Bad Debt

Unpaid invoice balances are recorded in accounts receivable. Outstanding sales invoices that are unlikely to be paid can be categorized as bad debt. Complete the following steps to write uncollectible accounts receivable (A/R) to Bad Debt.

-

For each sales invoice that will be written off as bad debt, remove the finance charges listed on the invoice. (Any accrued finance charges will be displayed in the Finance Chg field on the invoice.)

-

Verify that finance charges are blank by printing statements for the customer. Review Printing Customer Statements.

-

Identify per customer account the total amount of all invoices being written to bad debt. This total is shown on the statement generated in the previous step.

-

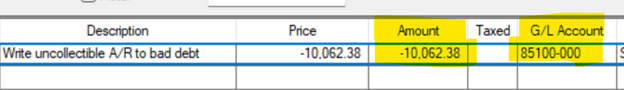

Create a credit invoice for the customer for the amount identified. Replace the sales general ledger account in the credit with your bad debt general ledger expense account and click OK when prompted to remove sales tax. Process the credit sales order to be an outstanding credit on the customer’s account.

Review Processing Customer Credits. -

Open the customer from the Sales > Customer Payments dialog. Mark all outstanding invoices as paid using the bad debt credit. Review Processing Customer Payments for more information.

-

Per your company policy, take any desired steps needed to lock down the customer account, restrict the customer from charging or change their due terms (terms tab), consider adding a message on the customer account that prompts users to collect payment from the customer before making new sales (messages tab), etc.