Process Returned Check from a Customer

When a check or payment has been deposited into a bank account and then is subsequently rejected and returned (i.e. the payment bounced), the return needs to be processed differently than just voiding the payment.

How to process a returned check:

Go to Sales > Deposits and select a payment.

Click on the Wizards button on the bottom right corner of the page.

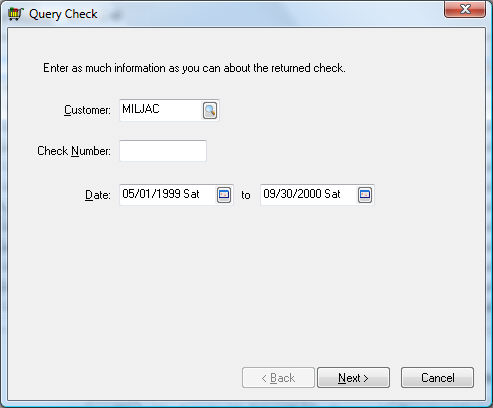

Choose the Process Returned Check option to open the following wizard:

Fill in the information that will be helpful in locating the desired check. (Putting in only a Customer ID will bring up all payments from that customer, putting in only a check number will bring up payments from all customers with that check number, and putting in only a date or range of dates will show all payments within those dates.) Any combination of the three helps to narrow down the search.

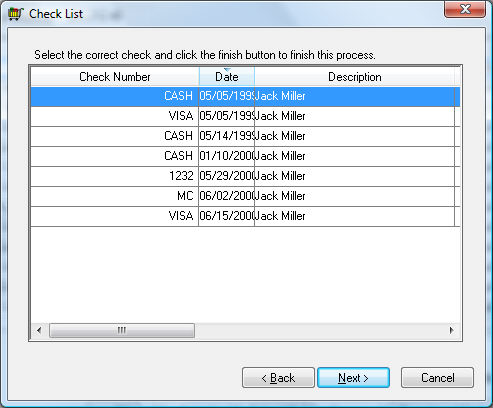

Click on Next to bring up the list of payments that meet the selected criteria.

Select the correct check from the list and click Next.

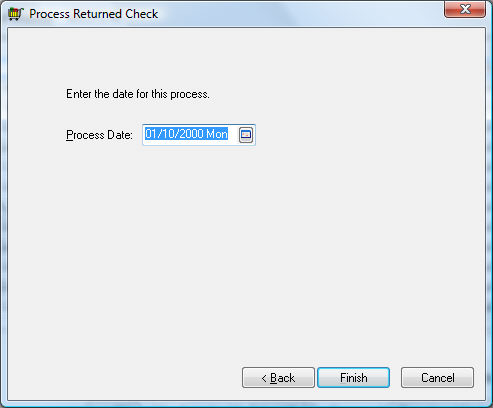

Enter the Process Date for the return to take place. Note: The date field defaults to the payment date, but the process date should match the date that the bank made the correction to your account.

When you click on Finish, the bank account will be deducted by that amount and the check will be available in your cash account to redeposit.

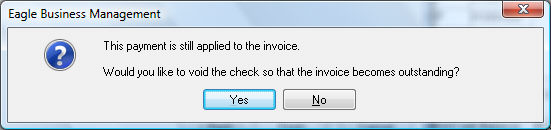

If the check is void and will not be redeposited, click Yes on the question to void the check and make the invoice appear outstanding. If you charge for returned checks, create a second invoice to that customer with the service fee. When you receive the new payment with the service fee added in Customer Payments, select both the original invoice and the service charge invoice to apply the payment to both.