Allocating Indirect Expenses to a Profit Center

Indirect expenses are allocated to multiple profit centers using a ratio. These expenses are costs such as utilities, building expenses, or other expenses that are not directly assigned to any specific profit center. The ratio is set using multiple percentage values that must equal 100%. This method allows a user to post expenses to a single account but divide the values to multiple profit centers.

Some common indirect expense accounts are utilities, administrative labor, and other overhead costs. The direct expense accounts normally are codes with an extension of -000. A profit center P&L report may contain direct and indirect expenses.

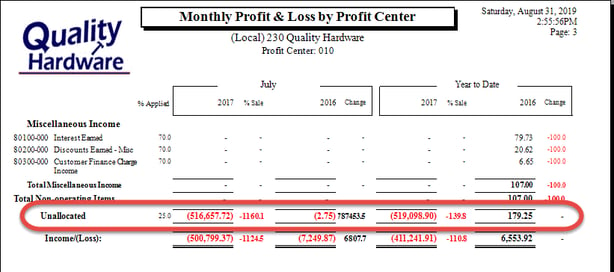

The example Monthly Profit & Loss by Profit Center report can be launched by selecting File > Reports from the main EBMS menu and selecting Financials > Profit & Loss > P&L by Profit Center > Monthly Profit & Loss by Profit Center report options. For example, in the following report, the revenue, purchase, and labor accounts are configured as direct income and revenue with indirect expenses being listed later in the report.

Note that the direct expenses are identified with a '-010' account extension and % Applied value is set to 100%. The indirect expenses or overhead accounts can be allocated to the profit center based on a ratio as shown in the % Applied column.

Allocating Indirect Expenses Individually:

Indirect expense ratios are used to allocate a portion of the costs to a specific profit center. The common percentages can be set within either of the following dialogs:

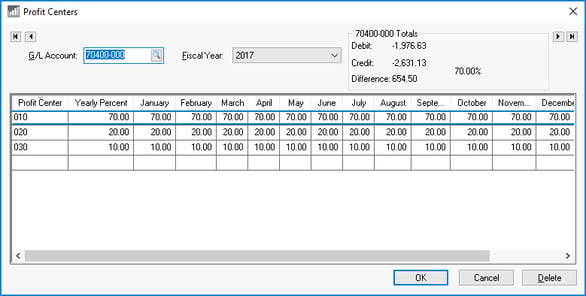

Select a G/L account record from the list in Financials > Chart of Accounts and click the Profit Centers button on the right side of the General tab to open the following dialog:

From the Profit Centers dialog associated with an account record, follow these steps to set indirect expense allocation ratios for the specified G/L Account:

-

Verify the correct Fiscal Year. The ratio entered on this dialog is for a single fiscal year. The expense allocation can vary by month or year.

-

Enter a record for each profit center that is responsible for the expense within the G/L Account. Create a single record with a Yearly Percent of 100% if a single profit center is responsible for the entire cost amount. Enter the following information for each record:

-

Enter the Profit Center ID. Review Creating New Profit Centers for more details on creating profit centers.

-

Enter the indirect expense allocation Yearly Percentage for the profit center. The Yearly Percentage can be copied to the monthly ratios if the percentage is the same for each month.

-

Make changes to individual months if the indirect expense allocation is not equally distributed throughout the year.

-

-

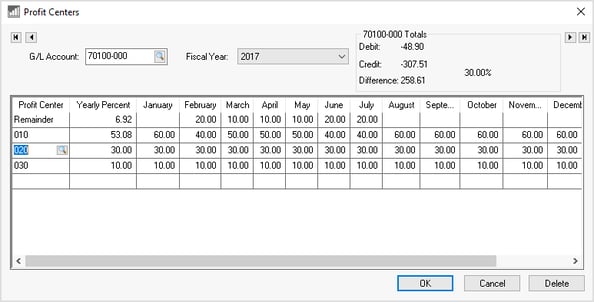

The Remainder record will appear to balance the total Profit Center percentages to equal 100 percent as shown below:

Repeat these steps for each G/L Account within the profit and loss or income statement. This should apply to all revenue and expense accounts listed on the P&L statement.

