Calculating Overtime Piecework Pay

Increased piecework pay may be required for overtime labor. The piecework overtime process will increase the piecework pay by time and a half, in the same way as regular overtime pay. EBMS gives the user a number of options, especially if the worker's timecard contains a mixture of hourly pay and piecework pay. Continue with the following section for details on these options.

Set Up Overtime Piecework Pay Type

Go to the Labor > Labor Options > General tab as shown below:

Enable the Calculate overtime on piecework option and click OK.

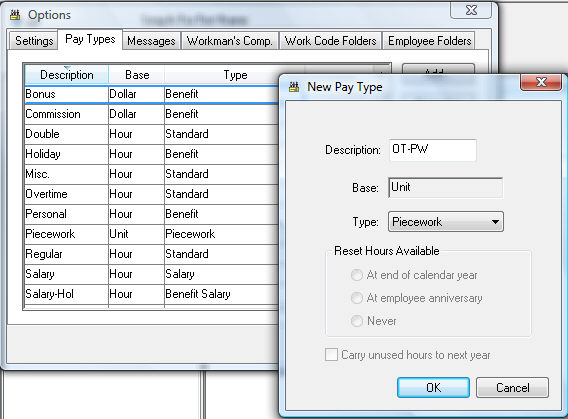

The next step is to create an overtime piecework Pay Type if it does not already exist.

Select the Labor > Labor Options > Pay Types tab from the main EBMS menu.

Click on the New button on the Pay Types tab if no pay type for piecework overtime exists.

From the New Pay Type window, enter the overtime piecework pay type Description. Make sure the Description name differentiates this overtime variation from standard piecework. Change the Type option to Piecework and the Base will automatically change to Unit (see image above). Click the OK button to save the pay type.

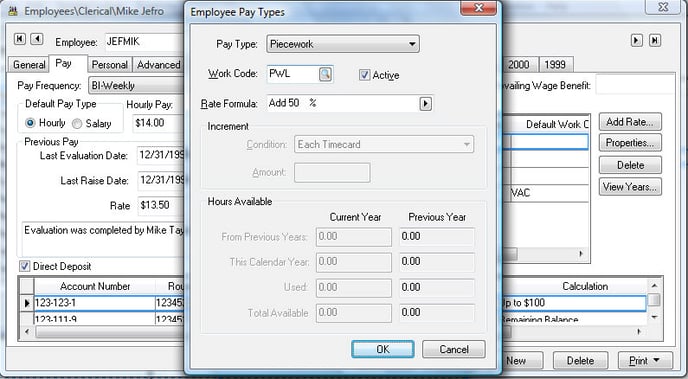

Add Overtime Piecework Pay Type to the Worker Record

The new overtime piecework pay type must be added to each worker that will be paid piecework overtime. Go to an individual worker record and select the Pay tab. From the Pay Rates table, click the Add Rate button to set up a new Pay Type for the worker. Make sure the Rate Formula is set to Add 50 % as show above. Review the Pay tab section of Changing Worker Information section for details on adding pay types into the worker record Pay tab.

Make sure the Rate Formula is set to Add 50 % as show above. Review the Pay tab section of Changing Worker Information section for details on adding pay types into the worker record Pay tab.

Review the Pay Tab section of the Setting Worker Defaults section to add the pay type to a group of an employees or all employees. Save the employee record by clicking the OK button.

Calculate Overtime Piecework on a Timecard

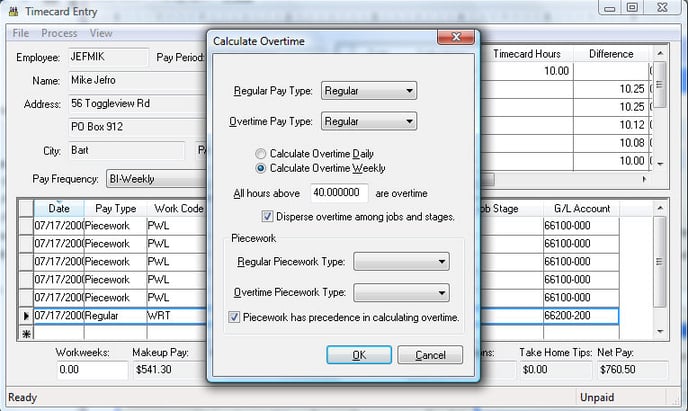

Enter hourly and piecework time into the timecard using the standard pay types as described in the Entering Timecards section of the documentation. Click on the Process > Calculate Overtime option from the timecard menu.

Click on the Process > Calculate Overtime option from the timecard menu.

- The Regular Pay Type and Overtime Pay Type settings must be set properly. Review the Calculating Overtime section for more details on the standard overtime fields.

- Set the Regular Piecework Type and Overtime Piecework Type. These are pay types created within the Labor > Labor Options > Pay Types tab described earlier in this section. Review the Pay Types section for more details on pay types and setting them up.

- The Piecework has precedence in calculating overtime option will determine if the hourly time or piecework time will be calculated first. Unless this option is selected, hourly will have precedence.

The following tables describe the calculations that are completed using the overhead wizard and the effect that this option on the pay calculations. The following table includes only regular hourly and piecework pay.

| Pay Type | Work Code | Units/Hours | Rate | Total Pay |

|

Regular Piecework |

A | 15 | 10.00 | 150.00 |

| Regular Piecework | B | 10 | 5.00 | 50.00 |

| Regular Piecework | B | 20 | 5.00 | 100.00 |

| Regular Hourly | C | 10 |

15.00 |

150.00 |

| Overtime Piecework | A | 5 | 15.00 | 75.00 |

| Overtime Piecework | B | 10 | 7.50 | 75.00 |

| Totals: | 60 units, 10 hours | 600.00 |

If the Piecework has precedence in calculating overtime option is enabled, the wizard will determine the ratio of piecework overtime. If the employee worked 50 hours this week, then 10 hours of the 40 piecework hours are overtime, because 40 is a standard workweek. This results in 25% of the piecework being overtime. The wizard will create overtime piecework lines in the timecard for each work code. The following chart illustrates how these new lines are created in the timecard.

If the Piecework has precedence in calculating overtime option is disabled, the wizard results will be as follows.

| Pay Type | Work Code | Units/Hours | Rate | Total Pay |

|

Regular Piecework |

A | 20 | 10.00 | 200.00 |

| Regular Piecework | B | 10 | 5.00 | 50.00 |

| Regular Piecework | B | 30 | 5.00 | 150.00 |

| Overtime Hourly | C | 10 | 22.50 | 225.00 |

| Totals: | 60 units,10 hours | 625.00 |

Click the OK button to create the overtime records.

Repeat this step for each timecard that contains hourly and piecework pay.