Configuring Use Tax for a Job

EBMS uses the job costing module to process use tax when it is consumed by a job. Use tax is required to be paid when product was purchased without sales tax for a job. Use tax must be paid if the job billing does not include sales tax. This is common when a customer is billed for construction and other nontaxable services that include taxable parts or materials. Use tax must be paid based on the cost of the taxable products used within a non-taxable job.

The recommended method for processing a tax-exempt job in EBMS is to use the optional Job Costing module. An alternative method is to group products in a materials list within a sales order and enable the Collect Use Tax option. Review the sales invoice settings within Paying Use Tax on Items Consumed to use a sales order instead of job cost module.

Configuring a Job

Complete the following steps to enable use tax calculation for a job:

-

Verify that the use tax option is enabled. Review Configure Use Tax for steps to enable use tax settings within EBMS.

-

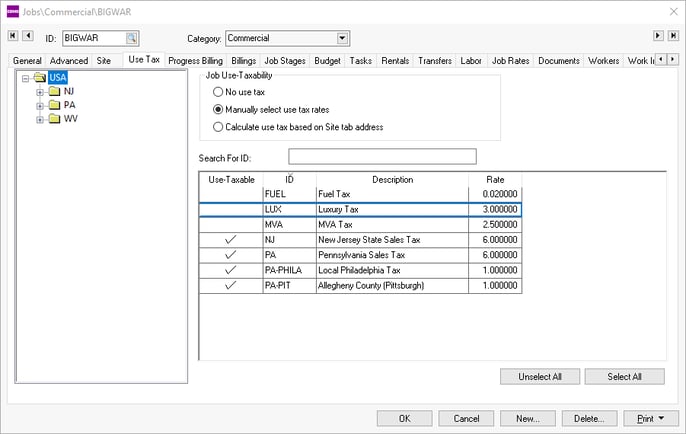

Open a job and click on the Use Tax tab as shown below:

-

Set one of the following Job Use-Taxability settings:

-

Select No use tax to disable use tax calculations for this job.

-

Select Manually select use tax rates to select the appropriate Use-Taxable taxes as shown at the bottom of the dialog. Select a jurisdiction from the category folder tree to query specific tax rate options.

-

Select Calculate use tax based on the Site tab address option to select use tax rates based on the site tab address.

-

Click on the Site tab and enter the required address information if use tax is calculated based on the job's location. Review the Site Tab section of Changing Job Information for more details on this setting.

Processing Use Tax on Taxable Purchased Product

Use tax is calculated when product is consumed within a job. Use tax is calculated from the following job expenses:

-

Expense invoices applying costs to a job: Review Allocating Job Costs from a Purchase Order or Expense Invoice for steps to apply Accounts Payable expenses to a job.

-

Materials transfers to a job: Review Job Costs > Transfers for steps to apply material expenses to a job.

-

Sales invoice that contain inventoried product: Review Job Costs > Sales Invoice for details on applying cost of goods sold from a sales invoice to a job.

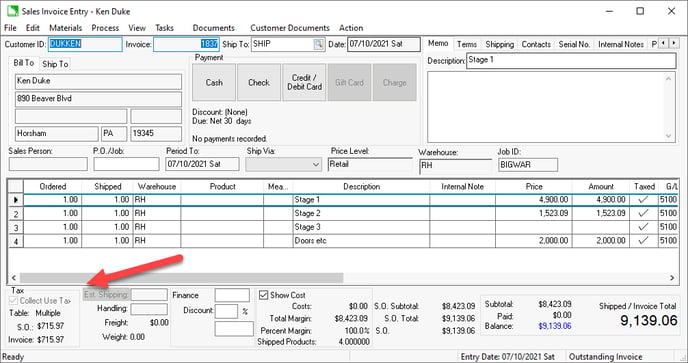

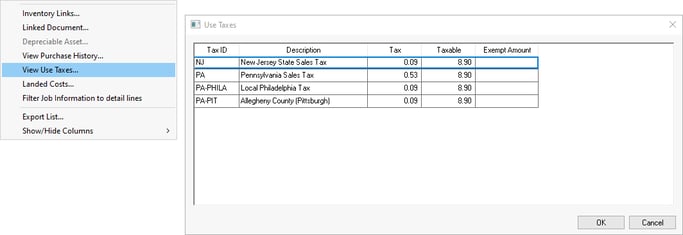

Save any of these documents, right-click on a detail line, and select View Use Taxes to view the taxes for a specific line.

Billing Jobs with Use Tax Enabled

All billings for a job with use tax enabled will exclude sales tax on the sales invoice. Note that the Collect Use Tax option on the sales order is enabled which disables sales tax for the same invoice. This option can only be changed by disabling Use Tax on the job or by removing the job.