Assigning Direct Expenses to a Profit Center

The profit center configuration within EBMS allows the user to report revenue, cost of goods sold, and expenses for a segment of the company or profit center. The goal of a profit center report is to show the profit of a segment of the business that is labeled as a profit center. Profit is calculated by listing the revenue or income and subtracting the expenses. Expenses can consist of the cost of goods sold amount, direct expenses, and overhead or indirect expenses. The department or 3-digit extension on the general ledger account is an ideal way to apply direct expenses or revenue to a profit center. Review the following definitions:

Direct vs. Indirect Expenses:

Direct Expenses

Direct expenses consist of the following types of business costs:

-

Products purchased specifically to conduct business, such as product to resell, parts used for service, or raw materials.

-

Direct labor that is identified within the EBMS work code for the specific profit center.

-

Supplies and other costs allocated to the profit center at the time the expense is entered into the accounts payable (A/P) invoice.

Indirect Expenses

-

Overhead expenses such as utilities, building expenses, or other expenses that are not expensed directly to a profit center at the time the cost is entered into the Accounts Payable (A/P) invoice.

-

Overhead labor such as clerical, management, or sales work that effects the entire company rather than a specific function within the company.

-

Overhead labor expenses such as taxes, insurances, and benefits for employees that work within multiple profit centers.

Adding Direct Expenses

Complete one of the following options to populate the allocation ratio percentage for each revenue and expense accounts. Note that balance sheet accounts (asset, liability, and equity accounts) can be ignored.

Go to Financials > Profit Centers on the main EBMS Menu.

-

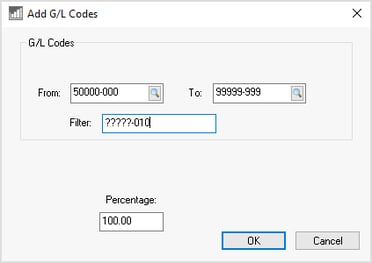

Launch the Add By G/L Code wizard by clicking on the Wizard button on the lower right of the dialog to open the following dialog:

-

Enter the allowable range of G/L Codes into the From and To fields. The Filter can be used to query a subset of G/L accounts. In the example above, all the accounts will be added to the profit center allocation table that have a suffix of -010. Enter a Percentage of 100 and click OK. This utility will add all the direct expense accounts. Review Allocating Indirect Expenses to a Profit Center for details on adding indirect expense ratios.

-

-

Launch the Copy from One Year to Another wizard by clicking on the wizard button to copy the G/L account ratios from another year. Enter the Year To Copy From and the Year To Copy To, decide whether to copy all data, update only existing records, or only add different records. Enter the Profit Centers information into the range - to select a single profit center, enter the 3-digit department code into the From and To fields.

-

Manually enter the profit center ratios for each G/L account and click OK. Review Allocating Indirect Expenses to a Profit Center for detailed instructions on entering allocation percentages per profit center.

Review Fine Tune Indirect Cost Ratios to complete the process.