Labor entered through Labor Module

Allocating payroll expenses to a job is an important element in proper job costing. An worker's gross pay is directly expensed to a job using the labor module. Review the Job Overhead > Adding a Percentage Overhead section of this chapter for detailed instructions in processing payroll overhead. The job information is entered within the timecard window as shown below:

Enter timecard information as explained in the Labor > Processing Payroll > Entering Employee Timecard Information section with the following exceptions:

-

Enter a Job code for each detail line that should be expensed directly to a job. Keep the Job code blank for all other pay such has holiday, clerical, maintenance, and other general pay.

-

A Job Stage must be entered on each line that contains a Job code. Click on the lookup button to list all available stages for the current job. A stage must be classified with a source of Payroll to be used within a timecard. Review the Job Costing > Classifications section for more details.

A G/L Account is normally copied from the General Ledger Account entered within the work order. The work order can be set to use the stage's G/L Account rather than the general ledger account set within the work order. Go to Labor > Work Codes to open the following window:

An additional field labeled Timecard G/L Account appears within the work code window when the Job Costing module is being used. This setting has three options:

-

The Use Work Code G/L Account option will copy the General Ledger Account shown within the work code window to the timecard column.

-

The Use Job Department option will copy the 5-digit General Ledger Account from the work code extended with the last 3 digits of the General Expense Account s etting found within the stage's Advanced tab.

-

The Use Job Stage G/L Account option will copy the G/L Account from the General tab of the job stage.

Set all work codes that are not associated to use the Use Work Code G/L Account option. All other work code settings are optional. The general ledger account must be configured as a Direct Job Cost Account to be used within a timecard if the option is toggled ON. Review Direct Job Cost General Ledger Accounts for more details on this option.

Labor costs are considered as committed payroll costs until the timecard is processed. Review Committed Costs for more details on actual committed costs.

The user can post a week's payroll to job costing at the end of the first week even if the payroll is processed on a bi-weekly basis. Review the Payroll > Processing Payroll - Advanced > Posting Expenses section for details.

Variable Labor Rates

Review [Labor] Piecework Pay > Variable Piecework Pay by Job for information on setting different piecework labor rates per job.

Job Stage Labor Financial Accounts

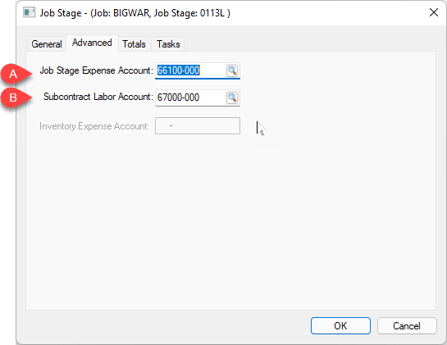

Click on the job stage's Advanced tab to set the financial accounts:

-

The Job Stage Expense Account is used for standard labor costs within a labor stage.

-

The Subcontract Labor Account records subcontract labor costs.

Subcontractor Labor

Labor expenses can be added to a job using a service product code instead of using the labor module. This method is common to add subcontract labor and other services to a job.

Complete the following steps to create a Service product code with a proper description. Review Using Product Codes for No Count Items > Service Items for more details about creating new inventory items classified as "service".

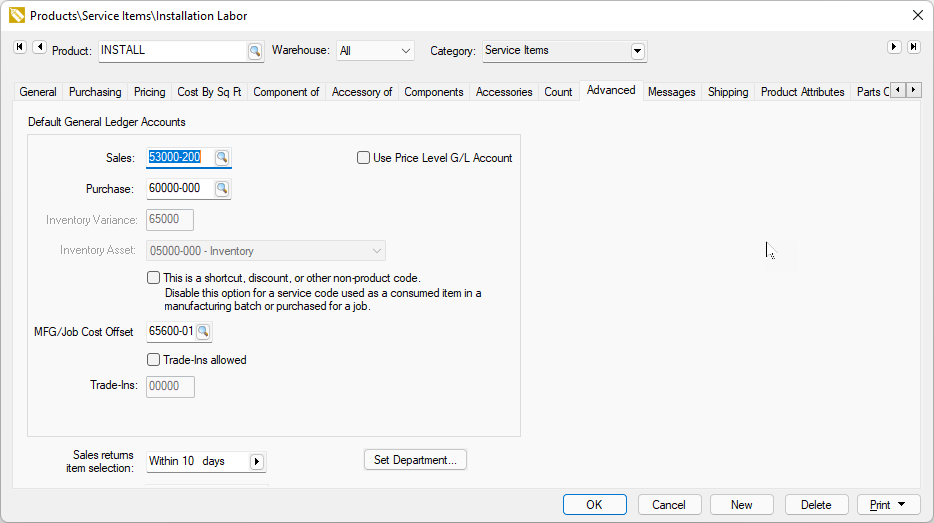

Click on the Advanced tab of the labor inventory item.

The Sales general ledger account can be ignored if this item is not sold.

Set the Purchase G/L accounts. The inventory debit transaction created for the labor item consists of the Inventory Variance general ledger code and the last 3 digits of the Purchase G/L code.

Disable the shortcut option since the labor costs are subcontractor costs rather than internal labor costs.

Enter the MFG Offset financial account. Review Transactions > Credit Offset Transactions for more information on the shortcut option and offset financial account.

Apply subcontractor costs to a job using the Job Transfer tool. Service codes should never represent labor costs from labor module; only subcontractor costs. Job stage labor hours will be updated from the quantity within the transfer or expense invoice.

Review Job Materials > Subcontractor Labor within a Job Transfer for more information on this process.

Job Stage Labor Report

A labor hour summary report including the budgeted hours can be launched by selecting report from the main reports menu ( ).