Removing Disposed Assets

An asset must be removed from the asset list if it is being disposed of and not being used. This process will mark the asset as disposed and will remove any asset values and accumulated depreciation from the asset General Ledger accounts. See the previous section, Selling Assets within a Sales Invoice, if the asset is being sold. Complete the following steps if the asset is being disposed or the sales invoice has been processed already.

-

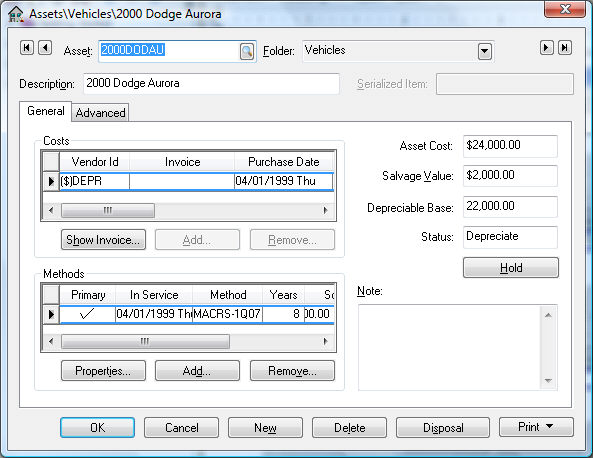

Go to Depreciation > Depreciable Assets and select the asset that is to be disposed as shown below:

-

Click on the Disposal button located in the lower right-hand corner of the asset window to start the disposal wizard. If the asset is completely depreciated, the accumulated depreciation page will not appear, since it is irrelevant to the disposal process.

-

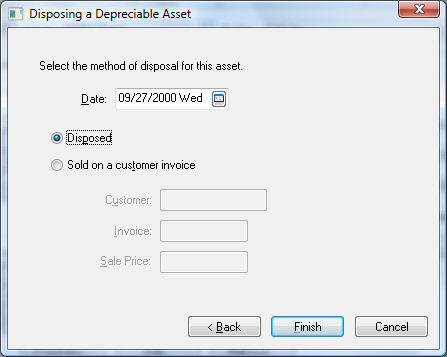

Enter the Date the asset was disposed. This date must be within an open fiscal period since the General Ledger transactions use this date.

-

The screen options are to dispose the asset are: Disposed and Sold on a customer invoice.

-

Enter a Customer ID, Invoice number, and Sale Price if the asset has been sold. The fields should remain blank if the item has been junked. The Sale Price value will be credited to the Sale of Asset general ledger account as shown below. The asset value and accumulated depreciation amounts will be adjusted.

Debit Credit Accumulated Depreciation (Asset G/L) Asset Value (Asset G/L) Asset Disposal (Expense G/L) Depreciation Disposal (Expense G/L) -

Clicking on the Reverse Disposal button of a disposed asset will reverse the disposal transactions; this button will appear only for disposed assets. All disposal transactions listed above will be reversed, allowing the user to make corrections and activate the disposal wizard again.