Financial Reporting Overview

Financial reporting is a key component in business management. The general ledger Chart of Accounts contains a summary of the financial activity of the company or profit center. The financial transactions contain the details to verify the summaries created within the financial module.

Video: Profit Evaluation ERP Support Training

Main Financial Management Reports

The three main reports that summarize the financial activity of the business are listed below:

- Balance Sheet: Lists the assets (what the company owns), liabilities (what the company owes), and the capital (owner's equity). Review the Balance Sheet article for more details and examples.

- P&L / Income Statement: This report summarizes the company's revenue, cost of sales, and expenses. Review Profit and Loss/Income Statements for more details and examples.

- Cash Flow Statement: Reports the amount of cash and cash equivalents that is entering and leaving the company. Review Cash Flow Statement for more details and examples.

Other Financial Reports

EBMS contains many other financial reporting tools as listed below:

- Budget reports: Review Budget Comparison Reports for budget reporting details.

- Reviewing Transactions: Review Transaction Overview for details, including reporting.

- Reconciliation reports: Review Account Reconciliation for reconciliation steps, including reports.

- Profit center reporting: Review Departments and Profit Centers for profit center setup and reporting.

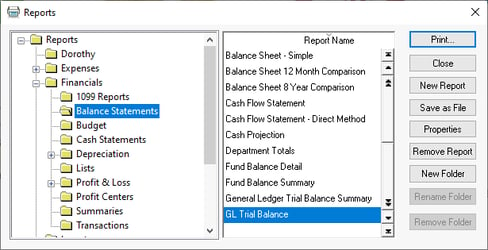

- General Ledger Trial Balance: Launch this report by selecting Reports > Financials > Balance Statements > GL Trial Balance as shown below:

- Fund reporting: Review Reviewing Fund Balances for fund reporting for non-profit organizations.

- Cash accounting year end reports rather than accrual reports: Review Create Cash Accounting Adjustments for a process to create adjusted cash statements.

Monthly and Quarterly Reports

- Accounts Receivables: Review Accounts Receivable Transactions for steps to reconcile and report outstanding customer invoice balances.

- Accounts Payable: Review Accounts Payable Transactions for steps to review and report outstanding expense invoice balances.

- Payroll reports: Review Annual and Quarterly Payroll Reports for 941 and other payroll report details.

Year End Reports

- Fixed asset reports: Review Depreciation Reports for various year end fixed asset reports.

- Payroll reports: Review Annual and Quarterly Payroll Reports for 941 and other payroll report details.

- 1099 reports: Review 1099 Overview for vendor and account configuration, filing, and reporting.