Reviewing Fund Balances

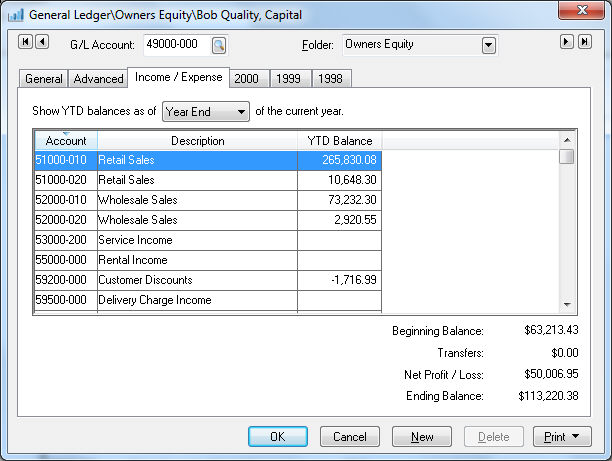

The fund balance is affected each time the revenue account is credited, or the expense account is debited. The fund balance can be viewed within the Income / Expense tab of the fund account record. Go to Financials > Chart of Accounts and open a fund account (Classified as Retained Earnings). Click on the Income / Expense tab as shown below:

The Beginning Balance shown on this tab is the beginning balance of the current fiscal year (year 2000 in the example shown above).

The Transfers value reflects debits and credits within the fund account itself. Review the next section for details on fund transfers.

The Net Profit / Loss value is calculated by the sum of all the revenue and expense accounts associated with the specific fund and listed within the Income / Expense tab.

The Ending Balance equals the sum of the three: Beginning Balance + Transfers + Net Profit / Loss.

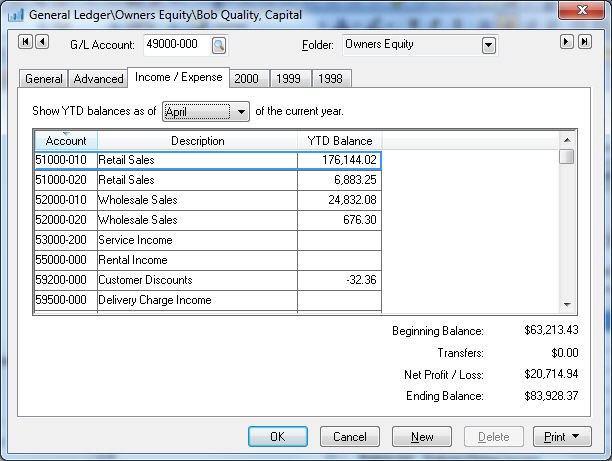

The Transfers, Net Profit / Loss, and Ending Balance values can be limited to the values on or before the monthly setting set located on the top of the Income / Expense tab. For example, Set the Show YTD balances as of [month] of the current year option to the month of April to view the values at the end of the month of April as shown below:

Fund Reports:

A number of financial statement fund reports can be printed based on a fund. Go to File > Reports to view the following reports.

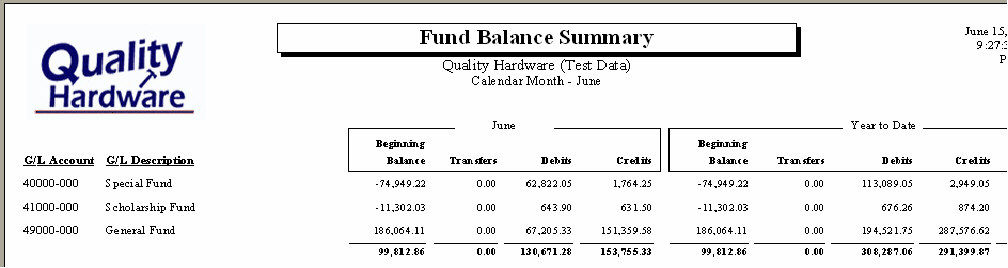

Select the Fund Balance Summary report from File > Reports > Financials > Balance Statements > Fund Balance Summary for fund account balances as shown below:

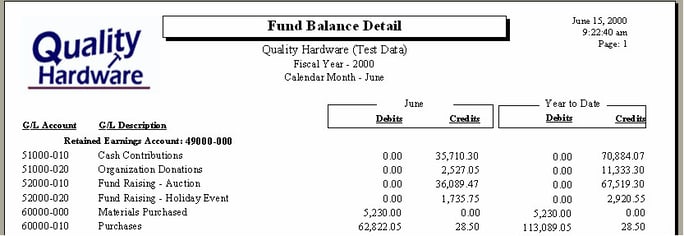

Print the Fund Balance Detail report from File > Reports > Financials > Balance Statements > Fund Balance Detail for detailed general ledger account balances as shown below:

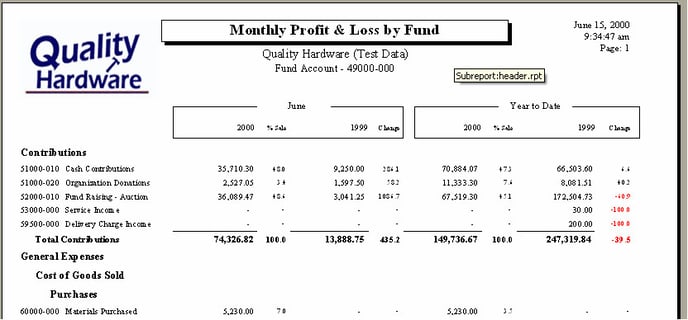

Print the Monthly Profit & Loss by Fund report from File > Reports > Financials > Profit & Loss > P&L by Fund > Monthly Profit & Loss by Fund for a profit and loss statement for a specific fund as shown below:

Review Financial Reporting Overview for a complete list of financial reports.

Review Retained Earnings and Other Equity Accounts for information on configuring fund accounts.