Origin vs Destination Sales Tax

Configuring the sales tax calculation to identify the sales tax “sourcing,” which means the location where a sale is taxed. Origin-sourced sales are taxed where the seller is located, while destination-sourced sales are taxed at the location where the buyer takes possession of the item sold. The more sales that are conducted by a company and the more customers, potentially the more states may need to be configured within EBMS to calculate sales tax.

Note that the sourcing option is not based on the EBMS user's discretion but is based on the tax laws of individual states. As a seller, it is important to know whether you are located in an origin-sourced state or a destination-sourced state. Many states and Washington, D.C. are destination-based. Review this TaxJar blog post for a list of origin-based states.

Destination-Based States

Although origin-based sourcing is easier for businesses to administer because they only have to keep track of the rates where they are based, most states use destination sourcing, which requires the company to figure out the correct sales tax rate for any location where the company is selling and has nexus. Destination-based sales tax method was the method EBMS used in the past before the Origin-based option was made available in version 8.3.

Origin-Based States

Generally, if you are located in an origin-based state and make sales to customers within that state, sales tax is based on the sales location (often the main company location). This includes any local or county taxes that are common in many states. For example, if you are based in Harrisburg, Pennsylvania, and a sale is made to a customer in Philadelphia, Pennsylvania the sales tax rate of 6% (Harrisburg's rate) is applicable, instead of the 7% point-of-possession rate in Philadelphia.

If the company is based in Ohio and makes a sale to another location in Ohio, any city, county, or state taxes will be based on the seller’s location (origin) rather than the customer's location (destination). Sales taxes are always based on the seller's location, so the rate does not change depending on whether the item is shipped or picked up at the seller's location.

Remote Interstate Sales

However, origin vs. destination sourcing rules work differently if the company is a remote seller, meaning the seller is based in one state and the customer is located in another state. Contact an accountant to identify all states where the company has nexus (an obligation to collect sales tax). Sales are generally destination-based for sales in a remote state, which requires EBMS to be confirmed to calculate sales tax for the remote state.

If you are selling to customers in a state where you don’t have nexus, you don’t have an obligation to collect sales taxes. EBMS must be configured to calculate the appropriate tax rate for origin-based, destination-based, tax in remote states with nexus, and no tax for states without nexus. Contact your Koble Systems software consultant or a sales tax accountant to verify that EBMS has been configured properly.

Configuring Origin-Based Sales Tax

Complete the following steps to configure origin-based sales tax. Note that EBMS defaults to destination-based sales tax if a sales location is not specifically identified as origin-based.

-

Identify if the main sales location is within an origin-based state: Identify origin-based states by reviewing this TaxJar blog post.

-

Identify if other sales locations of the company are located in origin-based states.

-

If the company maintains a single sales location (Single Profile) and that main location is located in an origin-based state, then complete the following steps:

-

Open the following dialog by selecting File > Company Information from the main EBMS menu and clock on the General tab as shown below:

-

Enable the Origin-based Sales Tax option as shown above. Note: This option will not appear if EBMS is configured to manage multiple sales locations.

-

If the company has multiple sales locations (Based on Warehouses) and any of these locations are within an origin-based state, complete the following steps:

-

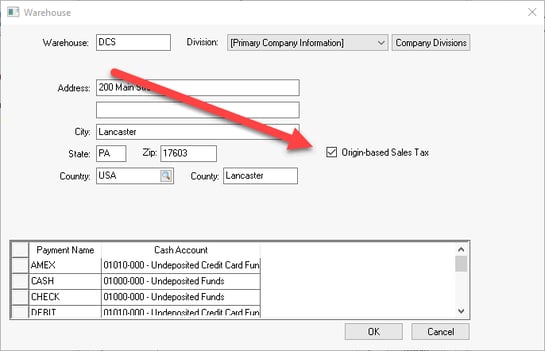

Open the Inventory > Options > Warehouse tab from the main EBMS menu as shown below:

-

Select a Warehouse that identifies the sales location and click Properties to open the following dialog:

-

Enable the Origin-based Sales Tax option if the warehouse or sales location is within an origin-based state. Click OK to save.

-

Repeat for all other warehouse locations.