Separate Bonus Pay Periods

This chapter explains the process of creating and processing an extra pay period for bonus pay. The tools explained in this section may be useful in a variety of circumstances, but this section will explain them in the context of a special bonus pay period. Complete the following steps to complete a bonus pay period:

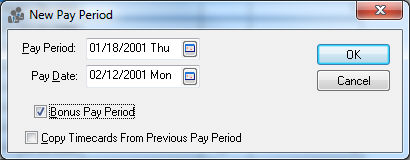

Go to Labor > Set Pay Period in the main EBMS menu. Click the New button to create a new pay period.

-

Set a unique Pay Period date for the new pay period. Enable the Bonus Pay Period option as shown below:

For example, if the normal weekly payroll pay period date ends on Saturday with a pay date of the following Thursday, a bonus pay period date of Monday with a pay date from the same week would be recommended. Review the Opening New Pay Period section for more details in creating a new pay period.

Reminder: The pay date dictates when the tax liabilities must be paid.NOTE: After the bonus pay period, the next Pay Period date will not automatically default to the correct date, because the bonus period can throw off the normal cadence. It is advisable to open the next few standard pay periods after the bonus pay period and verify that the dates are correct.

-

Verify that the worker's pay rate list contains a bonus pay type. Go to the Pay tab on the worker record and make sure the Pay Rates table contains a Bonus Pay Type.

-

Review the Changing Workers Information section for details on adding a pay type to the employee’s pay rate table. Review the Pay Types section for more information if a bonus Pay Type does not exist in the system. A bonus pay type should have a dollar Base and a Type of Benefit.

Tip: Go to Labor > Labor Options > Worker Categories > Edit Defaults button > Pay tab, enter the bonus pay type into the Pay Rates list and right-click on the Bonus pay type field to Filter Down the pay type to all workers. -

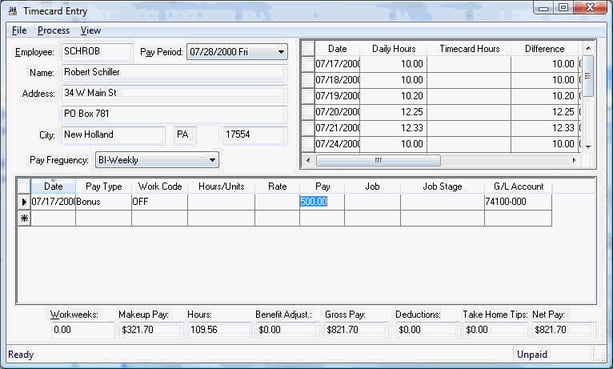

Enter the bonus pay into a new timecard as shown below:

-

Enter the bonus pay period Date on the single bonus line of the timecard.

-

Set the Pay Type to the bonus pay type.

-

Enter a Work Code that contains the bonus pay’s General Ledger expense account. This can be defaulted within the worker record Pay tab > Pay Rates table > Properties.

-

Enter the bonus pay amount within the Pay column.

-

-

Calculate taxes and deductions using the advanced process options.

-

Go to Labor > Worker Payments, select timecards by checking the Pay column, and click on Process button > Process Payments to process all the selected timecards.

-

Select the Process button > Calculate Taxes (Advanced) option and the following dialog will open.

The message on the Choose Taxes page reads: "Select the taxes that should be used for this pay period. Any taxes that are not selected will not be used even if they are specified in the employee's account. Add to Taxable: Select this option if the gross pay of this timecard should be added to the taxable gross of the tax / deduction. Normally this is selected for taxes, but is not selected for deductions that are not affected by these timecards."

The Calculate Taxes (Advanced) process allows the user to change the way the employee’s taxes and deductions are processed. The Select column identifies all the taxes and deductions that will be deducted from the gross bonus pay. The Add to Taxable column allows the user to ignore the deduction but add the gross pay to the taxable amount of the tax or deduction. Turning both check marks ON will process the tax or deduction in the same manner as a typical calculation.

-

Suggestions for Calculate Taxes (Advanced)

- All taxes that contain a flat rate should have both the Select and Add to Table options ON.

-

If the user prefers to not deduct for a table-based tax on the timecard such as FWT (Federal Withholding Tax) and the Select option is turned OFF, the Add to Taxable should be turned ON for proper tax reporting.

-

The Select option may be turned OFF for deductions that the user wishes to ignore when processing a bonus paycheck. Deductions such as housing, medical, and other period-based deductions may be ignored during an extra pay period. The Add to Taxable switch should remain ON if the gross pay must be added to the taxable amount for the deduction.

-

The Calculate workweek amounts for this pay period option must be turned OFF for a bonus pay period, because this pay period is not part of a standard pay period. This step is very important, since the workweek amounts should not be incremented in a non-standard pay period such as an extra bonus pay process. Review the Processing Workweeks section for more details.

Use CAUTION when changing any tax or deduction settings since it may adversely affect tax liability reporting and other payroll documents, such as W2s. Contact your accountant to identify the proper settings for each tax or deduction, especially for a bonus pay period, which may have different rules.

Process checks using the normal payroll process procedure. Review the Process Worker Payments section for more details.