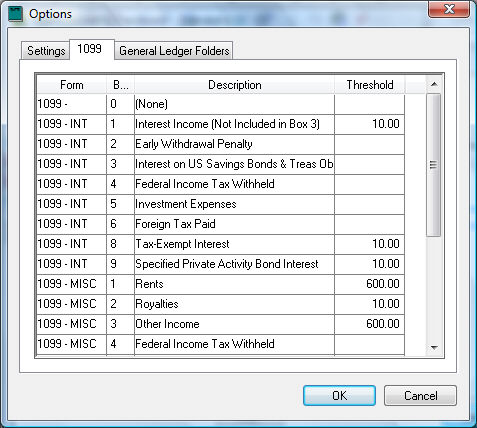

Viewing 1099 Controls and Changing Threshold Amounts

Only selected expense payments, such as interest, services, and royalties are to be reported on a 1099 form. Go to the Financials > Options > 1099 tab to view all 1099 expense categories distributed with EBMS.

Records cannot be added or deleted from this dialog since this information must match the 1099 form report files.

The Form column identifies the 1099 form where the expense will be reported.

The Box number identifies the location of the expense amount within the form.

Use the Description to identify the expenses that are to be reported on the different 1099 forms. (Note that the Form, Box, and Description settings are read only and cannot be changed from this tab.)

The Threshold value controls the amount of expense that is to be paid to a specific vendor before it must be reported. Any expenses below the Threshold amount will be ignored on the 1099 form. The user can change these values but use caution, because tax law dictates these values. 1099 thresholds are updated when 1099 forms and payroll tax updates are issued from Koble Systems annually. Updates are distributed free to users that have subscribed for the annual support plan. (Contact an EBMS consultant if you wish to verify your 1099 Threshold values and 1099 forms.)

-

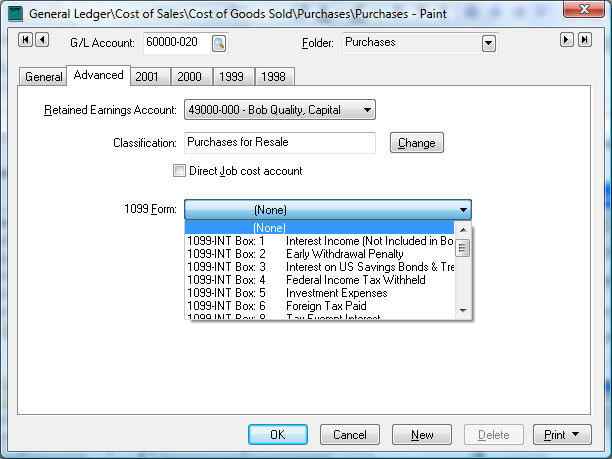

Go to Financials > Chart of Accounts and select an expense account. Click on the Advanced tab on the General Ledger account record to view or set the 1099 settings for the selected expense account.

-

Select the appropriate 1099 Form setting for each G/L expense account. The 1099 Form setting for all revenue, asset, liability, and equity accounts should be set to the default (None).

The 1099 Position of the GL account value is based on the GL Account Classification. Review the Account Classification including Cash Flow, Reconcile, and 1099 format settings section for more details on setting the Account Classification.

EBMS facilitates the printing of either continuous or laser 1099 forms. Go to the File > Reports > Financials > 1099 Reports folder to find and print all 1099 forms and reports.