Review the next section for instructions on time-saving wizards to change a group of accounts rather than setting ratios by each G/L account individually.

Batch Allocating Indirect Expenses using Wizards:

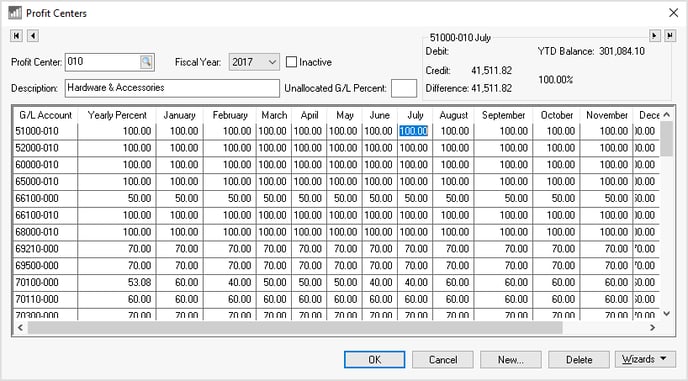

To allocate indirect expenses to a range of accounts, it recommended to use Wizard functions on the Profit Centers page. Select Financials > Profit Centers dialog from the main EBMS menu to open the following dialog:

Enter the desired Profit Center. (Click on the look up button to select a code from the list of profit centers.)

Choose the appropriate Fiscal Year. The default year will be automatically selected.

Look at the Unallocated G/L Percent field to view Unallocated G/L Balance details. (Review the end of this article for more details on the Unallocated G/L Percent setting.)

Complete the following steps to enter the income and expense allocation for the selected Profit Center.

-

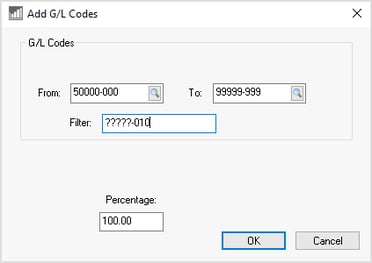

From the Financials > Profit Centers dialog, add direct expense G/L accounts by launching the Add By G/L Code wizard from the Wizards button in the lower right-hand corner of the page. Enter the range of G/L accounts as well as the query Filter. The following filter will set the allocation Percentage to 100 for all accounts with an extension of -010.

-

Use the same wizard to add another Percentage rate for a group of G/L Codes.

-

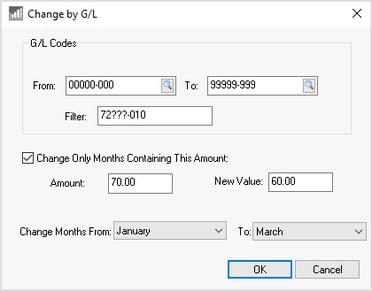

Launch the Change by G/L Code wizard from the Financials > Profit Centers dialog to change a group of G/L Codes. Add the profit center ID to the filter to change all accounts associated with the profit center.

-

Add or change a range of codes for a range of months using the wizard functions or manually set the monthly allocation percentages for profit center G/L accounts.

-

Validate that all account allocations equal 100% by printing the File > Reports > Financials > Profit Centers > G/L Allocation report to see Allocated and Non-Allocated percentages by G/L accounts.

Unallocated G/L Balance

This is the recommended method is to allocate all expenses and income to profit centers. Run the Reports > Financials > Profit Centers > G/L Allocation report to verify that the total ratio for every revenue and expense account equals 100%. A lump allocation percentage can be set for expenses and income amounts that are not allocated to profit centers(s) (>100%).

Set the Unallocated G/L Percent value on the header of the Financials > Profit Centers dialog as shown below:

The example shown above will expense a total of 25% of the total unallocated amounts at the bottom of the profit center report. Launch the Reports > Financials > Profit and Loss > P&L by Profit Center > Monthly Profit & Loss by Profit Center report and enable the Show Unallocated (Set on Profit Center) option on the report prompts as shown below:

Note the additional Unallocated line at the end of the following profit and loss statements:

Review Fine Tune Indirect Cost Ratios to complete the process.