Complete the following steps to add new assets to the depreciation system is though an expense invoice at the time the item is purchased.

Go to to open an expense invoice.

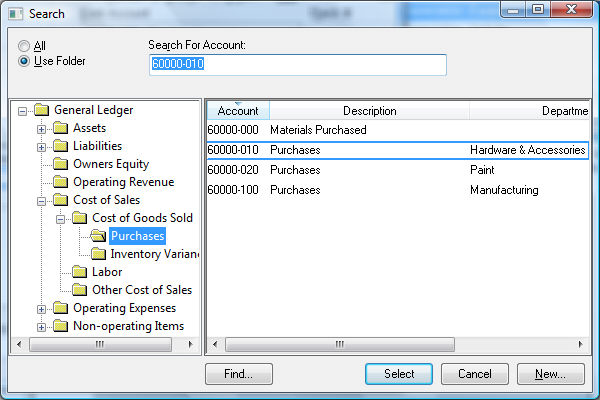

Enter a purchase order or expense invoice in the standard way with the exception of the General Ledger account. Click on the G/L Account lookup button. The General Ledger account must be set to an asset account that records depreciable assets.

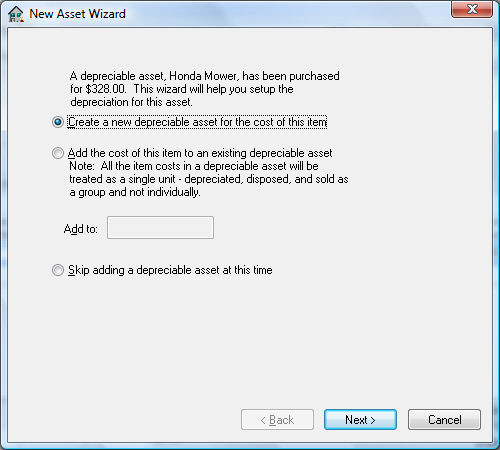

The wizard to add depreciable assets will be activated each time an expense invoice contains a General Ledger account that is classified as Depreciable Asset. Review Getting Started > Adding and Deleting Asset Folders for more details on account classifications. The following wizard will be activated at the time the invoice is processed:

- Select the first option – Create a new depreciable item for the cost of this item to create a new asset. Select the second option to add costs to an existing depreciable item. Click the Next button.

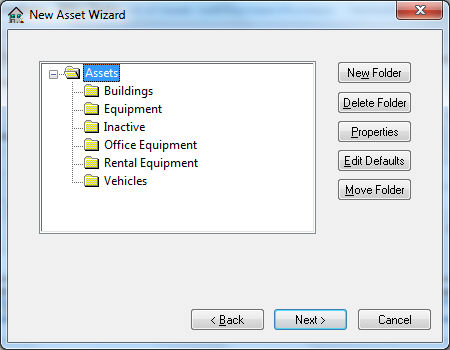

Select the appropriate folder. Adding items can be greatly simplified if the General Ledger accounts and other defaults are properly set for each folder (group of assets). See Chart of Accounts > Adding General Ledger Accounts for more details on adding folders. Click the Next button.

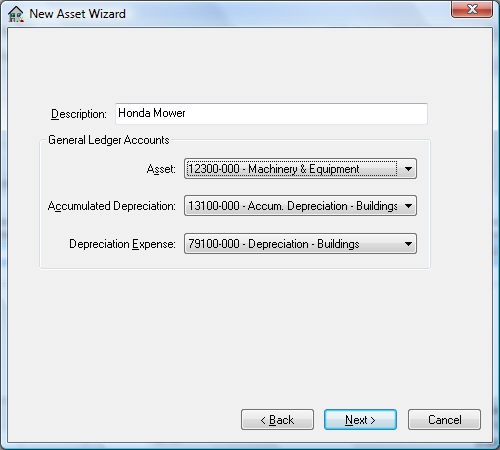

Enter an appropriate Description to identify the new asset.

