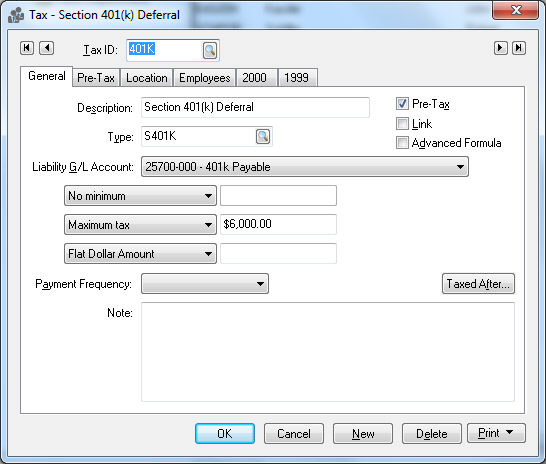

Changing Payroll Taxes and Deductions

Complete the following steps to edit or update a tax or deduction rate or make other adjustments to the tax file:

- Select Labor > Taxes/Deductions from the main EBMS menu:

-

Select the Tax ID that you wish to view or edit by entering the Tax ID or by clicking on the magnifying glass icon to search and select from the tax list. Note that you can also page through the taxes by using the arrows on top of the window or by pressing Ctrl + Page Up or Page Down on the keyboard. To change the Tax ID code, right-click and select Change ID on the context menu. This can be a lengthy process so use this feature sparingly.

-

The Description can be changed anytime and should briefly describe the tax or deduction.

-

To create or change a tax Link, review the Tax Links section of this manual.

-

Use caution changing the tax Type and Liability G/L Account, since the change could have an adverse effect on the General Ledger records or on the payroll process.

-

To change Minimum limits, Maximum limits, or Rate types, click on the appropriate field dropdown list by clicking on the down arrow button. Also enter the appropriate values into the Minimum and Maximum fields if they are activated. The tax rate can only be set in this window if the tax or deduction is based on a flat rate.

-

Click on the Taxed After button to open a View Pretaxes window. This allows the user to view all the taxes and deductions that are deducted before the current tax is calculated. The pre-taxes are displayed in a reverse manner from the way they are entered in the pretax wizard.

For example, if a medical deduction has FICA, MED, and FWT taxes listed as pretax within the medical deduction record, then if the FICA tax record is viewed, the medical deduction would be listed in the Taxed After list. This list can be viewed but cannot be edited. Depending on the type of deduction being viewed, some additional tabs such as Links, Pre-Tax, and Rates tabs may be present. For details on these tabs review the Adding New Taxes and Deductions for details on how to enter pre-taxes and rate tables.

- The Pre-Tax tab appears only if the tax's Pre-Tax option is enabled or if the tax rate type is set to either Pre-Tax Company Paid Dollar or Pre-Tax Company Paid Percentage. The pre-tax list affects how payroll taxes are calculated.

-

Click on the Location tab. Select the appropriate locations settings for this tax. Review the Taxes for Multiple Locations section for more details.

-

Click OK to save changes and exit the tax and deduction window.

Review Calculating Taxes for instructions on processing taxes and deductions within payroll.