Undeposited Funds, Deposits, and Reconciling Cash Accounts

Managing cash through undeposited fund accounts are very important components in maintaining accurate books. The general ledger account classified as "Cash" is an internal account that records undeposited money (cash or non-cash) from the time the money is collected until it is deposited into a bank account. These funds may consist of customer checks, cash, or sales paid via credit cards.

Whenever money is collected from a customer and processed as a cash sales invoice, down payment, or customer payment, that money is recorded in an undeposited funds account. Multiple accounts may be used to separate undeposited payments with cash or personal checks from payment card payments or other payment types.

Undeposited fund accounts should be reconciled each time a deposit is made via the Deposits window and weekly or monthly via the Cash Reconciliation window.

Associating Undeposited Fund Accounts to Payment Methods

Creating separate Undeposited Funds accounts for different payment methods allows the user to reconcile incoming payments properly. Setting up separate undeposited fund accounts for different locations is also recommended best practice.

Complete the following steps to configure undeposited fund accounts.

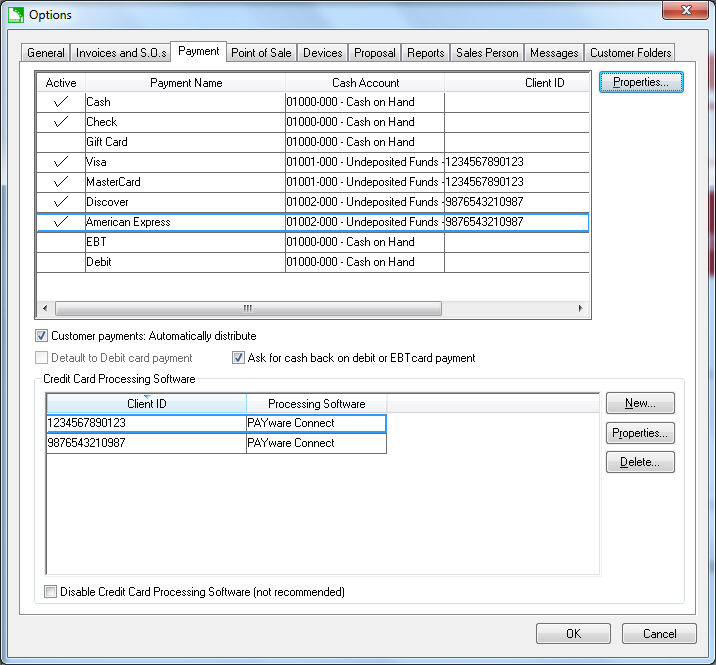

- Select Sales > Options from the main EBMS menu and click on the Payments tab as shown below:

-

Create a general undeposited cash account: In the example above, the user associated the Cash and Check payment types with the same Cash Account since cash and checks are deposited together. (Separating the Cash Accounts for the Cash and Check payment types would be the proper setup if all cash payments are added to a separate petty cash account and should not be combined with other check payments.)

-

Create separate payment card undeposited accounts: Notice that the credit card receipts from Visa, MasterCard, and Discover payment types are grouped into the same cash account, since these three card types are processed under the same merchant account. The three card types should be under a single cash account if they are settled into the bank account under a single account. The American Express payment type is separated into a different account since American Express transactions are processed under a separate merchant account.

-

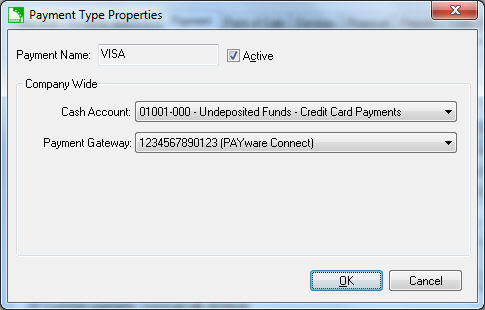

Click on each Payment option and click the Properties button to change settings.

-

A Payment Type can be made inactive by disabling the Active option. A payment type cannot be deleted or removed. Some Payment types such as Cash and Check cannot be disabled.

-

Set the appropriate asset account: Each Payment Type must be associated with a Cash Account.

-

Additional credit card processing details may appear on this dialog. Review the Payment Card Processing section for more details on the additional settings.

