Purchasing a rental item is the most common method used to add equipment into the rental system. The process required to process the purchase of rental equipment depends on the methods used. Each method includes a set of corresponding Classifications. The first pair are depreciated and the 2nd set is managed as inventory. The recommended method to manage rental items is the asset method:

-

Asset method that includes depreciation:

-

Non-inventory Serialized Items: this classification should be used for most equipment such as vehicles, power equipment, and other serialized items. Any rental equipment that has a serial number, VIN number, or other number attached to the item should be classified as Non-inventory Serialized Items. This classification is the most common classification used for rental equipment.

-

No Count: This classification should only be used for depreciable assets without a distinct number of items available. For example, a company that has a large number of chains, scaffolding, or other supplies that are not limited to a specific number of rentals would use this classification.

-

Inventory method that allows the sales person to sell or rent an item. This method is not common for new product since a rental item is normally discounted from the new item.

-

Serialized Item: This classification may be used for used equipment sales with some rentals until the unit is sold. This classification requires a serial or VIN number.

-

Track Count: This classification only be used for inventory items that are not identified individually, including used attachments, scaffolding or other inventory items that are not identified individually.

Asset Method

Complete the following steps to process the purchase of a rental item:

-

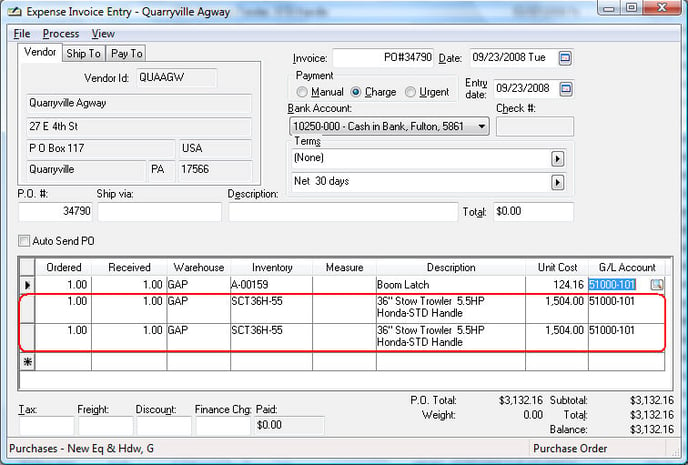

Enter a serialized item into a purchase order or expense invoice as shown below:

-

The 2nd and 3rd lines of the purchase order shown above contain the new rental items. Each rental item that is depreciated must be entered into separate purchase order lines. A depreciable rental asset cannot have a quantity of more than one. Notice that the information is entered into the PO using similar steps as other inventory items, with the exception of the G/L Account. The G/L Account for the rental item is a depreciable asset account since the rental item will be depreciated.

-

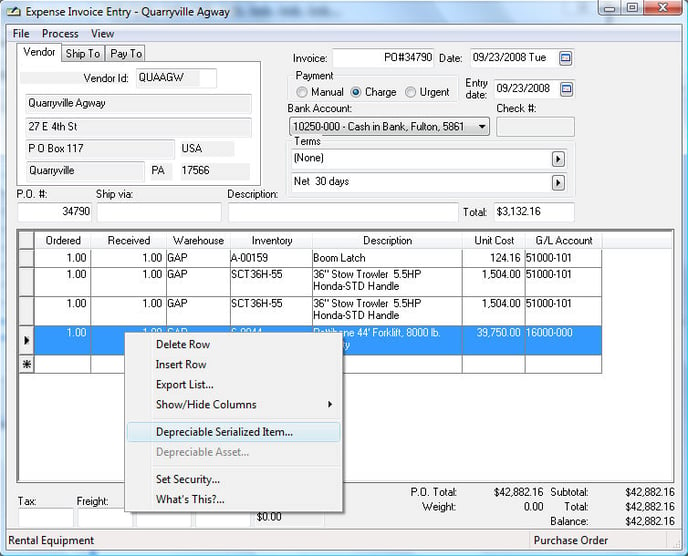

The Received column must be populated before the serial numbers for each item can be entered into the purchase order or invoice. Save the purchase order (Click File > Save) before entering serial numbers if you wish to enter product details. Right-click on each invoice line and select Depreciable Serial Numbers to enter the serial number for each rental item as shown below:

-

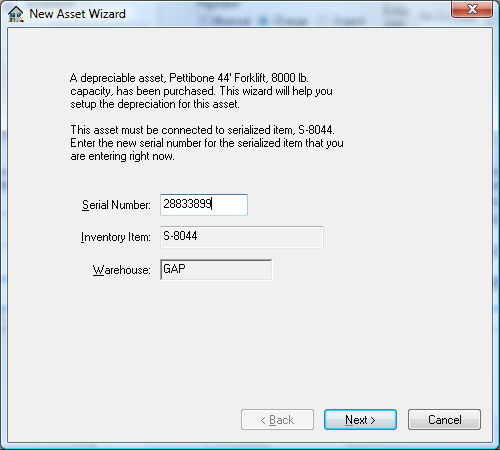

The following depreciable asset wizard will be launched if the optional EBMS depreciation module is installed:

-

Enter the serial number for the rental item and click Next.

