Inventory Count Overview

Periodic vs. Perpetual Inventory Tracking Methods

The Track Count inventory classification is used in EBMS to track inventory item counts in a perpetual inventory method. This method is commonly used for any product that is purchased and sold, manufactured, or consumed to manufacture other products. Services may be classified as Track Count if they are purchased from a subcontractor and resold to a customer. (Note: In EBMS and this article, the terms inventory item and product are used interchangeably.)

EBMS offers many features to help users accurately manage and record counts for each inventory item. This feature to track the exact stock count may be needed for some items but not for others. To learn how to keep track of inventory stock counts in EBMS, continue with this section of the Knowledge Base for feature tutorials and best practices.

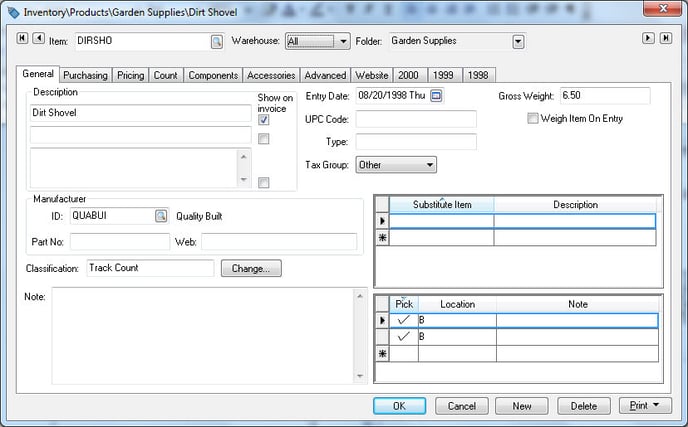

An item must be classified with a perpetual inventory classification such as Track Count, Serialized Item, etc. to maintain a current count of the items on hand. To set this classification go to Inventory > Product Catalog, double-click on an inventory item to open a product record, and select the General tab.

Set the appropriate perpetual Classification setting. Review the Inventory Classification section for a list of perpetual inventory classifications and more details on setting the classification. Be careful when assigning this important field, because the product classification determines how EBMS processes the inventory item and changing the classification is a labor-intensive process.

The user can set up EBMS to process inventory on a periodic or perpetual basis. How a company handles this should be discussed with management and the company's tax advisor.

-

Periodic

In a periodic tracking method, inventory is manually counted at set times throughout the year. For many companies, it is counted once at the end of the year or very close to the end of the year. After the count is complete, a journal entry is used to adjust the inventory asset account accordingly. The difference will go to an inventory change account.The disadvantage of periodic inventory tracking is that financial statements do not reflect inventory value changes between inventory counts. During months when more inventory items are purchased than the amount sold, the profit and loss statements would show a loss. The opposite would happen when the total amount of inventory decreases during a given period.

-

Perpetual

In a perpetual tracking method, inventory is tracked throughout the year as it is bought and sold. This means that as items are purchased, the inventory counts increase. When the items are sold, the inventory counts decrease. The overall value of the inventory is adjusted in real time, facilitating more accurate profit and loss statements.

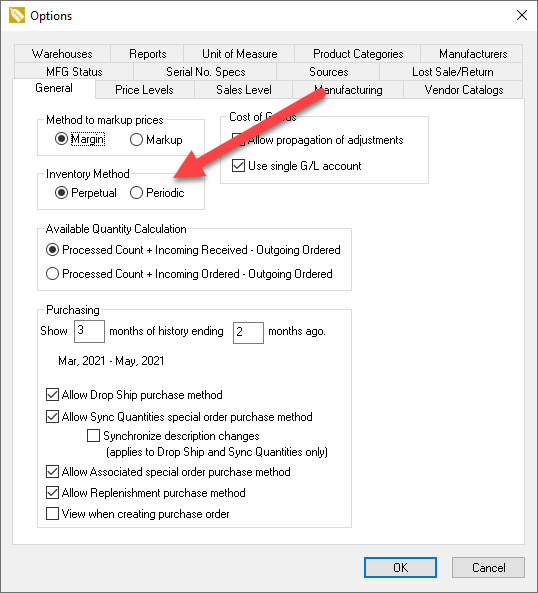

To set the Inventory methods, go to Inventory > Options > General tab and the following dialog will open. Find the Inventory Method section, select Perpetual or Periodic as the method, and click OK to save changes.

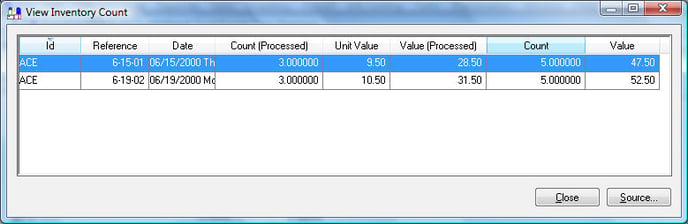

Perpetual Inventory Method uses the FIFO (First In First Out) valuation method, which means the first products bought will be the first products sold. For example, in a hardware store setting, the first hammers bought from the vendor should be the first hammers on the shelves and sold to customers. In the image below, the hammers purchased on June 15 for $9.50 each will be sold before the hammers purchased on June 19th for $10.50 each. If the user sells 5 hammers, the total cost of sale value is 3 at $9.50 each and 2 at $10.50 each for a total value of $49.50. The Count (Processed) column and the Value (Processed) column display the total number of items available to sell, while the Count and Value columns display the original purchase amounts.

