Reconciliation of Deposit

How to reconcile credit card settlements in EBMS

The credit card cash account within EBMS must be reconciled to reflect the settlement of funds within the merchant account.

The individual transactions can be viewed from the Sales > Deposits dialog or by going to the File > Reports > Sales > POS/Cash Register > End of Day Credit Card Statement report.

Reconcile Credit Card Settlement

Complete the following steps to reconcile the credit card cash account:

-

Go to Sales > Deposits from the main EBMS menu.

-

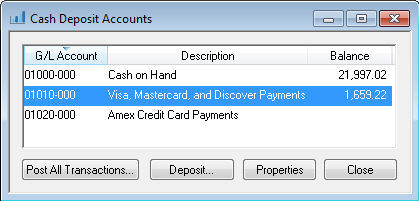

Select the cash account that contains the credit card transactions. Note that multiple settlements based on payment card type should be separated into multiple cash accounts. (Review the Undeposited Funds, Deposits, and Reconciling Cash Accounts section for more details on cash accounts.)

-

Open the Visa, Mastercard, and Discover Payments account to deposit the Receipts or view the transactions as shown below:

-

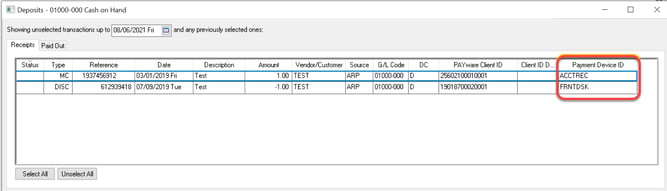

Select the transactions that are listed on the payment card settlement report generated by the merchant service provider. Use the Payment Device ID to separate transactions by payment processing device.

-

The amount on the Total Deposit should equal the total on the settlement report.

-

Click on the Deposit and Print to complete the deposit and print a deposit slip.

-

Click on the Deposit / No Print to complete the deposit without printing a deposit slip. (Review the Undeposited Funds, Deposits, and Reconciling Cash Accounts section for more details on deposits.)

End of Day Credit Card Statement

The End of Day Credit Card Statement from EBMS is helpful to verify the settlement report generated by the merchant account. Go to File > Reports > Sales > POS/Cash Register > End of Day Credit Card Statement report from the main EBMS menu to generate a credit card transaction list for a selected date.