-

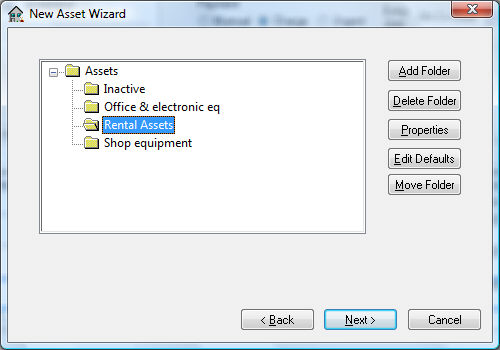

Select the asset folder that contains rental equipment and click Next.

-

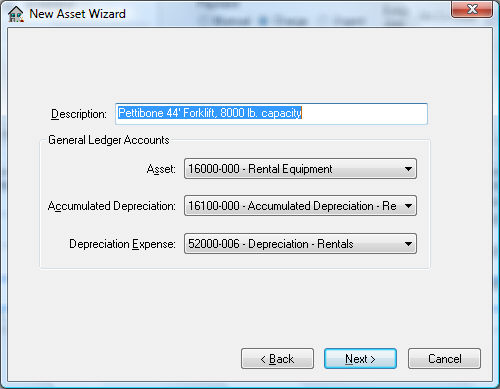

Enter an appropriate Description to identify the new asset.

-

Set the correct General Ledger Accounts. The Asset account will be set to the G/L Account entered within the invoice. The Accumulated Depreciation account is an asset account used to record the accumulated depreciation. The Depreciation Expense account is an expense account that records the annual depreciation. Click the Next button.

-

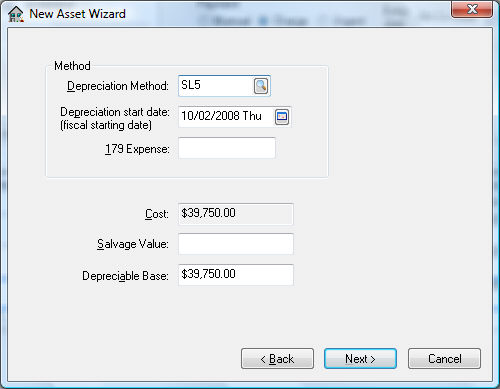

Enter a Depreciation Method by clicking on the lookup button and selecting a method. This method can be changed at a later time if a method has not been determined at this time. Review the Depreciation documentation within the main manual that is distributed with the deprecation module for more details on these settings.

-

The Depreciation Start Date will default to the date found on the expense invoice. The depreciation schedule will use this date to determine in which fiscal years the depreciation is scheduled.

-

The purchase Cost of the asset will be copied from the invoice. Enter the estimated Salvage Value of asset at time of disposal. This amount will be deducted from the Cost to calculate the Depreciable Amount. Depreciable Amount = Cost Salvage Value.

-

Click the Next button to continue.

-

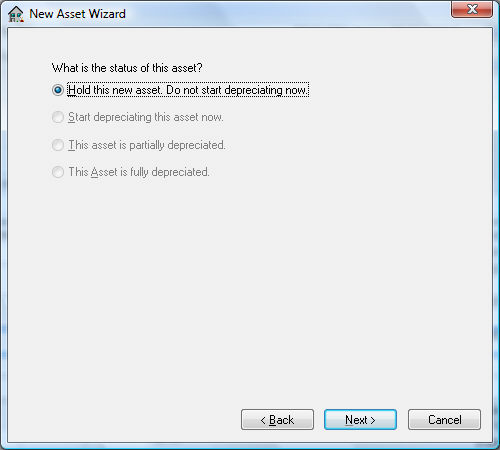

Select one of the following status options for the asset:

-

Hold this new asset. Do not start depreciating now. This option is the only available option if no depreciating method has been entered for this asset. The Hold option will record the asset but will not process any accumulating depreciation and is useful if the user wishes to obtain advice on the appropriate depreciation method. The asset status can be changed to a depreciating status at any time.

-

Start depreciating this asset now option will cause the asset to start depreciating at the time of the next Monthly Process.

-

This asset is partially depreciated and This Asset is fully depreciated. These options should not be used when adding new assets from an expense invoice.

-

Click the Next button.

-

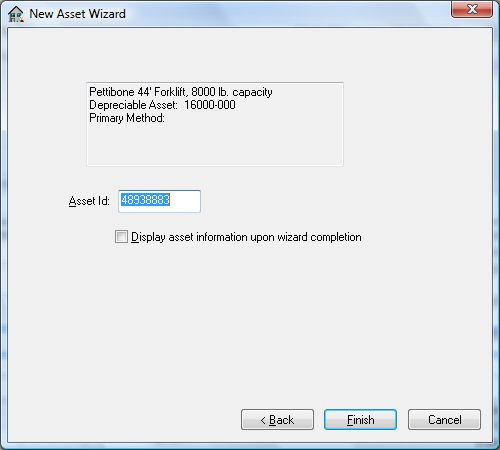

Enter the Asset ID. Display asset information upon wizard completion will open the Depreciable Asset window.

-

Click Finish to complete the deprecation wizard. Review the Depreciation section within the main manual that is distributed with the deprecation module for more details on these settings.

-

Repeat this wizard process for each rental item within the purchase order or expense invoice.

Inventory Method

Review the following standard inventory purchasing methods for each classification:

-

Serialized Item: Review [Inventory] Serialized Items > Purchasing Serialized Items for purchasing details for serial numbers.

-

Track Count item: Use a purchase order to purchase rental items. Review [Financials] Purchase Order > Overview for instructions on purchasing using a P.O.