Selling Fixed Assets within a Sales Invoice

How to sell and dispose of depreciable assets

The value of an asset will be recorded within the general ledger until the asset is sold or disposed (not being used or junked). This section will explain the steps that should be used when an asset is sold. See the next section, Removing Disposed Assets, for an alternative method to record asset disposal.

Often depreciable items that are being rented using the optional EBMS Rental module are recorded within inventory. Rental items are normally depreciated instead of recorded within the standard inventory system. Many fixed assets, such as vehicles, building equipment, and other depreciable assets, are not recorded as inventory.

Selling Rental or Inventory items

-

Go to Sales > Invoices and S.O.s to open the sales invoice as shown below:

-

Enter the sales order in a similar way as a normal sales order.

-

Enter the rental equipment item that was created at the time the rental item was purchased. Review Rental Equipment for details on creating these rental equipment product codes.

-

Enter the sale price into the Price column.

-

The general ledger account should default to a G/L account classified as Sale of Asset to launch the disposal of the depreciable asset.

-

Continue in the next section to continue with the sale of asset.

Selling general depreciable assets not recorded as rentals or inventory items

The asset should be removed from the depreciable assets list at the time a sales invoice is entered. Complete the following steps to process the sale of the general fixed asset:

Go to Sales > Invoices and S.O.s to open the sales invoice.

.

Enter a sales order in the same manner as any other sale with the following exceptions:

-

Do not enter an inventory item (product) when selling a depreciable asset but enter a brief Description in the invoice description line.

-

Enter the sale Price of the asset that is being sold.

-

Enter a G/L Account that is classified as Sale of Asset. This will activate the depreciation wizard at the time the sales invoice is processed.

Disposal of the Depreciable Asset

A separate sales invoice line should be entered for each depreciable asset. Complete the following steps to dispose of the asset.

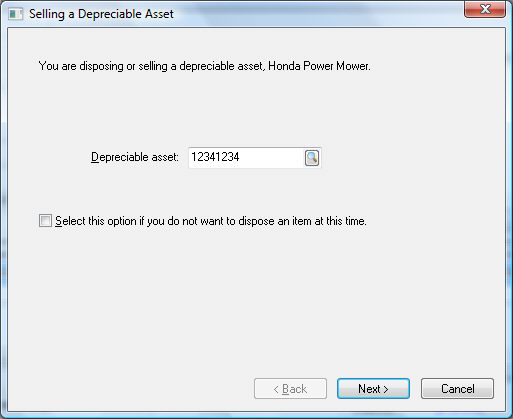

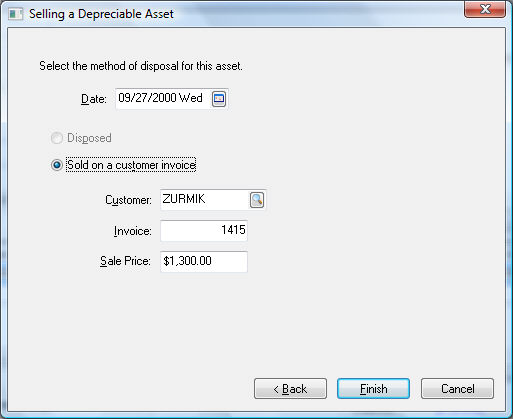

Process the sales invoice to activate the Selling a Depreciable Asset wizard as shown below:

Choose the Depreciable Asset that is being sold. Click on the lookup button to select an asset from the asset list.

Unselect the Select this option if you do not want to dispose an item at this time option. No assets will be disposed if this option is turned on.

Click the Next button to continue. The following dialog will only appear if the depreciable item is not fully depreciated.

-

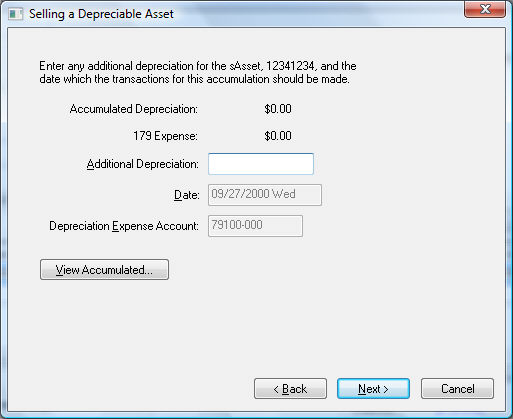

Enter any Additional Depreciation that is to be expensed before the asset is disposed. This value would be in addition to any depreciation that has been processed in the current year or prior year. Click on the View Accumulated button to list the total amount of depreciation that has already been accumulated, as well as the scheduled annual amounts.

-

The Date field and the Depreciation Expense Account are necessary only if Additional Depreciation is entered, because that action creates general ledger transactions. Otherwise ignore the values of these two fields.

Click Next to continue with the next page of the wizard as shown below:

Select the method of disposal and the Date it is to be disposed. If the Sold on a customer invoice option is selected, the contents of the invoice will be copied into the fields on this page. These copied values should equal the correct disposal information. Click the Finish button to complete the disposal process.

Standard sales transactions will be created in the general ledger, based on the information entered into the sales invoice. Additional depreciation transactions will be created to dispose of the asset as listed below:

| Debit | Credit |

| Accumulated Depreciation (Asset G/L) | Asset Value (Asset G/L) |

| Asset Disposal (Expense G/L) | Depreciation Disposal (Expense G/L) |

Additional depreciation transactions will be created if Additional Depreciation was entered on page 2 of the wizard.

See Removing Disposed Assets to remove assets without using a sales invoice.