Set the correct General Ledger Accounts. The Asset account will be set to the G/L Account entered within the invoice. The Accumulated Depreciation account is an asset account used to record the accumulated depreciation. The Depreciation Expense account is an expense account that records the annual depreciation. Click the Next button.

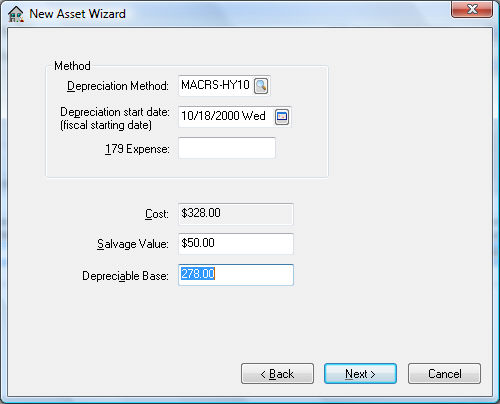

Enter a Depreciation Method by clicking on the lookup button and selecting a method. This method can be changed at a later time if a method has not been determined at this time. See Getting Started > Depreciation Methods for more details on adding or changing methods. See the following Managing and Processing Assets > Changing Methods within an Asset section for details on changing the depreciation method.

The Depreciation Start Date will default to the date found on the expense invoice. The depreciation schedule will use this date to determine in which fiscal years the depreciation is scheduled.

The purchase Cost of the asset will be copied from the invoice.

Enter the estimated Salvage Value of asset at time of disposal. This amount will be deducted from the Cost to calculate the Depreciable Amount. Depreciable Amount = Cost – Salvage Value. Click the Next button to continue.

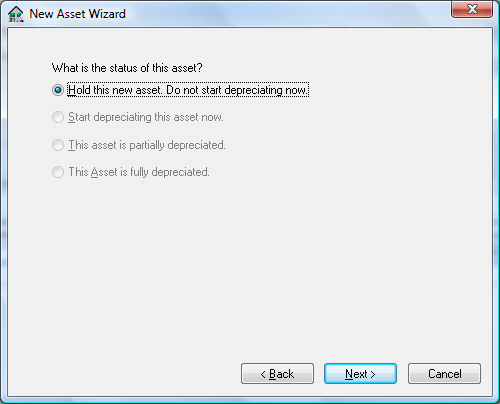

Select one of the following status options for the asset:

Hold this new asset. Do not start depreciating now. This option is the only available option if no depreciating method has been entered for this asset. The Hold option will record the asset but will not process any accumulating depreciation and is useful if the user wishes to obtain advice on the appropriate depreciation method. The asset status can be changed to a depreciating status at anytime. See Managing and Processing Assets > Changing Methods within an Asset.

Start depreciating this asset now option will cause the asset to start depreciating at the time of the next Monthly Process. See Managing and Processing Assets > Depreciating Assets Using a Monthly Process for more details on processing depreciation.

This asset is partially depreciated and This Asset is fully depreciated. These options should not be used when adding new assets from an expense invoice.

Click the Next button.

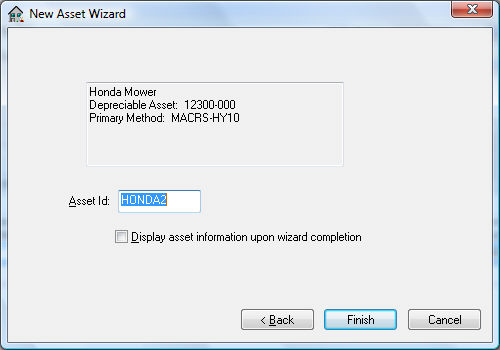

Enter the Asset ID. Display asset information upon wizard completion will open the Depreciable Asset window. Click Finish to complete the wizard.

See Managing and Processing Assets > Viewing or Changing Asset information for more details on viewing or changing new asset information.