Reconciling Inventory Value

Verifying an accurate balance sheet involves reconciling the total inventory value, which is made up of thousands of individual values, with the General Ledger balance in the EBMS financial tools. EBMS contains a strong audit trail and reconciliation tools to verify that the inventory totals in the General Ledger match the inventory totals listed in the EBMS inventory system.

Compare Inventory Value with General Ledger Totals

Complete the following steps to reconcile the General Ledger totals with the perpetual value recorded in the EBMS inventory product catalog:

-

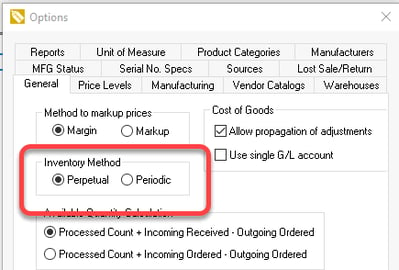

The Inventory Method option must be set to Perpetual. Open Inventory > Options > General tab to review this setting, as shown below:

Review Inventory Count Overview for more details on this setting. -

Launch the Financials > Utilities > Verify Balances from the main EBMS menu.

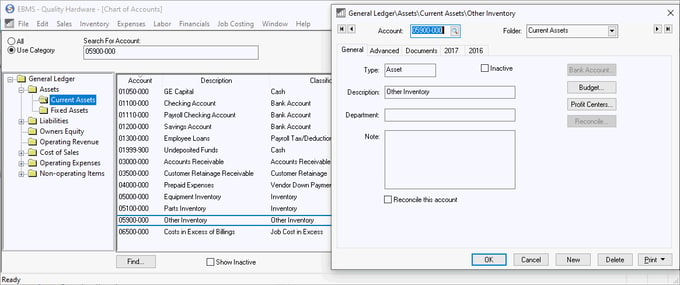

In the Verify Balances window, the Inventory Asset balance in the left column of the utility reflects the total of the inventory asset accounts. This total can include one or more G/L accounts. The General Ledger accounts that contain FIFO (First In First Out) inventory within EBMS are classified as Inventory accounts. Review the Inventory Count Overview section of the inventory documentation for more details on perpetual inventory and FIFO.Note that all inventory asset values that reflect inventory NOT recorded in EBMS as FIFO inventory MUST be classified as Other Inventory. The G/L account classification is very important for consistent financial recordkeeping within the EBMS system. EBMS will require multiple inventory General Ledger accounts if inventory is recorded as an asset but not classified as FIFO inventory.

-

Perpetual inventory accounts: These accounts must match the inventory within the EBMS inventory system. EBMS will compare the total inventory value for a given period with the inventory G/L account(s) balance in the General Ledger.

-

Other inventory values: All inventory values that are not included in the perpetual inventory value within EBMS MUST be recorded within inventory asset accounts classified as Other Inventory. This applies to inventory asset values such as supplied, adjustments, or any other inventory that is not identified as perpetual inventory within EBMS.

Do not mix inventory values between EBMS inventory items and other inventory in the same general ledger account.

-

Use a journal entry to adjust the inventory asset balance (left column). Review the Creating Journal Entries documentation.

-

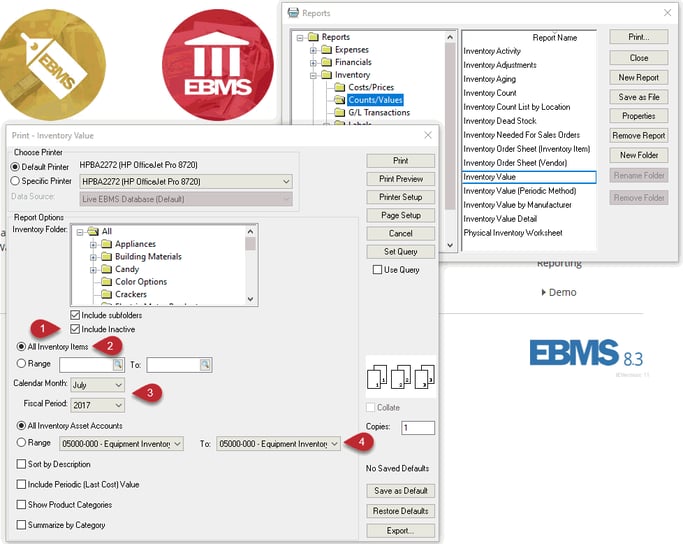

Go to File > Reports > Inventory > Counts / Value > Inventory Value report from the EBMS menu if the Inventory Asset balance on the right column of the Verify Balances utility is incorrect. (Verify Balances can be accessed by going to Financials > Utilities > Verify Balances.)

-

Enable the Include Inactive option to verify that the report is not ignoring the inactive inventory that has value.

-

Select the All Inventory Items option to list all items in the system.

-

Make sure that the Calendar Month and Fiscal Period match the Month and Fiscal Year on the Verify Balances utility:

-

Select All Inventory Asset Accounts to match the Verify Balances utility.

-

-

Disable the Inactive option on any inventory item that contains count and values until the items are sold.

-

Do not continue with the next step till the Inventory Asset and the Inventory Items total equal. Review the Adjusting Inventory Count and Value section of the inventory documentation for inventory adjustment instructions.

-

-

Continue with this step only when the Inventory Asset total in the Verify Balances (Step 2) utility match the Inventory Items total. This step may be necessary to run if multiple inventory asset accounts classified as Inventory are listed in the General Ledger.

This step will verify that the balances for a specific inventory asset account match. Run the same Inventory Value report as described in Step 2D but query for a specific asset account Range as shown below:

-

Verify that the total at the end of this report equals the total value within the specified asset account. Use a journal entry to adjust the specified account and offset the journal entry with another inventory asset account. Since the total of the inventory asset accounts match the total inventory then any journal adjustment should merely move the value from one inventory asset account into another account with the same classification.

Identifying Causes to Check

-

Are general ledger accounts classified properly?

-

Are inventory counts accurate?

-

Were inventory classifications changed?

Subsidiary Ledger

EBMS records the inventory value of each product on a monthly basis within the history tabs of the item. Review Inventory History for details on this value summary ledger.

Adjusting Values

Review Adjusting Inventory Count and Value to instructions to correct individual product values

Review Adjusting Inventory Counts as a Batch to adjust the count for a group of items.