay type for tip payments:

Go to Labor > Labor Options > Pay Types tab and click on the New button to create a new pay type.

-

Enter a pay type Description that describes the tip pay. For example, use the EP-TIP description for Employer paid tip or TH-TIP for take home tips. (See image above.)

-

The Base should be set to the Dollar option.

-

The Type option should be set to Employer Paid Tips if the tip is included within the worker's paycheck. The Take Home Tips option should be used if the cash tips were given to the worker but must be added to the gross pay for tax calculations. Create both pay types separately if employees are paid using both methods.

-

Click on the OK button to save changes to the pay type.

Review the Entering Salaried Employee Timecards section for details on entering pay into the timecard.