Select Inventory > Product Catalog, double-click on a product to open the product record, and go to the Count tab. From the product record Count tab, double-click on the Processed value to open the View Inventory Count dialog shown above. This is a drill-down window and shows the layers of inventory that are considered on hand using the FIFO valuation method. FIFO inventory tracking is the most common method used by businesses and requires the stock inventory to be rotated each time the product is purchased.

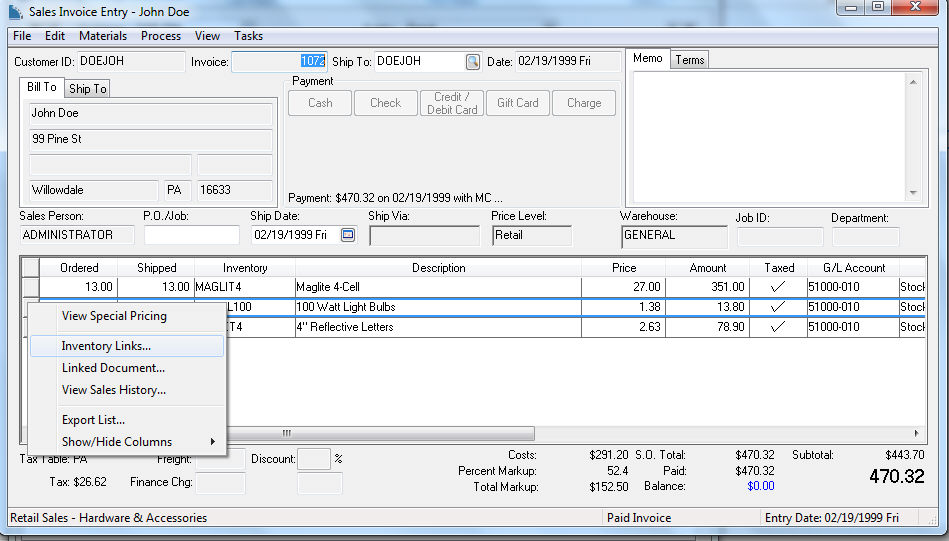

The purchase (or manufacture) of an item is linked to the sale (or consumption) of an item. These links can be traced by right-clicking on the beginning of an inventory line within any processed document. For example, open a sales invoice that contains a track count inventory item and select Inventory Links... from the context menu as shown below:

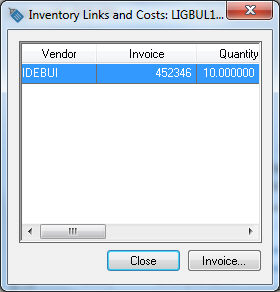

The following Inventory Links dialog will appear, listing the incoming inventory documents that set the cost of the item:

The source list may consist of one or more source documents. Highlight the desired document from the list and select the Invoice button to view the source document.

The source document may be accessed by clicking on the Linked Document option within the right-click context menu shown above.

The method used to create Inventory Links is based on the inventory item classification as listed below:

-

Track Count with the standard purchase method: Inventory links are created based on a FIFO method as described above. See the Purchase Methods section for more details on the standard purchase method.

-

Track Count with special order or drop ship purchase methods: Inventory links are created by the user when a purchase order is created from a sales order. See the Special Orders and Drop Shipped Items section for more details.

-

Lots with Linked Costs: Inventory links are created based on the lot within the item. Review the Lots section for more details.

-

Serialized Items: Inventory links are created based on the selection of individual serial numbers. Review the information within the Serialized Item section.

Review the Inventory Classifications section for a complete list of inventory classifications. Review the Changing an Inventory Classification for instructions to change the Classification.

A company may wish to consult their tax advisor or accountant to determine the proper inventory valuation method to use. Review the Item Classification section for a list of perpetual inventory classifications.

An optional stock location entry field gives the user the ability to note the location of stock inventory. Review the Stock Locations section for more details.

Review the Inventory Variance section for more details on how General Ledger transactions are generated for perpetual inventory items.

EBMS contains tools to manage stock levels. Some of these tools including the Sales Level Classification are part of the optional Advanced Inventory tools. Review the Stock Level Settings section for more details.

The stock levels of individual items can be color-coded to reflect stock levels. See Stock Level Color for more details.

Review Creating a Batch from the Purchasing Page to create a manufacturing batch based on the product's stock levels.

Continue with the Inventory Item Count section for more count details.

Related Videos and Content

Videos