Changing the Tax Rates within an Invoice or Proposal

The sales tax rate is automatically set on a sales invoice based on the Ship Via setting and the customer's Ship To address. Review the Tax Overview section for details.

The sales tax rates and tax amounts can be manually changed within a sales invoice by completing the following steps:

-

Open an existing sales invoice.

-

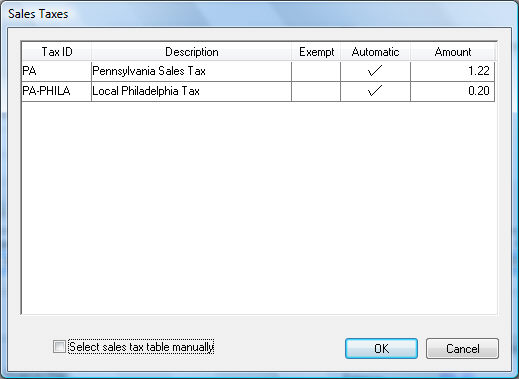

Select View > Sales Taxes from the sales invoice menu. The invoice shown above is being shipped to a location that involves multiple sales tax rates. (Notice the "Multiple" setting in the Tax Table field in the lower left-hand corner.) Multiple taxes are shown on the following list:

-

Individual taxes can be marked as exempt by enabling the Exempt option for each Tax ID.

-

The tax amount can be changed by disabling the Automatic option and entering the sales tax Amount.

-

Enable the Select sales tax table manually option to add or remove taxes from the sales tax list. WARNING: The sales Tax ID rate list will not change if the Select sales tax table manually option is enabled. The tax Amount will continue to be calculated if the Automatic option is enabled.

-

Click on the OK button to save.

Review Configuring Use Tax for details on the Use Tax option at the bottom of the invoice.