-

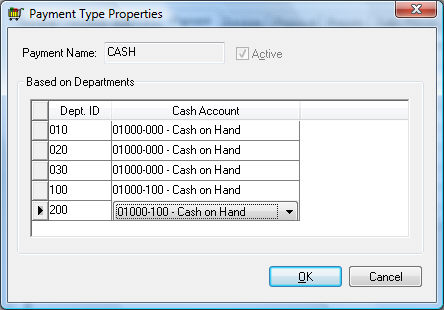

If the Company Expenses Profiles option set in Financials > Options > Settings is set to Based on Departments, the cash accounts are set for each department. For example, the following dialog shows a list of Cash Accounts for each payment type instead of a single Cash Account.

-

The Cash Account for each Dept. ID may be the same or differ as shown above. A list of Cash Accounts will be displayed if the user chose the Based on Warehouses option in the Financials > Options > Settings > Company Profiles setting. Review the Company Profiles section of the main documentation for more details on company settings.

-

The associated Cash Accounts will default within the sales invoice or customer payments dialog when a specific payment type is selected. Review the Payment Methods and Terms section for more details.

Review Penny Rounding Cash Payments to round all cash payments to the nearest nickel.

Deposits

The Sales > Deposits window is used to transfer money from a cash account to a bank account, or in other words, make a bank account deposit. The cash Ending Balance should be verified each time a deposit is processed. Verifying the cash Ending Balance will guard against a cash sales invoice being accidentally processed as charge, customer payments not processed properly, or expense invoices being paid from a cash account instead of a charge account. Reconciling cash will expose any user error involving payments, deposits, or cash disbursements.

Complete the following steps to process a deposit:

-

Go to Sales > Deposits to open the Deposits window. A dialog may prompt the user to post any unposted transactions before opening the Deposit window so all transactions are posted to the General Ledger. The Showing unselected transactions up to [date] and any previously selected ones will default to today's date. Note that all deposits in the Receipts and Paid Out tabs dated after the Show transactions date will not be displayed.

-

The Receipts tab of the Deposits window lists all the payments that were processed from cash invoices, down payments, or customer payments using the selected cash account. Select all the payments that are being deposited by clicking on the Status column. Click the Select All button to select all cash transactions. Notice that as the Selected Receipts values reflect the total selected transactions that were processed as Cash, Check, or Other. The Other total includes all payments such as credit card, debit card, gift card, and other payments that were not processed using the Cash or Check methods.

-

The Current Balance reflects the general ledger balance of the selected cash account. Review Account History for more details on account balances. Note that the Paid Out total is already deducted from the Current Balance.

-

Compare the Cash total with the total amount of cash that is in the deposit. Enter the cash adjustment value into the Cash Adjustment entry so that the Total Deposit is correct.

IMPORTANT: It is important that the Total Deposit reflects the total of the deposit and the Ending Balance reflects the total cash left after the deposit is made. The Ending Balance should equal zero if all payments are being deposited and no petty cash is stored in the office after the deposit. The Ending Balance should equal the cash balance before continuing with the process. Review the Correcting Differences in Reconciliation section of the main documentation for details on making cash adjustments. -

Right-click on any payment line and select Remove from List to remove any cash transactions that will not be deposited. This option should be used with caution.

-

Process the deposit by completing the following steps:

-

Verify that the Total Deposit equals the total being deposited in the bank account. Also verify that the Ending Balance equals the petty cash.

-

Enter the Deposit Date.

-

Enter a Description that will be included with the deposit financial transactions.

-

Set the appropriate Deposit To bank account.

-

Click Deposit and Print to generate and print a deposit slip or Deposit / No Print to carry out the deposit transaction, but skip printing the deposit slip.

To check the settings of the deposit ticket report, go to File > Reports > Sales > G/L Transactions > Bank Account Deposits. Review Changing Bank Account Information for report configuration instructions for deposits and other forms.

-

Paid Outs

The Paid Out tab on the Sales > Deposits page lists all the cash paid outs. This feature is used when the cash account is also used to pay miscellaneous expenses (petty cash). Expenses paid with petty cash must be entered and processed within the Accounts Payable (Expenses) module. Go to Paid Outs section of the main documentation for details on processing paid outs.